Image Source

DLF Shares: Despite strong Q4 earnings, encouraging remarks from management, and optimistic analyst opinions, the DLF share price decline is probably the result of profit booking given the stock’s about 32% gain over the previous six months.

DLF Shares update

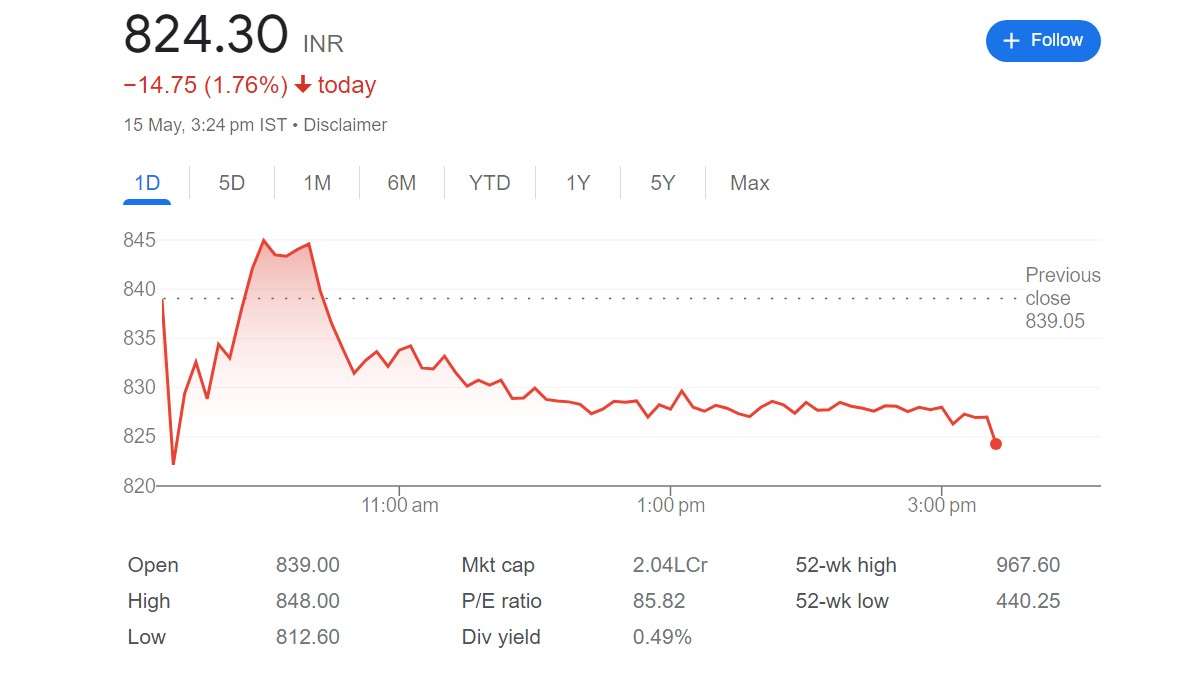

Major real estate player DLF’s shares dropped more than 2 percent on May 15, despite brokerages’ bullish outlooks and increases in target prices for the stock in the wake of the company’s impressive performance for the quarter that ended in March 2024. Analysts think that DLF’s enormous land holdings will always provide growth potential.

The company’s cash flow generation trend is increasing, and its balance sheet is lean. Brokerages have raised target prices because to the relative absence of competition in the NCR market. DLF shares were down 1.8% at Rs 825.20 on the National Stock Exchange (NSE) at 9:18 a.m.

The stock has increased by 76% over the past year, surpassing the benchmark Nifty 50’s 21% gain in the same time frame. Profit booking is probably to blame for the share price decline despite strong Q4 earnings, encouraging management remarks, and optimistic analyst opinions. Over the past six months, the stock has increased by almost 32%.

The largest real estate company in India revealed on May 14th, Rs 921 crore, a 61.5 percent increase in net profit for Q4FY24. With a 33 percent year-over-year gain, its net profit for the entire fiscal year was Rs 2,733 crore. At Rs 2,135 crore, its revenue for the March quarter increased by approximately 47% year over year.

Consolidated revenue for FY24 was Rs 6,958 crore. About 6 msf (million square feet) of new items were released by DLF in FY24. Due to significant absorption, nearly all of the inventory was monetized within the launch period. According to the firm, more than 11 million square feet of new products would be introduced during the current fiscal year (FY25), with a focus on areas such as Chandigarh Tri-city, Gurugram, Mumbai, Goa, and Goa.

“These launches have an approximate sales potential of Rs 36,000 crore,” DLF stated. Motilal Oswal analysts see an 8–10% CAGR in prices in Chandigarh, Delhi, New Gurugram, and Gurugram—the real estate company’s four main markets. They have valued the land at Rs 1.11 lakh crore based on these estimates.

“The enormous land holdings of DLF still provide growth visibility. Motilal Oswal maintained a “neutral” rating on the company with a higher target price of Rs 850. “However, our expectation of a 12–13-year monetization timeframe for its remaining 160msf of land bank (including TOD potential) appropriately accommodates this expansion,” the brokerage said.

It stated that the land’s current appraisal suggests a value of Rs 1.16 lakh crore, suggesting little room for growth. With a “buy” rating, Nuvama is still positive on DLF since it thinks that pre-sales growth will continue to be solid given the strong housing demand and a sizable launch pipeline for FY25E. Launches, in our opinion, would be a significant trigger, the brokerage stated.

The fact that DLF has a premium brand and limited availability of equity investments is what motivates the optimistic view. The analysts’ confidence was further enhanced by its strong rental portfolio, which provides excellent visibility to rising rental income, and its capacity to expand its rental portfolio through internal accruals.

Read more: ICICI Securities Stock Update