Pre-market trade setup

The market was off on Monday due to Lok Sabha Elections.

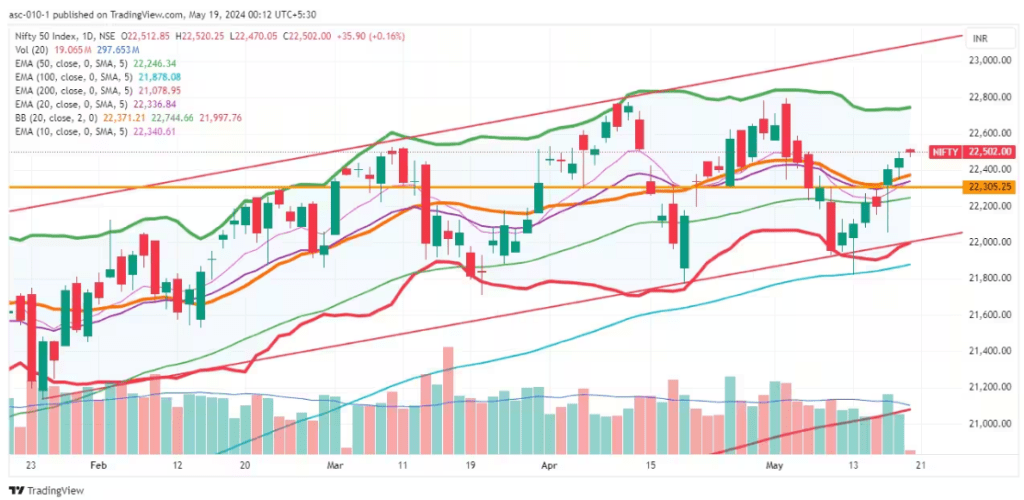

The market remained under the hands of bulls even during the special trading session that was held on Saturday, May 18, as the key indices closed in the green. The Nifty 50 closed over 22,500 for the first time since May 2, after having been below that level since May 2. The construction of higher tops for five consecutive days, together with a positive trend in the momentum indicator RSI (relative strength index), and the Bullish Piercing Line candlestick pattern on the weekly charts, all indicate to the possibility that the upward ride will continue in the days and weeks to come.

On Saturday, the Nifty 50 finished the day at 22,502, an increase of 36 points, or 0.16 percent, and a rally of 2 percent by the end of the week. Because of this, market analysts anticipate that the index will move toward 22,600 in the short term and then 22,800 in the weeks to come, with the levels of 22,300-22,200 serving as major support stations.

The Bank Nifty, on the other hand, finished the trading day at 48,199.50, representing an increase of 83.85 points, or 0.17 percent, over the previous closing. Additionally, it gained 1.64 percent for the week.

Image source

Levels That Are Crucial For The Nifty 50

In terms of resistance, the pivot points are as follows: 22,507, 22,529, and 22,548

The pivot points that provide support are as follows: 22,478, 22,466, and 22,447

A unique formation occurred when the index continued to build higher highs for the fifth session in a row, resulting in the index trading above all of the important moving averages.

The Most Important Points for the Bank Nifty

In terms of resistance, the pivot points are as follows: 48,210, 48,247, and 48,291.

The pivot points that provide support are as follows: 48,133, 48,106, and 48,062

48,480, 48,830 are the levels of resistance based on the Fibonacci retracement.

The Fibonacci retracement provides support at 47,930 and 47,745 respectively.

Nifty Call Options data

In accordance with the weekly options statistics, the strike price of 23,000 continues to have the highest level of open interest in the call option. Within the short term, this level has the potential to serve as a significant resistance level for the Nifty. The 22,500 strike and the 22,800 strike came after it in the sequence of events.

The most number of calls were written during the 23,000 strikes, followed by the 23,400 and 23,200 strikes. On the other hand, the highest number of calls were unwound during the 22,400 strike, followed by the 23,300 and 22,300 strikes.

Read more: Technical stock review

Nifty Put Options Data

According to the Put side, the highest level of open interest was seen at the 21,500 strike, which is a level that has the potential to function as a significant support level for the Nifty. Immediately after that, the 22,400 strike occurred, and then the 22,000 strike took place.

A significant amount of put writing was observed at the 22,500 strike, followed by the 21,500 and 22,400 strikes. On the other hand, there was practically any put unwinding inside the 21,500-23,500 strike range.

Nifty Put Call Ratio

The Nifty Put-Call ratio (PCR), which is a measure of the sentiment of the market, increased to 1.24 on May 18 from 1.23 levels in the previous session.

Traders are selling more put options than call options, which normally implies that a bullish attitude is becoming more pronounced in the market. The increasing PCR, which is defined as being higher than 0.7 or surpassing 1, suggests that traders are selling their put options. The ratio indicates that selling in calls is higher than selling in puts, which reflects a bearish sentiment in the market. If the ratio falls below 0.7 or moves towards 0.5, then it suggests that the market is in a bearish mood.

For more such pre-market info, follow the updates on Stockfinz.