Technical Analysis

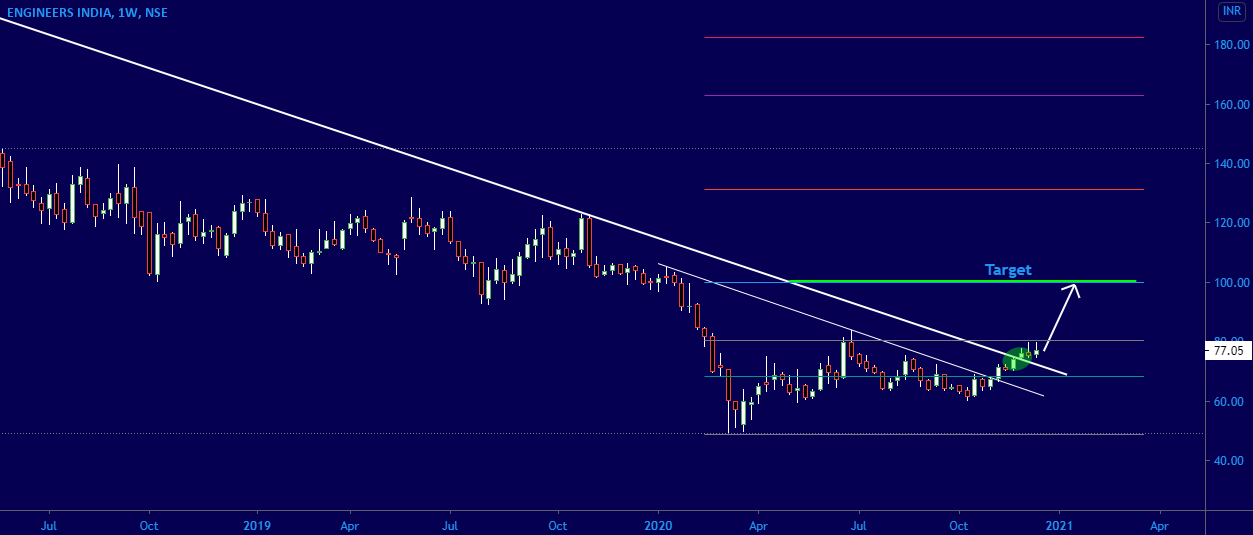

ENGINEERS INDIA Stock Analysis

Engineers India Stock Analysis Engineers India belongs to the Industry of Project Consultancy/Turnkey Projects. Engineers India is a Government Enterprise under Ministry of Petroleum and

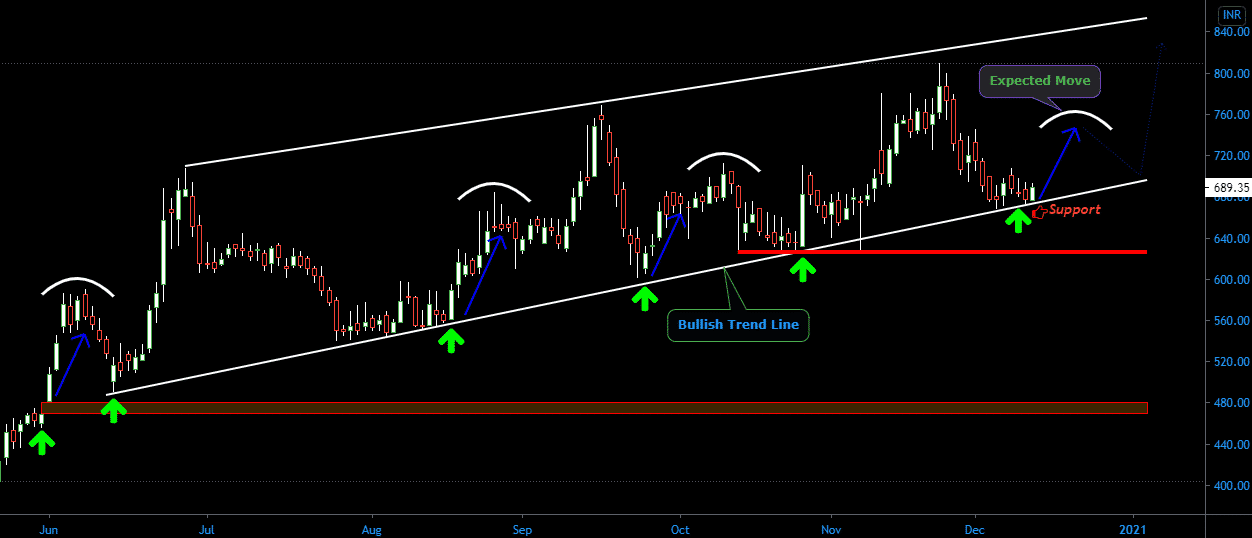

Trent Share Analysis | Trent Stock Analysis | Trent Ltd.

