Investing in stocks market can be challenging, particularly for those who are unfamiliar with it. These days, investing is hassle-free since people may use a variety of digital platforms to allocate their assets to shares. Here is a comprehensive explanation explaining how to invest in the share market online, just in case you are not familiar with the procedure.

How Can I Invest in India’s Stock Market?

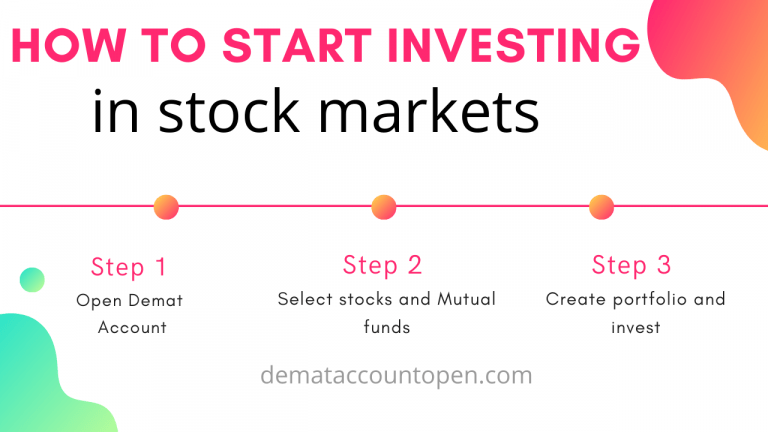

We have all the information you need if you are wondering how to invest in the Indian share market online. The procedures listed below can help you purchase stocks conveniently from the convenience of your home:

In order to facilitate seamless transactions, open a DEMAT account and make sure it is connected to an existing bank account.

Use the web platform or mobile application to log into your DEMAT account. Select a stock that you wish to purchase.

Verify that you have enough money in your bank account to acquire the shares you want to buy.

Acquire the stock at the indicated price and indicate how many units you want to buy.

Your purchase order will be executed as soon as the seller grants your request in kind.

The necessary amount will be debited from your bank account after the transaction is complete.

You will receive the shares in your DEMAT account simultaneously.

Image source

Investing in stocks-requirements

People should be aware that there are particular requirements in place before they can open a DEMAT account. These include:

-Financial Institution Account

-Evidence of Address Verification of Identity

-PAN Card Refundable Check

-An investment advisor

Some things are crucial to remember for people who wish to learn how to invest in the stock market.

Prior to making stock market investments, keep the following things in mind:

Investment Objectives

You must first decide what your financial objectives are if you are wondering How to Start Investing in the Stock Market in India or any other kind of investing. The goal of investments varies from investor to investor and is not constant. As a result, you should choose stocks after considering your financial objectives. Prior to investing, determine your investment horizon as well.

Capacity to Take Risks

Your risk tolerance is a crucial consideration when making stock investments. Those with a low tolerance for risk might want to look into defensive equities, which offer steady returns and are less susceptible to market swings.

The act of diversification

A diverse portfolio can help you reduce risk. As stated otherwise, the greater the degree of diversification of your investments, the lesser the financial risk involved. There are two marketplaces you might think about while investing in equities.

Conclusion

Now that you are aware of the procedures involved in investing in the Indian share market online, register a DEMAT account with the broker of your choice and begin investing by following the advice provided above. Now that you understand the basics of stock investing, keep in mind these many important considerations when deciding which stocks to include in your portfolio for optimal results.

Read further: why everyone should invest in stocks

Frequently asked questions about investing in stocks

How should I start investing in stocks?

Investing in stocks is not as complex as it seems. You can choose any good platform and start by making an account. These days, many platforms offer free account opening, and hence, you can start without any fee or charge.

What are some good stock-investment platforms?

There are many platforms that offer genuine investment options. Some of the popular ones include Growww, ICICI Demat Account, Kotak Mahindra Demat, Paytm Stocks, etc.

What are the risks involved in stock investing?

Stock investment do carry financial risks. You may invest a huge amount of money without understanding the nature of the stock and it may lead to losses. Its better to do you research and study before investing.

Is stocks a good way to earn money?

Stocks can be a good way to earn money only if you have the time to analyze and research about market trends and other updates. If you think you can use one or half an hour of your day and earn money, then investing in stocks may not work well for you.