Shares Today- Stocks like Havels, Ramco Cements, Dalmia Bharat, and Steel Authority of India amongst other 77 are set to witness a long build-up.

On April 2nd, the market consolidated after three-day gains and closed on a lower note. The trend is likely to continue today and in the coming days as well. This also resonates with the upcoming RBI policy meeting.

Nifty Continues to Dip Down

The Nifty shall take the support at 22,300-22,200 in the coming days. On the higher side, the 22,500 level is anticipated to pose a significant challenge for the index. If breached, the index could potentially surge towards the 22,700-23,000 levels.

The BSE Sensex declined 111 points to 73,904 on April 2, while the Nifty 50 fell 9 points to 22,453. Both indices formed a small bearish candlestick pattern with upper and lower shadows, which on daily charts resembles a Doji-like pattern and indicates that buyers and sellers are unsure of the future direction of the market.

A lead research from 5paisa.com said “There are no negative signs as of now as the short-term uptrend remains intact. It’s just that Monday’s record high is around the previous high of 22,525 and there has been open interest addition seen in the 22,500 Call option. Thus, the index consolidated for the day and it could trade within a range for one or two sessions”

Talking of dips, we estimate that level 22,300 would get immediate support and a move above 22,530 may carry forward the move upward to 22,700 – 22,750 levels.

Suggestion for traders-shares today

We suggest traders deal with the stocks today with a positive bias. It’s also important to look out for stock-specific buying options throughout the day.

On the brighter side

Many other experts believe that even if the market may stay down, the sentiment remains positive. The Nifty is expected to close above important moving averages. The momentum is also good, indicated in the Relative Strength Index in the so-called bullish crossover.

About Volatility

The closing volatility reached a new low for 2024, providing additional support for the bulls. Since November 24, 2023, the India VIX, the anxiety index, fell 3.56 percent to 11.65, its lowest level since that date.

The broad markets continued their ascent higher than benchmark indices for an additional trading session. Each of the Nifty Midcap 100 and Smallcap 100 indices experienced a 1.2% increase.

Bank Nifty Shares Today

Source-https://in.tradingview.com/

The Bank Nifty also experienced consolidation on April 2, closing at 47,545, a decrease of 33 points. On the daily charts, the index has formed a small-bodied bullish candlestick pattern with an upper shadow.

In the near term, the banking index is anticipated to resume its ascent towards 47,850–48,000. Therefore, pullbacks of a minimal degree should be regarded as purchasing opportunities.

The pivot point calculator indicates that resistance for the Bank Nifty index could be encountered at 47,668, followed by 47,738 and 47,853. It is anticipated that the pair will find support below 47,440, then proceed to 47,369 and 47,255.

Call options data-Shares today

The maximum call open interest was seen at around 23,000 strike. It included 97.52 lakh contracts. This may act as the key resistance level in the short term for Nifty. Further, the 22,500 strike with 95.09 lakh contracts and the 22,700 strike with 57.6 lakh contracts make things more interesting.

Significant call writing was observed during the 23,000 strike, which resulted in the addition of 26.71 lakh contracts; the 22,500 strike and 22,700 strike subsequently added 21.17 lakh and 15.55 lakh contracts, respectively.

Maximum call unwinding occurred at strike 23,500, resulting in the cancellation of 4.28 lakh contracts, followed by strikes 23,400 and 22,000, which canceled 1.17 lakh contracts and 71,600 contracts, respectively.

Which stocks can deliver maximum returns today?

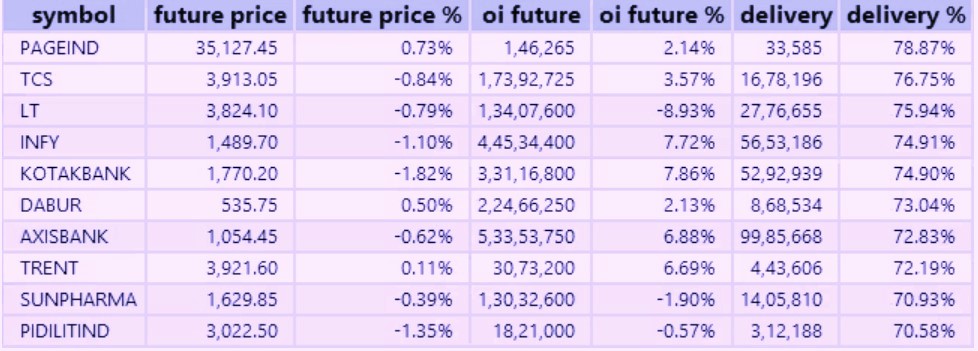

Here is a chart showing an increase in open interest while the price is indicating a long build-up of long positions.

The value is calculated on the basis of stocks that attract maximum attention from investors. Among the F & O stocks, we saw great values for Tata Consultancy Services, Kotak Mahindra Bank, Page Industries, Infosys, and Larsen & Turbo.

Among others, 77 stocks will show a long build-up today. These included Havells India, Ramco, Dalmia Bharat, Steel Authority of India, and United Breweries.

Popular Stocks Today

JSW ENERGY: The board of directors of the JSW Group has authorized the company to raise up to Rs 5,000 crore in one or more tranches through qualified institution placement (QIP).

BIOCON: BIOCON BIOLOGICS, a subsidiary of Biocon, has completed the Rs 1,242 crore decline sale-based transfer of its branded formulations business in India to Eris Lifesciences. The branded formulations division specializes in diagnostics for oncology, metabolic, and critical care.

HCL TECHNOLOGIES: HCL Investments UK, a step-down wholly owned subsidiary of the company, has sold its 49 percent equity stake in its joint venture (JV) with State Street International Holdings of the United States, according to the IT services provider. $172.5 million has been paid to the subsidiary in exchange for the divestiture of the joint venture and the termination of the agreement for related services.

MOIL– The manganese ore mining company achieved its highest-ever production of 17.56 lakh tonnes in a single fiscal year since its inception. Year-on-year growth was a significant 35 percent. This is 29 percent more than the previous record-breaking yield of 13.64 lakh tonnes in fiscal year 2008.

ESAF SMALL FINANCE BANK– With effect from April 2, ESAF SMALL FINANCE BANK has activated the Authorized Dealer Category 1 license, which pertains to foreign exchange operations.

SRM CONTRACTORS: On April 3, the EPC CONTRACTORS headquartered in Jammu and Kashmir will list its equity shares on the bourses. Per share, the ultimate issue price has been set at Rs 210.

Read more to know about our intraday stocks watchlist.