What are dividends? – Amidst the profit and loss-driven stock market, Dividends provide a steady flow of cash . these payouts represent more than just a periodic reward for shareholders. They can accumulate with time and help you build wealth. In this piece of writing, we shall delve into the importance and definitions associated with the concepts of dividends and how companies reward shareholders with these from time to time.

What are dividends? An overview

Dividends are the payments paid by the companies to shareholders for choosing it for investment. These quarterly or annual payments can be cash or shares. Dividend payments can be a reliable income source for shareholders, especially retirees and passive income seekers. Most companies pay dividends, but irregular dividend payments can annoy investors.

Also read: what exactly are dividends- a detailed guide

Important concepts to understand dividend payments:

Firms don’t always issue shareholders dividend payments. Profits can be reinvested, used to pay off debt, or acquired. Investors seeking dividend-paying stocks must research and identify companies that meet their requirements.

Dividend payments from various companies may differ. The economy, financial performance, and tax restrictions may determine how much a company pays its shareholders. During the COVID-19 outbreak, many companies decreased or discontinued dividend payments.

The tax treatment of dividend payments varies too. Qualified dividends are taxed less. The tax consequences of dividend payments can help you prepare taxes.

Interestingly, dividend payments aren’t the only way to profit from stocks, despite their dependability. Investors can profit from buying and selling stocks or holding onto them and waiting for a price increase.

As a result, investors face risk and complexity with dividend payments. Understanding dividend payments aids investors in stock selection and portfolio management.

Paying Shareholders for Their Investment-understanding dividends

Dividend payments is one of the main reasons people invest in stocks. Companies make payments to shareholders in exchange for their investment. But, how exactly do dividend payments work? From both the business and shareholder perspectives, this section will discuss dividend payments.

1. The dividend payment process begins on the declaration date. Directors set dividends per share. The company discloses records and payment dates.

2. Shareholders must be on the company’s books by the Record Date in order to receive dividend payments. Buying after the record date causes missing dividend payments.

3. Stocks trade ex-dividend. Pre-ex-dividend purchases trigger dividend payments. If you buy shares after the ex-dividend date, you won’t get the dividend payment.

4. Dividend payment: The company pays shareholders. Your broker may delay payment for many days.

Important Note: Companies may distribute dividends quarterly, semi-annually, or annually. Profits decide the dividend payment, thus it’s not guaranteed. A steady dividend payment pleases shareholders, so many companies try.

Read more: Understanding the power of compound interest

Lets take an example:

Company A pays Rs. 0.50 per share dividend. Record and ex-dividend dates are June 1 and May 27, respectively. A Rs. 0.50 dividend payment will be made to shareholders of Company A on May 26. Your account should receive the payment a few days after June 15.

Dividend payments can help investors profit from investments. Knowing the process helps investors pick stocks and invest.

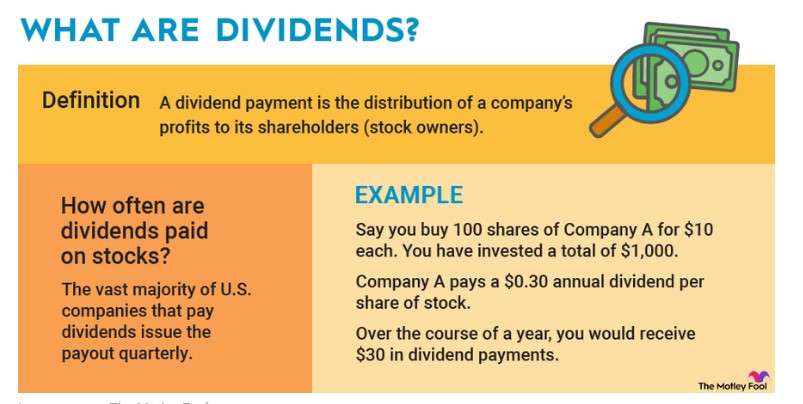

Here’s another example in a different currency for better understanding.

Image Source

Dividend shares and payment types

1. Cash dividends

These are the most common types of dividend payments, in which a firm pays shareholders cash. Cash dividends appeal to investors seeking investment income. A shareholder with 100 shares would receive $50 every quarter if a company paid a $0.50 dividend.

2. Stock Dividends

A company gives shareholders more stock than cash in a stock dividend. A company with a 10% stock dividend will give 100 shareholders 10 more shares. Stock dividends attract investors who seek firm ownership without paying more.

