Pre-market trade setup: Despite consolidation, equity benchmarks continued their upward trajectory, concluding the opening session of the current week on a positive note on May 21, extending the uptrend for a fourth consecutive day. On the closing day, the Nifty 50 was able to maintain its hold on 22,500 for an additional trading day. The daily charts displayed a bullish candlestick pattern, and the relative strength index (RSI), a momentum indicator, showed a positive crossing. On the hourly charts, however, the RSI showed a negative crossover along with a further steep spike in volatility, suggesting consolidation in the upcoming sessions prior to continuing its march toward a record high.

Pre-market trade setup- Nifty Levels

Tuesday saw the Nifty 50 settle at 22,529, up 27 points or 0.12%. Analysts predict that the index will settle between 22,400 and 22,600, and that any break out of this range will provide additional guidance. The key obstacle is projected to be at 22,700–22,800 on the higher side, with the support levels predicted to stay at 22,300–22,200.

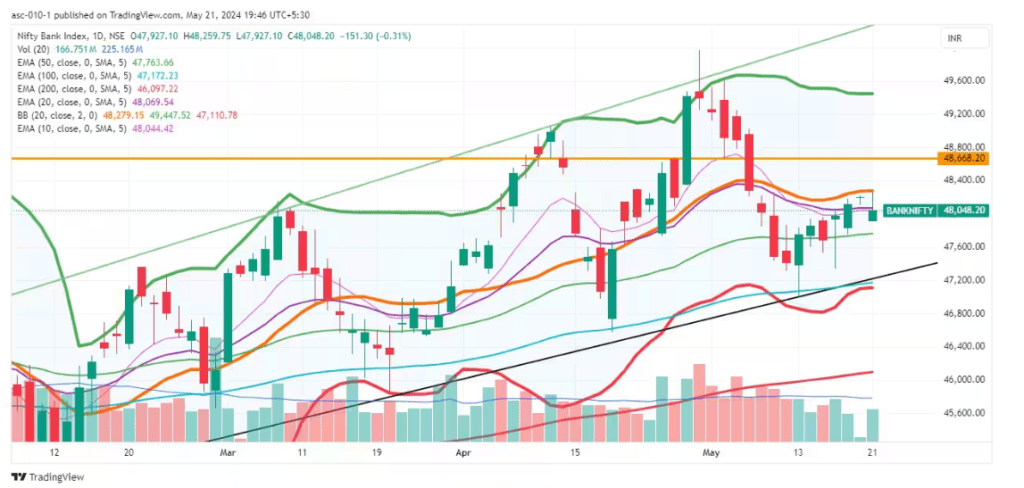

On the daily charts, the Bank Nifty formed a bullish candlestick pattern with a lengthy upper shadow, suggesting selling pressure at higher levels, while managing to hold onto the 48,000 mark, dropping 151 points or 0.31 percent to 48,048.

Image Source

Pivot point-based resistance: 22,580, 22,624, and 22,695

Pivot point support: 22,437, 22,393, and 22,322

Unique formation: In spite of increasing volatility, the index traded above all significant moving averages as it set higher highs for the seventh straight session.

Important Bank Nifty Levels

Pivot point-based resistance: 48,205, 48,284, and 48,411.

Pivot point support: 47,951, 47,873, and 47,746

Fibonacci retracement-based resistance: 48,478, 48,830

Fibonacci retracement-based support levels are 47,773, 47,621.

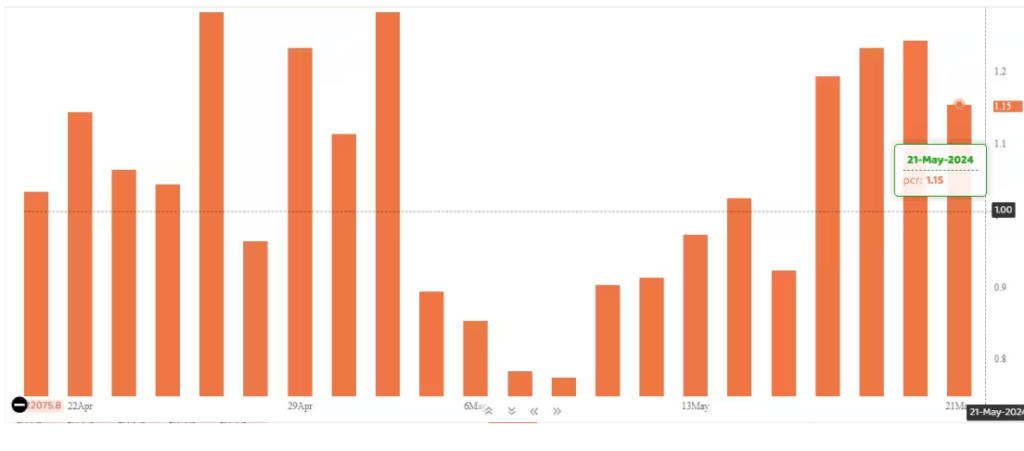

Nifty Put Call Ratio

Image Source

The market sentiment-gauging Nifty Put-Call ratio (PCR) dropped from 1.24 levels in the previous session to 1.15 on May 21.

When the PCR rises, either over 0.7 or above 1, it signifies that traders are selling more Put options than Call options, a sign that the market’s bullish attitude is solidifying. Indicating a bearish sentiment in the market, the ratio suggests that selling in calls is greater than selling inputs when it drops below 0.7 or approaches 0.5.

Read more: Deepak nitrite profit rises to 8.5%