Image Source

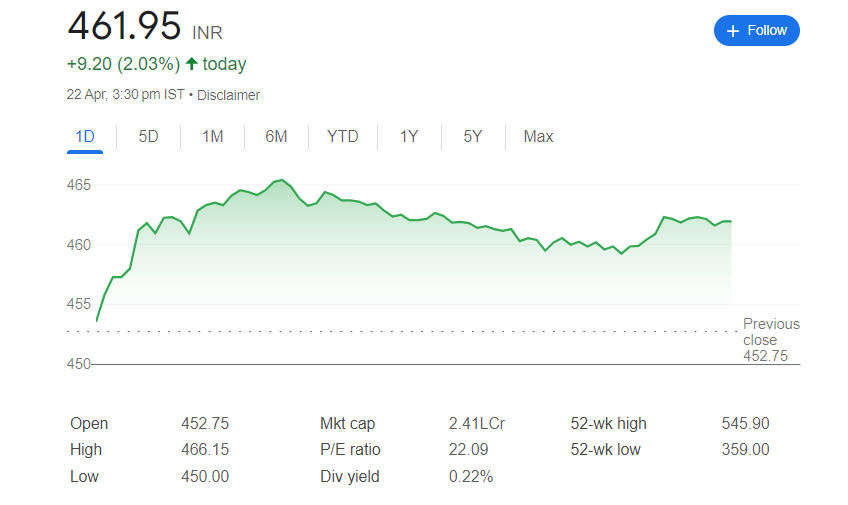

Wipro’s stock finished the day on Monday at Rs 461.95, representing a gain of 2.02 percent. When this price is taken into consideration, the stock has experienced a decline of 15.41 percent from its one-year high price of Rs 546.10, which was reached on February 19, 2024.

Notwithstanding the decline that was indicated, the share price has increased by 27.19 percent in comparison to its 52-week low value of Rs 363.20, which was reached on April 21 of the previous year.

Wipro Shares Net Profit in Q4

Wipro’s overall net profit for the fourth quarter of fiscal year 24 (Q4 FY24) was Rs 2,835 crore, representing a 7.9 percent decrease. In the fourth quarter of the fiscal year 24 (Q4 FY24), the information technology company’s consolidated sales decreased by 4.2%, reaching Rs 22,208 crore.

The counter might be found to have support in the range of Rs 450 to Rs 440, according to the technical configuration.

When the stock is trading at its current price, one can think about purchasing it with a severe stop loss of R$ 445. Additionally, the anticipated increase in value for Wipro is going to be Rs 500, as stated by CA Rudra Murthy BV, MD at Vachana Investments, in an interview with Business Today TV.

According to the daily charts, Wipro is bullish, and there is good support near R$ 450. “In the short term, an upside target of R$ 510 could be reached if it is able to achieve a daily close that is higher than the resistance level of Rs 469,” said AR Ramachandran from Tips2trades.

The counter might be found to have support in the range of Rs 450 to Rs 440, according to the technical configuration.

Also Read- Adani’s latest 500 million investment .