Pre-market analysis

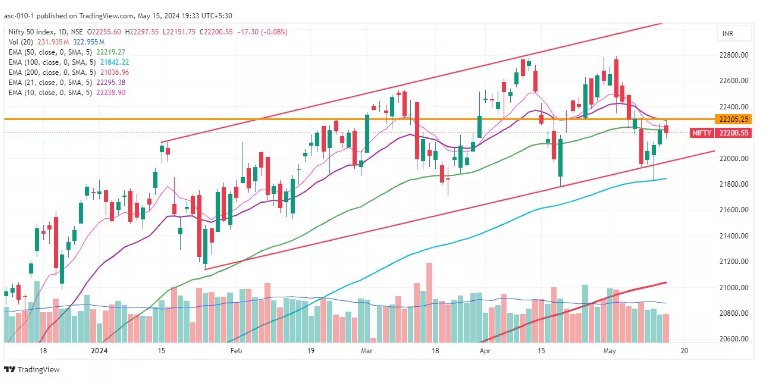

In the upcoming sessions, the market is anticipated to stay consolidative unless and until it clearly breaks above 22,300, the crucial barrier for the Nifty 50, but overall market sentiment is still positive. If the index closes above 22,300 and holds there for a few more days, it is expected to go toward the 22,500–22,600 range. In the short term, experts believe that the 22,000 mark will serve as a crucial support level and will not be breached.

The Nifty 50 was down 17 points at 22,201 and produced a bearish candlestick pattern with tiny upper and lower shadows on the daily timeframe, reflecting the choppy trade in the market. On May 15, the BSE Sensex concluded the tumultuous session on a negative note, sliding 118 points to 72,987. For the preceding three sessions in a row, both indices had continued their upward trajectory.

According to Osho Krishan, senior analyst for technical and derivative analysis at Angel One, “one needs to take a pragmatic approach of the ‘buy on dips’ and’sell on the rise’ till we witness a definite participation of the bulls in carrying momentum.”

In addition, he believes that the bulls will face a difficult challenge in the near future due to the durability of the 20 DEMA (days exponential moving average, which is currently around 22,300), and that an authoritative breach might only determine the direction of the index’s next leg of rallies.

According to him, the sacred support at 22,000 is followed by the support at 22,150–22,100, which is located on the lower end of the spectrum and is projected to absorb any intraday blips.

Image Source

Technical analysis analyst Jatin Gedia of Sharekhan by BNP Paribas said the Nifty is in a pullback mode and has had a brief pause at 22,308 levels, which is the location of the 50% Fibonacci retracement level of the recent decline.

Therefore, he thinks there is still room for the pullback and that a dip towards 22,130–22,100 would be a good time to purchase. The immediate resistance on the upswing, according to him, is between 22,308 and 22,422. On the front of the larger markets, the Nifty Midcap 100 and Smallcap 100 indices had positive breadth with gains of 1% and 0.6%, respectively.

Stocks under F & O Ban

In addition to Balrampur Chini Mills, Birlasoft, GMR Airports Infrastructure, Hindustan Copper, Vodafone Idea, Piramal Enterprises, SAIL, and Zee Entertainment Enterprises, the NSE has added Biocon, Granules India, India Cements, and LIC Housing Finance to the F&O ban list for May 16.

Canara Bank was taken off of the aforementioned list.

Securities that are prohibited under the F&O segment comprise businesses whose derivative contracts exceed 95 percent of the maximum position limit on the market.

Read More : RBI’s Draft Norms may impact banks