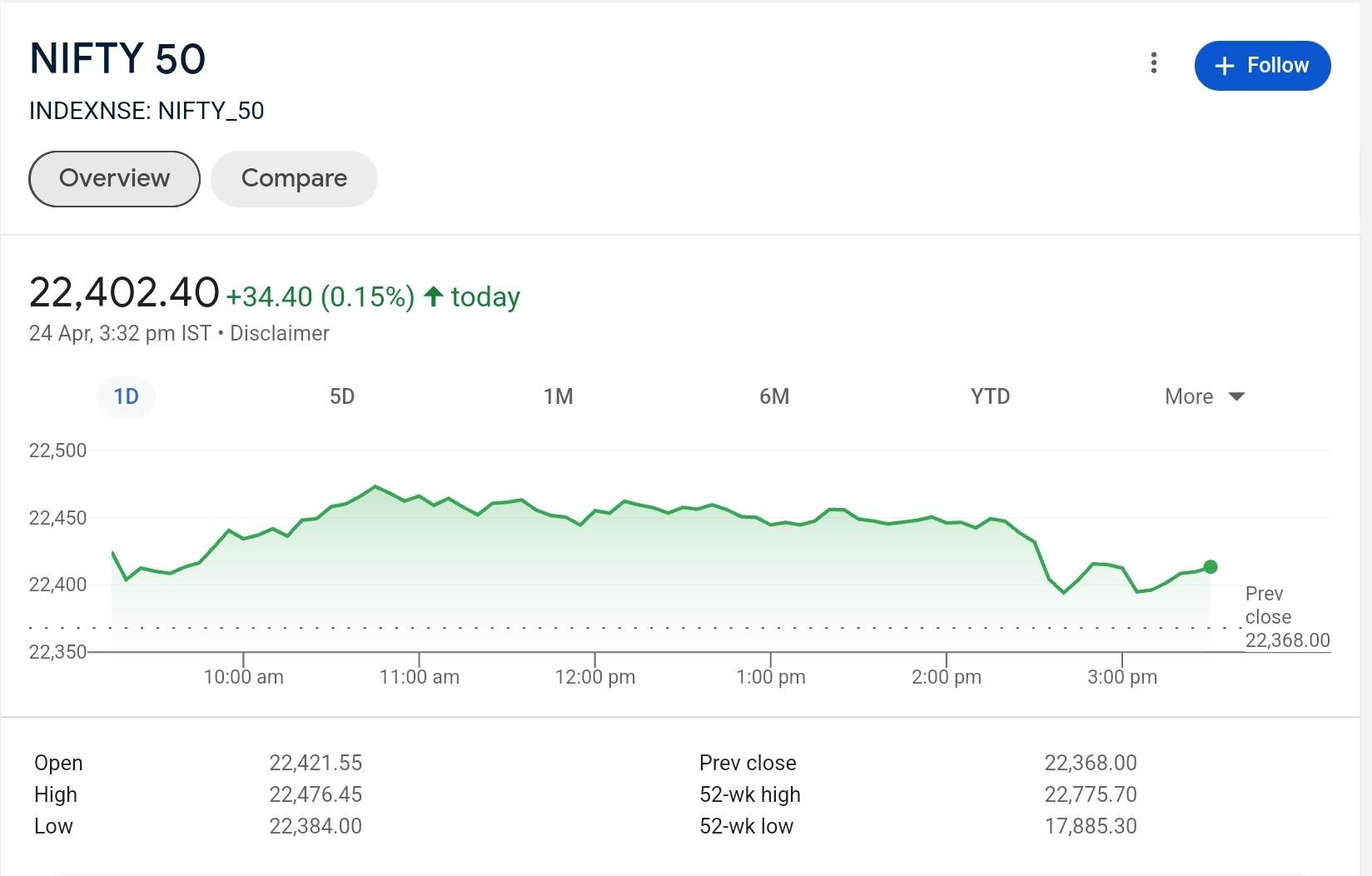

Stock Update as on 24th April : Midcap and smallcap indices in India continued to increase, although the country’s Sensex and Nifty indices flattened following morning advances.

