RCF

RCF (Rashtriya Chemicals & Fertilizers Ltd.) is a leading fertilizers and chemicals manufacturing company in India with about 75% of its equity held by the Government of India.

| Current Price ₹ 47.45 | Book Value ₹ 57.6 | Stock P/E 9.27 |

| Market Cap ₹ 2,618 Cr. | Face Value ₹ 10.0 | ROCE 7.53 % |

| High/Low ₹ 60.1/22.0 | ROE 8.75 % | Dividend Yield 0.00 % |

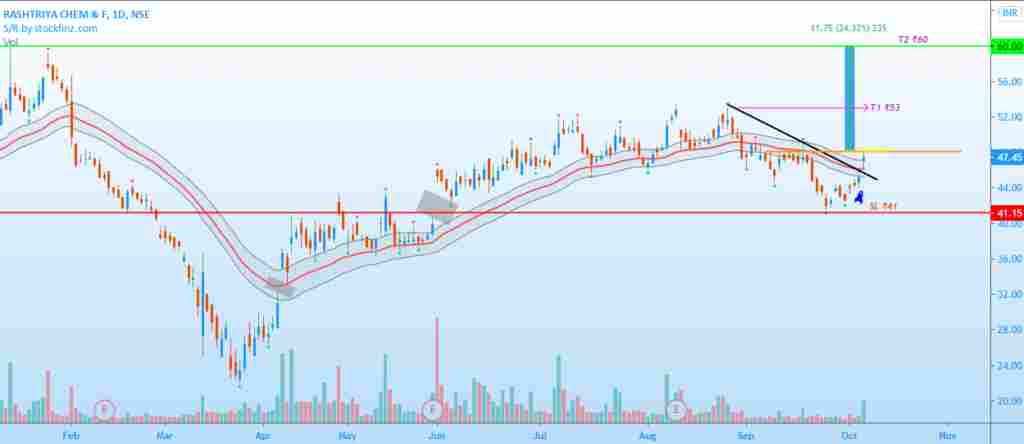

RCF is in uptrend and trading near its Resistance. Sustaining above 45 will make the stock to move towards 60.

Buy RCF above Rs. 48 for the Targets of Rs. 53 and Rs. 60.

Stoploss Rs. 41.

CMP- 47.45 | Support- 41.15 | Resistance- 47.95 , 53, 60 | Trend UP↑

Technical Analysis

| MOVING AVERAGES | Indication |

|---|---|

| Simple Moving Average (9) | Bullish |

| Simple Moving Average (18) | Bullish |

| Simple Moving Average (25) | Bullish |

| Simple Moving Average (43) | Bullish |

| Simple Moving Average (100) | Bullish |

| Simple Moving Average (200) | Bullish |

| OSCILLATORS | Indication |

|---|---|

| Commodity Channel Index (20) | Bullish |

| Williamson%R(14) | Overbought |

| MACD(12,26,9) | Bearish |

| Relative Strength Index (14) | Bullish |

| MFI(14) | Neutral |

| Stochastic(20,3) | Overbought |

| PIVOT LEVELS | Classic | Camarilla | Fibonacci |

|---|---|---|---|

| Resistance 1 | 48.23 | 47.62 | 47.87 |

| Resistance 2 | 49.02 | 47.79 | 48.31 |

| Resistance 3 | 50.08 | 47.96 | 49.02 |

| Pivot Point | 47.17 | 47.17 | 47.17 |

| Support 1 | 46.38 | 47.28 | 46.46 |

| Support 2 | 45.32 | 47.11 | 46.02 |

| Support 3 | 44.53 | 46.94 | 45.32 |

| Strengths |

|---|

| Annual Net Profits improving for last 2 years |

| Stock is trading at 0.82 times its book value |

| Company with Zero Promoter Pledge |

| Weaknesses |

|---|

| Contingent liabilities of Rs.1692.59 Cr. |

| Decline in Net Profit with falling Profit Margin |

| Company has a low return on equity of 5.22% for last 3 years. |

| Daily Trend – Bullish ↑ |

| Weekly Trend – Bullish ↑ |

| Monthly Trend – Bullish ↑ |

Profile:- Rashtriya Chemicals & Fertilizers Ltd

Sector:- Fertilizers

Industry:- Chemicals – Agricultural

Employees:- 3112

Rashtriya Chemicals & Fertilizers Ltd. is a leading fertilizers and chemicals manufacturing company in India with about 75% of its equity held by the Government of India. view more +

Quarterly Results Standalone

| Quarterly | JUN 2020 | MAR 2020 | DEC 2019 | SEP 2019 | JUN 2019 |

|---|---|---|---|---|---|

| Sales | 1,621 | 2,606 | 2,225 | 2,456 | 2,409 |

| Other Income | 28 | 55 | 19 | 26 | 24 |

| Total Income | 1,649 | 2,661 | 2,245 | 2,482 | 2,434 |

| Total Expenditure | 1,565 | 2,381 | 2,190 | 2,450 | 2,361 |

| EBIT | 83 | 280 | 55 | 31 | 73 |

| Interest | 56 | 80 | 40 | 54 | 61 |

| Tax | 8 | 57 | -64 | -1 | 3 |

| Net Profit | 19 | 142 | 78 | -20 | 8 |

Share Holding Pattern in (%)

| Date | Promoters | FIIs | DIIs | Public |

|---|---|---|---|---|

| Jun 2020 | 75.00 | 1.08 | 3.46 | 20.46 |

| Mar 2020 | 75.00 | 1.23 | 3.53 | 20.24 |

| Dec 2019 | 75.00 | 1.46 | 3.54 | 20.00 |

| Sep 2019 | 75.00 | 1.45 | 3.54 | 20.01 |

| Jun 2019 | 75.00 | 1.54 | 3.56 | 19.90 |

| Mar 2019 | 75.00 | 1.30 | 3.50 | 20.20 |

Also Read | Intraday Stocks Watchlist | Stocks for Intraday Trading

Get Important Stock Market Update and regular stock investment ideas From StockFinz. Follow Us: Telegram | Twitter | Facebook | YouTube

(*Note:- The recommendation are based on technical analysis. There is a risk of loss.)