Copper Price, globally, has reached all-time highs due to constrained supply and bullish long-term tendencies. The metal is selling at an all-time high in the US and has gained about 5% in the overnight market. Thus far this year, the metal has seen a jump of about 19%.

Copper Price trends

The metal is currently trading at a two-year high on the London Metal Exchange (LME), and after posting significant increases in April and May thus far, it has touched record highs on the CME, Shanghai, and Indian markets. Additionally, the prices of CME Copper are $300 higher than those of LME, indicating a strengthening US demand. The long-term outlook is bright for investors, and although CME copper inventory have dropped by 30% since March, there is some supply scarcity.

Read more: Hindustan Copper

Further support for the copper surge has come from fresh stimulus initiatives from China. The greatest copper consumer in the world has seen low demand due to an economic slowdown. Nonetheless, the issue of one trillion yuan worth of bonds last week in order to raise capital is probably going to boost important economic sectors.

Investors think there will be enough inventory for this year. But worries about FY25 and FY25, when demands are probably going to be higher, still exist. In 2024, China’s copper smelting has already decreased by 10%.

The long-term prospects for copper have also improved due to a number of variables, including the manufacturing of electric vehicles, data centers, the renewable energy sector, and the defense industry.

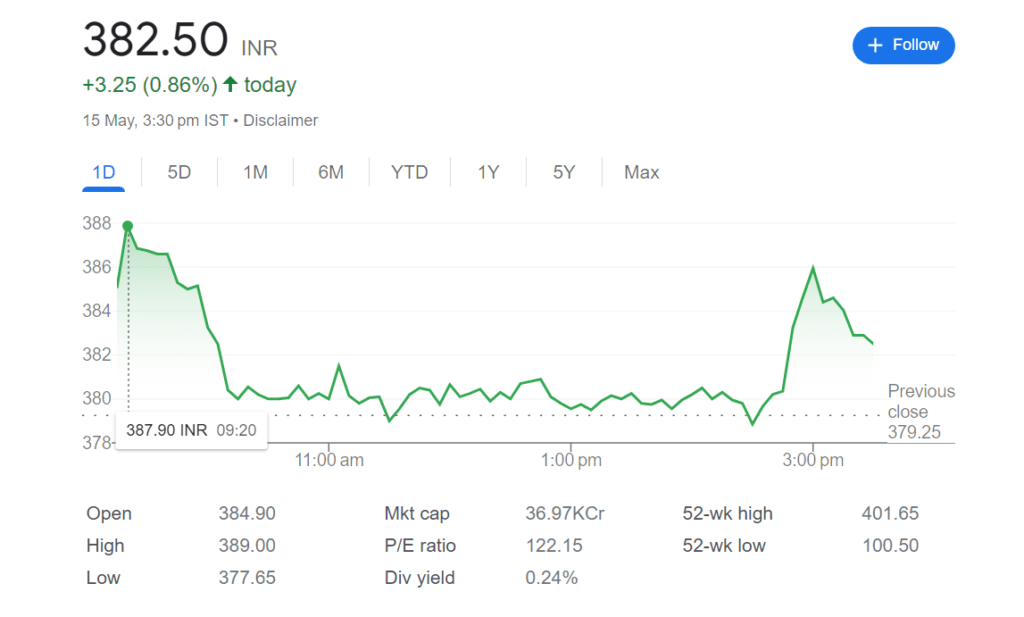

Hindustan is run by the state In the last month, the price of copper’s stock on the BSE has increased by more than 7%. At 14:15 pm on May 15, the stock was trading at Rs 380.2 on the BSE.

Image source

Supply and demand for copper

Bank of America forecasts 2023 will have a global production and (consumption) of 25.98, (25.69) Regarding 2024* – 27.20 (27.66) Regarding 2025* – 27.05. (28.13) -LME prices are $10,200 per ton as opposed to the peak of $10,845 per ton.