Pre-market Stocks Monday news: As many as 96 stocks will see a short build-up. The major players will include Gujarat Narmada Valley Fertilizers & Chemicals, Maruti Suzuki, Sun Pharmaceutical Industries, and Page Industries.

On Friday, we could see the long bearish candle stock pattern after the record high on the daily graphs. There was also a small-bodied candlestick with a long upper shadow, resembling a shooting star pattern. It was followed by a bearish divergence in the RSI (Relative Strength Index). Then, there was some negative global news such as the Israel-Iran Tension (Read more here), that may weaken the market in the coming days.

Experts Say on Pre-Market Stocks Monday

Experts suggest that the Nifty 50 may take support at levels 22,300 to 22,200. This level can offer crucial support that will show an upward-sloping support trendline. On the higher end, the key resistance may be seen at the levels 22,750 to 22,800. The Shooting Star pattern will be a bearish reversal pattern. This will be at the top. Investors and traders will need to watch the follow-up candle before bringing in their marketing strategies.

As for the stats, the BSE Sensex got to 793 points to 74,245 level. The Nifty 50 got to 234 points to 22,519 levels. For the week, the index was up 6 points.

In the daily chart, a lengthy bearish candle has emerged, piercing the immediate support of the ascending trend line at 22650 levels. According to Nagaraj Shetti, a senior technical analysis analyst at HDFC Securities, “there may be more weakness in the coming sessions” since this pattern suggests the emergence of a significant top reversal pattern.

The market has reversed, he added, due to the heavy weight of the resistance trendline and Fibonacci projection at about the 22,800 level.

The Weekly Charts

Talking about the collective chart for the last week, a slightly negative candle was formed. This was accompanied by an upper shadow, hinting at a reversal type of formation. This was evident in both daily and weekly timeframes. The sign is not a positive one for the bulls.

Experts further suggest that the formation of the candlestick pattern of a Shooting Star indicates only a kind of weakness. However, there is good news too. The medium-term texture of the market is still intact. Unless the market goes above 22,650, the weak sentiment will follow.

A long build-up in 26 stocks

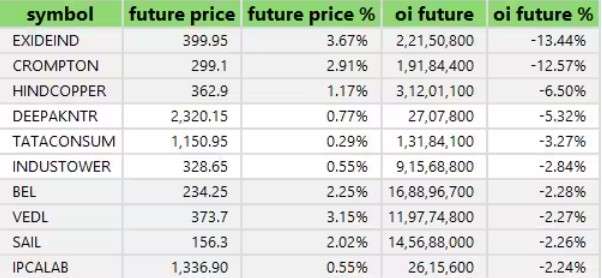

A short build-up in 96 stocks

Short covering in 21 stocks

Stock in News

Certain stocks are set to release their quarterly earnings on 15th April. These include

- Hathway Bhawani Cabletel & Datacom

- Sybly Industries

- GTPL Hathway

- Rajoo Engineers

- Hit Kit Global Solutions

- Metalyst Forgings

- Ontic Finserve

- Shekhawati Poly-Yarn

- Atam Valves

Tata Consultancy Services

For the quarter ending March FY24, Tata Consultancy Services outperformed analysts’ expectations with a net profit of Rs 12,434 crore, an increase of 9.1 percent year-on-year. The manufacturing segment, India, and the United Kingdom contributed to a 3.5 percent year-on-year increase in operational revenue to Rs 61,237 crore, with a 2.2 percent increase in constant currency revenue.

Read more about TCS Q4 results and growth here.

Anand Rathi Wealth

Despite poor operational margin performance, asset management firm Anand Rathi asset reported a net profit of Rs 56.6 crore for the quarter ending March FY24, an increase of over 33% year-on-year. Operating revenue for the quarter increased to Rs 184.3 crore, a 29% year-over-year increase.

Mphasis

A worldwide strategic cooperation agreement (SCA) covering several years has been inked between the IT solutions provider and Amazon Web Services (AWS). As a result of the partnership, Mphasis will be able to launch Gen AI Foundry.AI, with a focus on the banking and insurance sector.

Aster DM Healthcare

The healthcare provider Aster DM Healthcare has announced a one-time dividend payment of Rs 118/share.

Granules India

The company’s Unit V facility in Visakhapatnam was audited by the US Food and Drug Administration (US FDA) between April 8 and April 12, and the audit ended with zero 483s, according to Granules India.

Learn more about stocks and garner important information by reading our Blog section.