Trent Share Analysis BSE: 500251 | NSE: TRENT | SERIES: EQ | ISIN: INE849A01020 | Trent Limited is engaged within the retail sale of food, grocery, footwear, accessories, toys, games, non foodstuff & readymade garments.

Happy Diwali | Buy these 5 stocks in Muhurat trading for more than 50% return by Diwali Next Year.

5 stocks in Muhurat trading 1. BANDHAN BANK Bandhan Bank Ltd. engages in the banking and financial services. It operates through the following segments:- Treasury,

Bandhan Bank Stock Analysis | BANDHANBNK

Bandhan Bank Stock Analysis Bandhan Bank Ltd. engages in the banking and financial services. It operates through the following segments:- Treasury, Retail Banking, Corporate and

Shree Digvijay Cement Share Analysis | SHREDIGCEM Stock Analysis | CMP ₹ 61

Shree Digvijay Cement Share Analysis Shree Digvijay Cement Company Ltd. is pioneer in the business of manufacturing and selling of cements. Shree Digvijay Cement Company

Jsw Steel Stock Analysis, Jsw Steel Share Price, Jsw Steel Technical Analysis, Jsw Steel Ltd.

Jsw Steel Stock Analysis, Jsw Steel Share Price, Jsw Steel Technical Analysis Jsw Steel Ltd. Jsw Steel Stock Analysis JSW Steel Limited is engaged in

IDFC First Bank Stock Analysis, IDFC First Bank Share Price, IDFC First Bank

IDFC FIRST Bank is one among the leading banks in India, IDFC First Bank Stock Analysis, IDFC First Bank Share Price, IDFC First Bank, IDFC First Bank Share Price

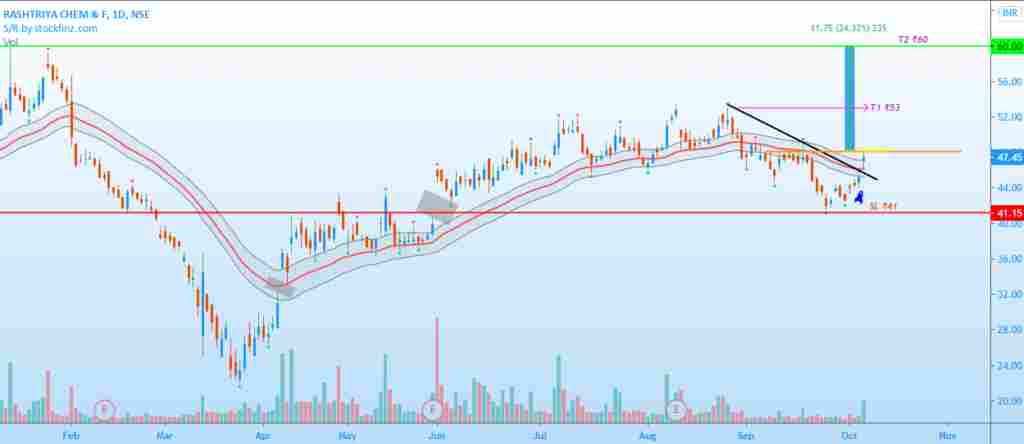

RCF | Rashtriya Chemicals & Fertilizers Ltd | RCF Stock Analysis

RCF RCF (Rashtriya Chemicals & Fertilizers Ltd.) is a leading fertilizers and chemicals manufacturing company in India with about 75% of its equity held by

