Pre-market Analysis

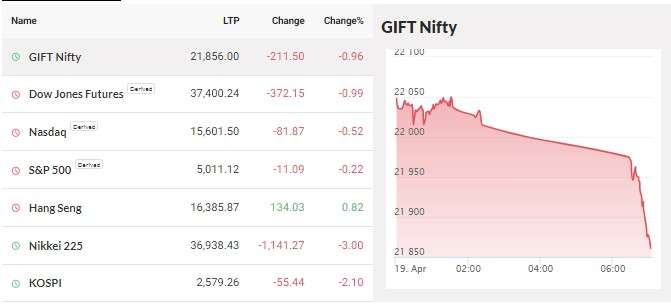

Given that the Nifty 50 has lost 758 points over the last four sessions, the market may continue to consolidate and try to rise in the upcoming session. However, overall, experts advise against buying on rallies as the sentiment is expected to be in favor of bears.

The next immediate support is expected around 21,900, and the 21,700 level is essential if the index closes below the rising support trendline in the upcoming sessions. However, analysts noted that if there is a rebound back, the 22,200–22,300 range is likely to be a barrier region on the upward side. It examined the intraday rising support trendline.

The Nifty 50 dropped 152 points to 21,996 and produced a lengthy bearish candlestick pattern on the daily charts with above-average volumes on the weekly expiry day on April 18, while the BSE Sensex plummeted 455 points to 72,489 points.

21,950 is a key short-term support level because the index challenged the lower end of the “Channel” that it has been trading in over the past few weeks. According to Ruchit Jain, head researcher at 5paisa.com, “the RSI oscillator on the daily chart is negative indicating a negative short-term momentum.”

Image Source

He believes that if the Nifty is able to stay in this channel, there should be a retreat from this support. If it is broken, he believes that the downtrend may continue until the 89 DEMA, which is located around 21,740. Conversely, he stated that the pullback move’s immediate resistance is between 22,330 and 22,380.

More from Experts

According to Jatin Gedia, a technical analysis analyst at Sharekhan by BNP Paribas, the Nifty is getting close to both the bottom end of the ascending channel and the 78.6% Fibonacci retracement line, which is between 22,000 and 21,938. thus, “it will be a crucial level to watch out for during the next few trading sessions.”

Bulls were uneasy as the fear index, India VIX, continued its upward trajectory for four days in a row, increasing 3.36 percent to the 13.04 mark.

Nifty and Bank Nifty Key Support and Resistance

According to the pivot point calculator, the Nifty 50 may find immediate support around 21,955, then 21,869, and 21,730 points. On the upward side, the 22,234 level, 22,320, and 22,459 levels might provide resistance for the index.

The Bank Nifty was still being controlled by bears on April 18, as every upward move was met with selling pressure, suggesting that traders were feeling sell on rise. For the fourth session, the banking index declined 415 points to 47,069, maintaining its downward trend.

According to Kunal Shah, senior technical & derivative analyst at LKP Securities, “the overall market tone continues to be bearish, and if the selling pressure persists, the index could test its next major support level at 46,500, where the 100-day exponential moving average (EMA) is located.”

He believes that the index’s main barrier is at 48,000, the level at which considerable call-writing activity has been seen, suggesting substantial resistance.

The pivot point calculator predicts that the Bank Nifty index will find support at 46,970, 46,770, and 46,446. Resistance on the higher side might be seen at 47,618, 47,818, and 48,141.

Stocks making the news

Infosys

The second-biggest IT services provider in the nation reported consolidated profit of Rs 7,969 crore for the quarter that ended in March FY24, up 30.5 percent from the previous quarter due to income tax refunds. However, total results fell short of analysts’ projections. Operations revenue decreased by 2.3 percent on a quarter-over-quarter basis to Rs 37,923 crore; sequentially, revenue decreased by 2.2 percent in constant currency and 2.1 percent in dollar terms.

Bajaj Auto

The two-and three-wheeler manufacturer from Pune, India, announced a standalone net profit of Rs 1,936 crore for the March FY24 quarter, a strong rise of 35% over the same period last year. During the same time period, operational revenue climbed by 29% to Rs 11,485 crore, while sales volume jumped by 24% to 10.62 lakh units.

ICICI Securities

With excellent topline and operating performance, the business recorded consolidated net profit of Rs 536.5 crore for the quarter ended March FY24, up 104.3 percent from the same period last year. Compared to the same time previous year, revenue from operations increased by 74.4 percent to Rs 1,543.2 crore.

Gokaldas Exports

On April 18, the business launched its qualified institutions placement (QIP) program. The floor price per share is set at Rs 789.99.

Housing and Urban Development Corporation (HUDCO) has been awarded the Navratna Status by the Department of Public Enterprises (OPE).

Mahindra Lifespace Developers

Following the debut of Bengaluru’s first net zero waste + energy residential project, Mahindra Zen, the real estate and infrastructure development division of the Mahindra Group has received reservations for over 150 houses in only two days, valued at Rs 350 crore.

For more such pre-market analysis, visit our website.