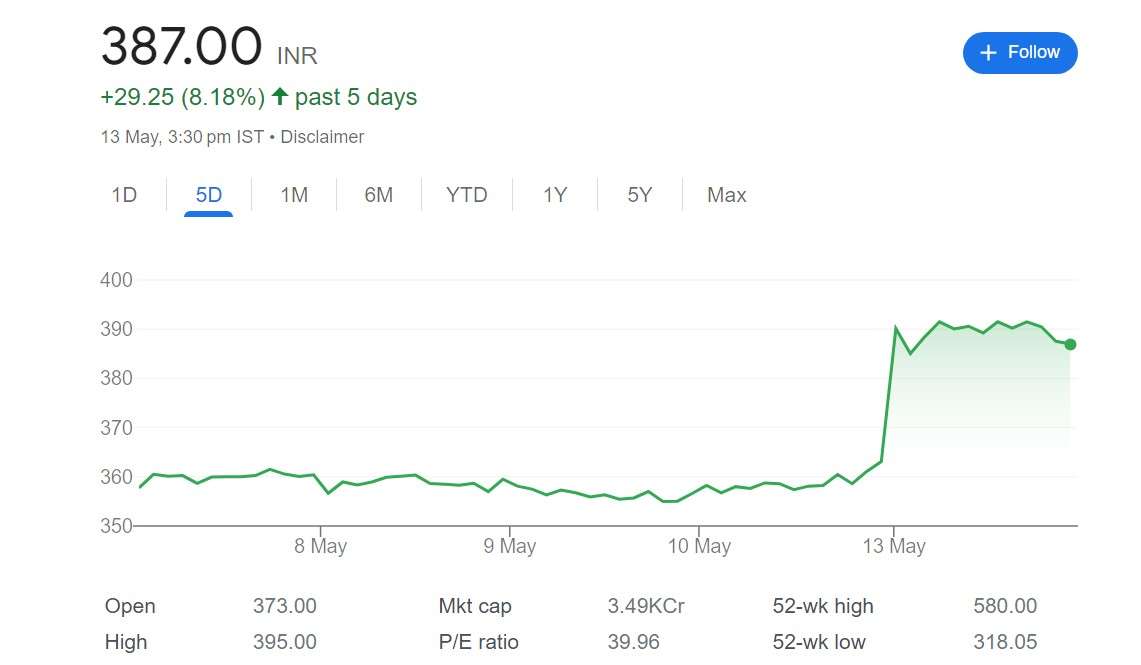

Sharda Cropchem Stocks Update: The Street celebrated Sharda Cropchem’s better-than-expected January-March quarter (Q4FY24) performance, which sent shares of the pesticide manufacturer soaring over 9% to a three-month high of Rs 394 apiece on May 13.

Profit-after-tax (PAT) for Sharda Cropchem decreased by 28% year over year to Rs 143 crore in Q4FY24 from Rs 198 crore in Q4FY23, exceeding street predictions of Rs 63 crore. The company’s operating revenue fell by 11% YoY to Rs 1,312 crore in Q4FY24 from Rs 1,481 crore in the same time last year.

The management projects that the value of the global market for crop protection chemicals will increase at a compound annual growth rate (CAGR) of 3.5 percent, reaching $62.8 billion by 2025 and $77 billion by 2030.

Sharda Cropchem Stocks Today

Image Source

The need for more food and protein production will rise due to the expanding middle class, which will in turn boost the demand for grains to support growth. The management declared in its investor presentation that they will “accelerate our focus on revenue-generating investments, margin improvements, and better cost management.”

ALSO READ: Aadhar Housing Finance IPO allotment

Reduced product price realizations in every location are the cause of the decline in revenue. According to management, this resulted in a revaluation of the stock in accordance with accounting standards, which had an impact on profitability of Rs 91 crore.

Subject to shareholder approval, the board recommended a final dividend of Rs 3 per equity share.

The stock of this pesticide manufacturer has fallen more than 14% so far this year, missing the benchmark Nifty 50 index’s 2% increase.