Amidst a time when many global companies are facing up and down in scaling, Zomato stocks continue to rise. Read more about this in this news post.

In the year after its 2021 IPO, Zomato shares originally drained more than half of investors’ capital, but they have since made a remarkable recovery.

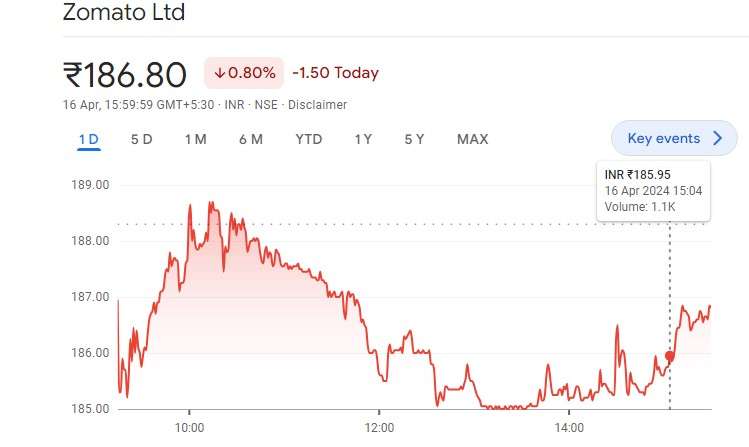

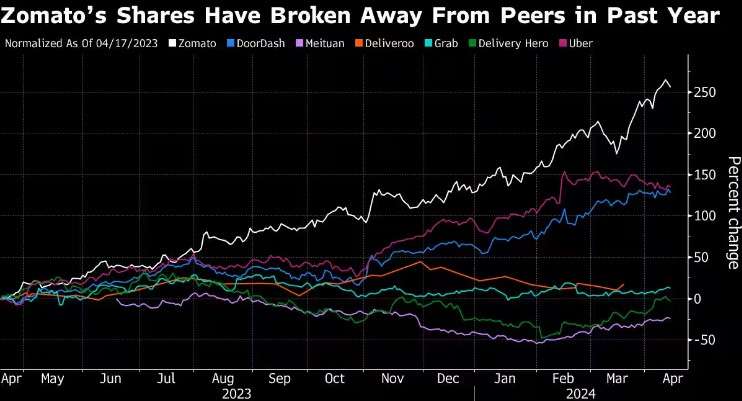

The stock price of the meal delivery and restaurant aggregator has soared by over 250 percent in the last year.

The stock price has surpassed that of all other major worldwide delivery services, including Uber and Deliveroo. Is Zomato’s surge over? Shares keep going higher thanks to regular stock upgrades.

Zomato Stocks In contrast to worldwide competitors

In terms of valuation, Zomato’s stock is rather expensive. According to Kotak Institutional Equities, Zomato is worth up to 94.3 times its one-year future earnings. The firm projects that Zomato’s price-to-earnings ratio will moderate to 47.2x in 2026.

Zomato has far higher values than its delivery competitors. Swiggy, Zomato’s main rival, was valued at $12.7 billion on April 12 by Invesco, which owns around 2% of the meal delivery company. The market capitalization of Zomato, on the other hand, is close to $19.89 billion.

Zomato records roughly 35 million MAU as of recent estimates, which is much lower than Meituan’s 75 million MAU. Meituan is a big player in the Chinese delivery market.

During the fiscal quarter ending in December 2023, Meituan earned over $10.20 billion in sales, while Zomato earned about $390 million, or Rs 3,288 crore.

What, therefore, is the impetus behind Zomato’s surge?

Market analysts anticipate that Zomato will continue to increase in comparison to some of its worldwide delivery competitors, who are struggling with scaling up and experiencing margin pressure. Much of the optimism, however, is based on the rapid expansion of its sister company, Blinkit, rather than its mainstay, meal delivery.

After being acquired by Zomato two years ago, Blinkit has been an important factor in the growth of both profitability and sales. The rapid commerce platform has been branching out into new areas, increasing the variety of products it offers, and growing its dark-store network.

Fast commerce has a far bigger potential customer base than food delivery, according to a JM Financial study, and it’s also far less saturated than the delivery sector. Even though Blinkit is just half the size of Zomato, Zomato Founder Deepinder Goyal is certain that it will soon overtake Zomato.

Zomato recorded a profit of Rs 2 crore in the first quarter of FY24, marking its first profit after 15 years of business. Continued growth in net profit brought it to Rs 138 crore by December 2023’s close. Blinkit has not helped the company turn a profit thus far. Blinkit could break even this quarter, according to management, but analysts aren’t sure how the company can turn a profit.

High operational expenses, poor margins, and client retention are a few of the challenges to turning a profit in a rapid commerce firm. One of Blinkit’s main problems is that it isn’t widely available, particularly in urban areas in southern and western India. Issues with the supply side include things like rider strikes and product shortages.

Kotak Institutional Equities calculated the fundamental costs of running a shadow market. Blinkit would make around Rs 39 lakh in income if the monthly Gross Merchandise Value (GMV) is approximately 2.59 crore. Rent, rider costs, packaging, franchisee fee, and utilities add up to about Rs 26 lakh; after deductions, the residual EBITDA per dark store is 13 lakh.

There is a lot of competition for Blinkit from both online marketplaces and local kiranas that provide free home delivery. Its rivals include, among others, Instamart (Swiniggy), BB Now (Tata group), Zepto, Amazon, and Flipkart.

Read more in our blog section.