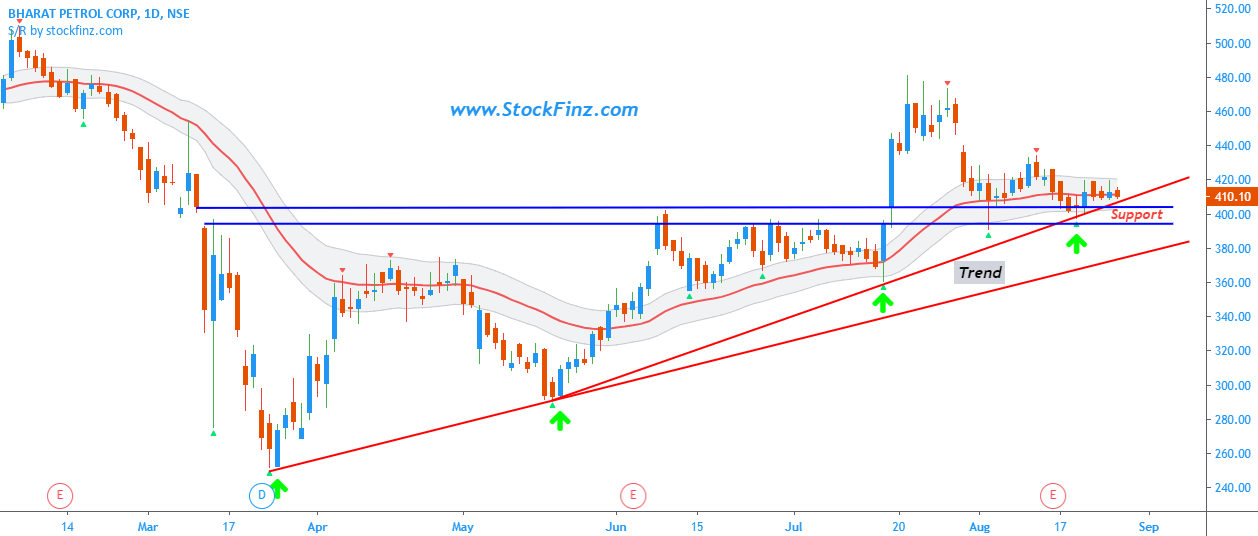

Bharat Petroleum Corporation Ltd | BPCL | BPCL Stock Analysis

Bharat Petroleum Corporation Limited is an Indian public sector oil and gas company headquartered in Mumbai, Maharashtra, India. Current Price: ₹410.10 Stock P/E: 18.75 Book Value: ₹168.41 Market

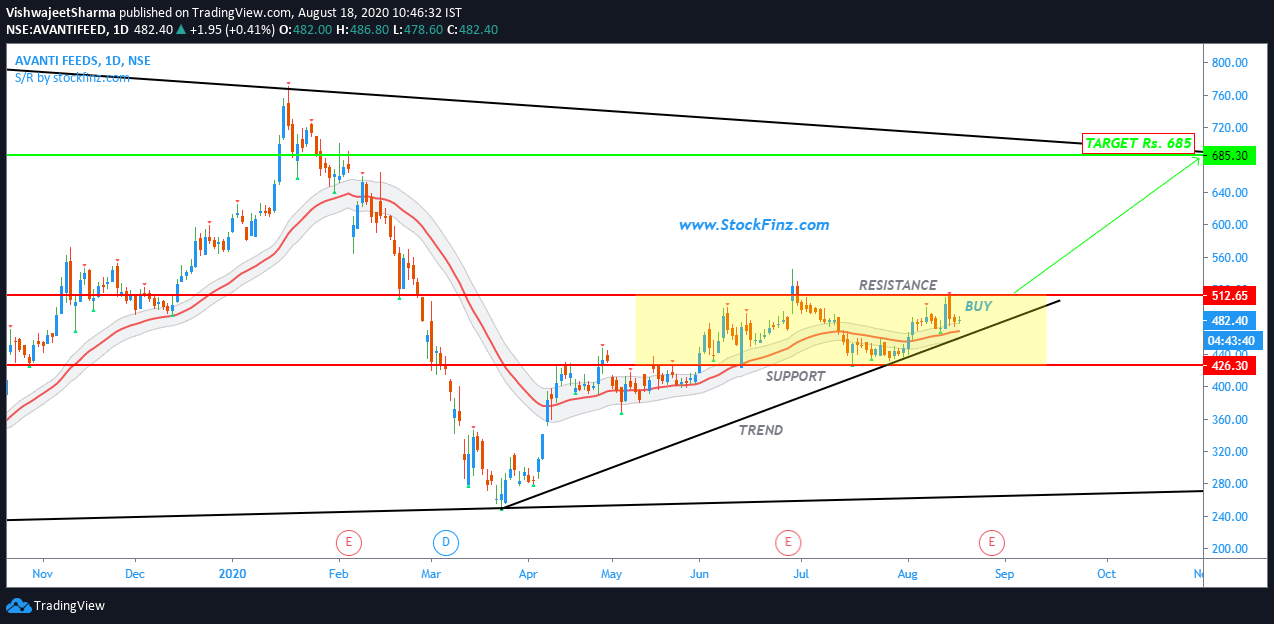

Avanti Feeds

Avanti Feeds Stock Analysis On the way to breakout. Current Price: ₹482.40 (As on 18-Aug-2020) Resistance: 512.65 Support: 426.30 Buy AVANTIFEED Around 480 – 515 for the Target