3. Property dividends

In some rare dividend payments, companies give shareholders property instead of cash. Real estate investment trust (REIT) shareholders may get subsidiary business units or properties. Property dividends provide investors a unique way to invest in a company’s assets.

Important note: Each dividend payment is taxed. Cash dividends are taxable; stock dividends are not until sold. Before investing in a dividend-paying company, understand the tax implications of each dividend payment.

Firms can distribute cash, stock, or property dividends. Each dividend payment has merits and cons, so investors should choose wisely. An understanding of dividend payments can assist investors in selecting equities and maximizing returns.

Interesting facts about dividends

Understanding dividends is crucial for investing. For their investment, shareholders get dividends. A significant metric for identifying dividend-paying stocks is the dividend yield. The annual dividend payment divided by the stock price yields this ratio. Understanding dividend yield can help investors locate equities with high yields and assess a company’s risks and benefits.

Remember these when calculating dividend yield:

1. The annual dividend payment determines yield, not quarterly or monthly. A company’s yearly dividend payment is Rs2.00 if it pays Rs. 0.50 per share quarterly.

2. Variable share price determines dividend yield. Stock price affects dividend yield.

3. Dividend yield can help investors get money from their investments. Always remember that high dividend yields may signify a company’s financial struggles and inability to make dividend payments.

4. It’s important to consider more than dividend yield when evaluating dividend-paying stocks. Also assess the company’s financial condition, growth potential, and management.

An example:

Consider a Rs. 40.00 stock with Rs 2.00 annual dividends. Dividend yield estimation for this stock:

5% dividend yield = Rs.2.00/Rs.40.00 x 100%

Income-seeking investors may like the stock’s 5% dividend. Before investing, investors should investigate and analyze dividend yield, just one metric.

Dividend Pros and Cons

Return on investment is important in the stock market. Dividend payments interest many investors due to their steady income that can be reinvested or used passively. There are disadvantages to dividend payments. Dividend payments may benefit or harm.

Pros

Consistent income stream – Dividend payments give investors a continuous income stream. Passive income seekers and retirees may like this.

Dividend payments, in contrast to growth stocks, provide a steady stream of income but no capital growth. Investors seeking capital appreciation may dislike dividend payments.

Investing in dividend-paying firms reduces risk. Dividend payments lower market volatility, making them a safer investment option.

Older, dividend-paying companies may have less growth potential than younger ones. Dividend payments may not appeal to investors seeking high-growth investments.

Dividend payments are taxed lower than ordinary income for investors. Dividend payments may be subject to capital gains tax.

Cons

Dependence on Company Performance – Dividend payments are not guaranteed and can be decreased or eliminated at any time by companies. Dividend payments can be sensitive to corporate performance.

Dividend payments are low-risk investments for many investors. Limited growth and firm performance reliance limit them. Like any investment, one should make sure to examine the pros and cons.

When do you get paid?

1. Dividend payments may be made periodically.

Image source

Company dividends might be quarterly, semi-annual, or annual. The most prevalent are quarterly payments since they give investors a steady income. Some corporations may make a one-time dividend payment or not pay dividends at all.

2. Announcement of dividends

Your board of directors declares the dividend payment amount and date on the declaration date. This information helps investors plan their investments.

3. Dividend Expiration:

The stock starts trading without the dividend on the ex-dividend date. The next dividend payment will not be made to investors who purchase the stock after this date. Therefore, to get the dividend, you may buy the stock before the ex-dividend date.

5. The payment date

The payment date is when shareholders on record get the dividend. Usually, a few weeks after the record date is set to be the payment date.

Conclusion

Summing it up, dividend payment schedules help investors plan investments. To get dividends, you must remember the declaration, ex-dividend, record, and payment dates. To make informed investments, investors must understand the dividend policies of different companies.

Read more: How dividends work?

Frequently asked questions about Dividends

What is the basic definition of dividends?

A dividend is a fraction of a share distributed by a company you are buying shares of from time to time.

Can we call dividends a type of income?

Probably not. Dividends are like rewards offered by the invested company when it achieves a milestone or garners wealth over time.

What is the meaning of the word Dividend?

The word comes from a Latin word named “dividendum”. It actually means a thing to be divided.

How do I get dividends?

Buying dividend stocks is an easy way to ensure that you are getting these rewards. You can either opt for index funds or exchange trend funds.

What are the different types of dividends?

The main types of dividends include cash dividends, stock dividends, script dividends, liquidating dividends and property dividends.