Stock Market Trade Setup: The Nifty 50 made a valiant effort to hold onto the critical 23,000 barrier for a second straight session, but was unable to do so. On May 27, it closed somewhat lower amid increased volatility as bulls ceded ground to bears. This suggests that although the trend is still in favor of bulls, market participants may be exercising caution in front of the May derivative contract expiration and the exit polls that are scheduled for later this week.

Therefore, in the upcoming sessions, the index is probably going to settle around the 23,000 level and maybe try to reach the upper band of the ascending channel, which is located between 23,100 and 23,200. Experts claimed that 23,500 is the level to monitor if the index closes and holds above these levels, with support at 22,800.

Stock market trade setup

The Nifty 50 formed a bearish candlestick pattern on the daily charts after losing ground in the final hour of trading and closed at 22,932, down 25 points, after reaching an intraday record high of 23,111.

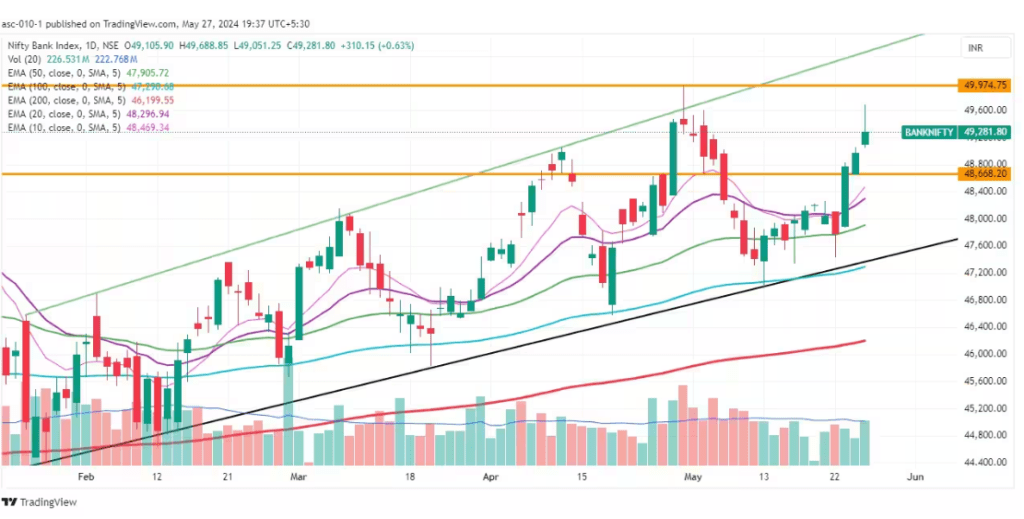

In the meantime, the Bank Nifty gained 310 points, or 0.63 percent, to 49,281, continuing to outperform the benchmark Nifty 50. On the daily charts, the index displayed a bullish candlestick pattern with a long upper shadow, suggesting profit booking at higher levels.

Crucial PointsFor The Nifty 50

Pivot point-based resistance: 23,063, 23,120, and 23,211

Pivot point support: 22,880, 22,823, and 22,732

Unique structure: Despite selling pressure at higher levels, the index maintained a higher highs formation for the eleventh straight session and traded above all significant moving averages, which is encouraging.

Bank Nifty Levels

Pivot point-based resistance: 49,584, 49,735, and 49,978

Pivot point-based support: 49,097, 48,947, and 48,703

Fibonacci retracement resistance: 49,331, 49,975

Fibonacci retracement support levels are 49,046, 48,654.

Image Source

Nifty Call Options data

The maximum Call open interest stays at the 24,000 strike, per the monthly options data. In the immediate term, the Nifty may use this level as a critical resistance level. The 23,500 strike and the 23,000 strike came after it.

The strikes that showed the maximum call writing were 23,200, 23,500, and 23,100, whereas the strikes that showed the greatest call unwinding were 22,800, 22,700, and 22,500.

Stocks Prohibited by F&O

Securities that are prohibited under the F&O segment comprise businesses whose derivative contracts exceed 95 percent of the maximum position limit on the market.

Added stocks to the F&O ban: none

The following stocks are exempt from the F&O ban: Vodafone Idea, Biocon, GNFC, Hindustan Copper, and Piramal Enterprises.

Read More: Ashok Leyland Stocks update latest

The following stocks were lifted from the F&O ban: Punjab National Bank, National Aluminium Company, Bandhan Bank, and India Cements.