RBI:

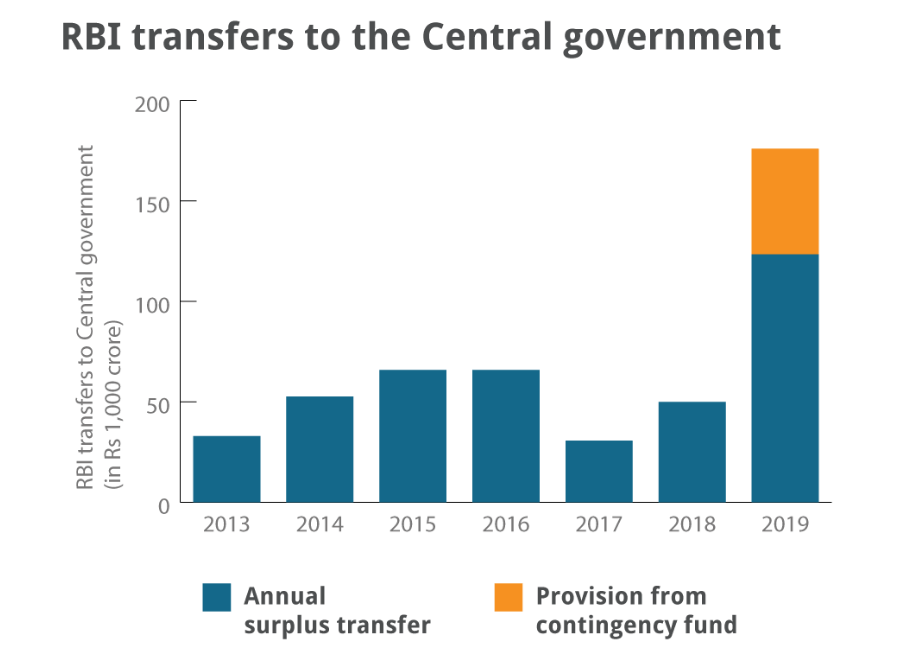

In a statement released on May 22, the Reserve Bank of India (RBI) stated that the Central Board of Directors has approved the transfer of Rs 2.11 lakh crores in surplus to the government for the fiscal year 2023–24. This is possibly the largest annual surplus transfer the Indian central bank has ever made to the government.

According to the central bank, the surplus transfer to the government for the 2023–24 fiscal year is predicated on the Economic Capital Framework (ECF), which was approved by the RBI on August 26, 2019, in accordance with the Bimal Jalan committee’s recommendations. The central bank’s currency holdings may have contributed to the sudden increase in surplus quantity, among other reasons.

When the dividend is transferred in 2024–2025, it will be significantly more than the government had anticipated. Although the surplus transfer is intended for the fiscal years 2023–2024, it will appear in the government’s account in 2025. According to experts, the central government should be pleased with the higher-than-expected surplus since it will strengthen the center’s liquidity surplus and subsequently, expenditure.

Image Source

More on RBI Approval

The Contingent Risk Buffer (CRB) for the fiscal year 2023–2024 was raised to 6.50 percent concurrent with the announcement. The Committee had suggested that the range of 6.5 to 5.5% of the RBI’s balance sheet be maintained for risk provisioning under the Contingent Risk Buffer (CRB).

Due to the current macroeconomic climate and the COVID-19 epidemic, the Board opted to keep the CRB at 5.50% of the Reserve Bank’s balance sheet size in order to stimulate economic growth and activity throughout the accounting years 2018–19 to 2021–2022.

“The CRB was raised to six percent in light of the economic recovery in FY 2022–2023. The Board has decided to raise the CRB to 6.50% for FY 2023–2024 because the economy is still strong and resilient, the RBI stated in a statement.

For 2024–2025, the government had allocated Rs 1.02 lakh crore for dividends. The budgeted dividend revenue for FY25 is Rs 1.02 lakh crore, which is 2.3% less than the revised projection of Rs 1.04 lakh crore for 2023–2024.

In fiscal year 2025, the RBI was expected to transmit a surplus of between Rs. 85,000 crore and Rs. 1 lakh crore to the government, based on the assumption of increased interest income from overseas securities. However, the actual number is significantly more than anticipated. At the 608th meeting of the RBI Central Board of Directors, the central bank approved the dividend.

Along with other Central Board directors Satish K. Marathe, Revathy Iyer, Anand Gopal Mahindra, Venu Srinivasan, Pankaj Ramanbhai Patel, and Ravindra H. Dholakia, the meeting was attended by Deputy Governors Michael Debabrata Patra, M. Rajeshwar Rao, T. Rabi Sankar, and Swaminathan J.

Read Further: RBI norms may impact banks