From its intraday high of 74121 and gain of 370 points, the Sensex closed up 0.2 percent, or 114 points, at 73853. After rising over 75 points to its intraday high of 22476, the Nifty ended the day 0.15 percent up at 22402. Broader indices saw gains of 0.8 percent to 46858.60 points for BSE SmallCap and 0.92 percent to 40957 points for BSE Midcap.

Tata Steel increased by 2.9 percent, Power Grid gained 1.8 percent, and JSW Steel jumped by 4% on the winners’ list. On the other hand, TCS, which fell 1.1 percent, was the biggest loser, followed by Tech Mahindra, which fell 1 percent, and Maruti Suzuki India, which fell 0.7 percent.

Sectoral indices saw increases of 2.8 percent for BSE Metal, 1.6 percent for BSE Commodities, and 1 percent for BSE Healthcare. The BSE Telecommunication index had a decline of 1.6 percent, while the BSE IT and BSE Teck indices saw a 1 percent decline apiece.

Following poor US business activity data, predictions of a Federal Reserve rate drop were boosted, and global markets saw an upsurge.

You Might Like to Read : IST timings for different markets.

Fourth day in a row that Nifty and Sensex have gained; important Q4 earnings will steer market Fourth day in a row that Nifty and Sensex have gained; important Q4 earnings will steer market

Three factors explain why the India VIX is trading softly following a five-month low. Three factors explain why the India VIX is trading softly following a five-month low.

The case for rate decreases was strengthened by the US business activity slowdown in April, which included the first employment decline since 2020 and a decline in output. The currency and bond yields declined, which momentarily raised the price of gold before declining. In order to gain more understanding of monetary policy, analysts are currently concentrating on impending US economic data, such as inflation statistics.

Rajesh Palivya, an analyst at Axis Securities, states that because of the uncertainty surrounding earnings season, large-cap volatility is anticipated to last till expiration. Investors wait for earnings reports to determine their course, which causes hesitation in large-cap industries and increased volatility. There might be more large-cap participation in May series. A surge in small- and mid-cap stocks demonstrates investor confidence and a favorable short-term market outlook with room for expansion.

Image Source

Due to Q4 earnings that were mostly muted, including poor IT performance and some disappointing results from index heavyweights, Indian markets underperformed their Asian counterparts. Nonetheless, the Indian composite PMI reached a multi-year high, indicating domestic resilience providing some buoyancy in the overall market, helped by robust manufacturing and service sectors. Declining oil prices and lessening Middle East tensions helped boost investor mood globally.

Shrikant Chouhan, Kotak Securities’ Head of Equity Research’s Advice

The major indices saw range-bound trading today. The Sensex gained 114 points, while the Nifty finished 34 points higher. Sector-wise, the IT index fell by almost 1% while the Metal index performed better, rising by over 2.5 percent. From a technical standpoint, during the past two days, the Nifty/Sensex has been trading between 22350/73700 and 22475/74100. Nonetheless, the market’s short-term texture is still favorable. We believe there may be a brief intraday correction until 22230-22200/7340073200 if the Nifty/Sensex falls below 22350/73700. Conversely, the bulls’ first breakout level would be around 22475/74100. The market may rise over this to 22600–22675 or 74500–74700. Since the market texture is now non-directional, level-based trading is the best course of action for day traders.

Senior Technical Analyst of LKP Securities, Rupak De Thoughts on Market Condition Today

Throughout the session, the Nifty stayed sideways and ended with a little gain. Given that the index ended above the crucial moving average, short-term sentiment is still favorable. The strong momentum is further supported by the positive crossover in the RSI. Immediate resistance is situated at 22,500 on the upper end. In the immediate run, the index may climb toward 22,750–22,800 if there is a strong advance over 22,500. The position of support is 22,350–22,400.

Stock Update Analysts Say

After the recent spike, the markets took a break and finished slightly higher. Following its early surge, the Nifty fluctuated within a constrained range before ultimately leveling off at 22,402. On the sectoral front, traders were kept busy by a mixed trend in which real estate, pharma, and metals all saw respectable gains but IT and auto closed lower. The wider indexes gained between 0.4 and 0.8 percent, outperforming the benchmark.

The Nifty may continue to consolidate in the 22,300–22,500 range, but volatility may be high because April monthly futures contracts are set to expire. Traders ought to keep their attention on industries or themes that are trending consistently, such as metal, auto, and military, and add to their holdings during downturns.