Pre-market analysis report: On May 28, the Nifty 50 fell for the third straight session in the final hour amid volatility. Just around 22,900, the index closed below 23,000. Given increased volatility to a two-year high, bulls appear wary and market participants preferred to book profits. Experts feel the chart formations showed bullish exhaustion, which could lead to a price-wise correction post-rally. The index needs a strong close over 23,000 to rise to 23,100-23,200. While waiting, consolidation may continue with support at 22,800 and 22,600.

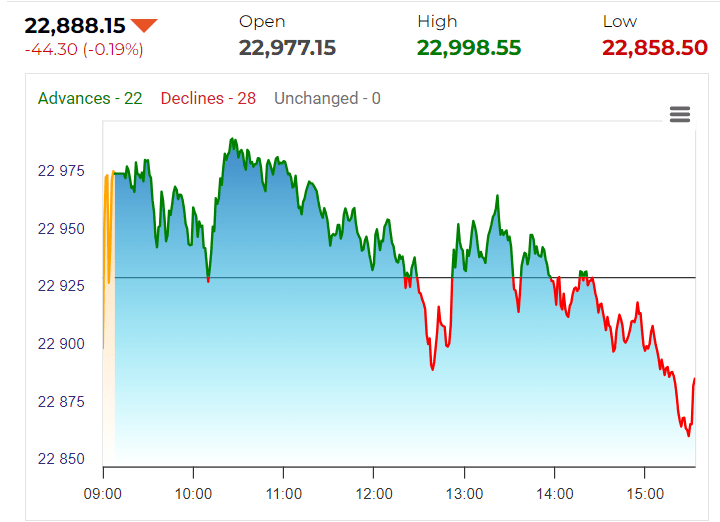

The Nifty 50 declined 44 points to 22,888 and established a bearish daily candlestick pattern with a lower high-lower low. Profit booking drove the Bank Nifty down 140 points to 49,142, its first fall in four days. The index showed a bearish candlestick pattern on the daily timeframe, but experts believe the trend is still bullish and Tuesday’s profit-taking was expected given the recent climb.

Read More: Insider trading and its aspects

Pre-market Analysis Report- Key Points

Pivot point resistance: 22,969, 23,002, 23,055.

Support from pivot points: 22,862, 22,829, 22,775.

Special Formation: The index traded above all important moving averages despite consolidation near 23,000, a psychological level.

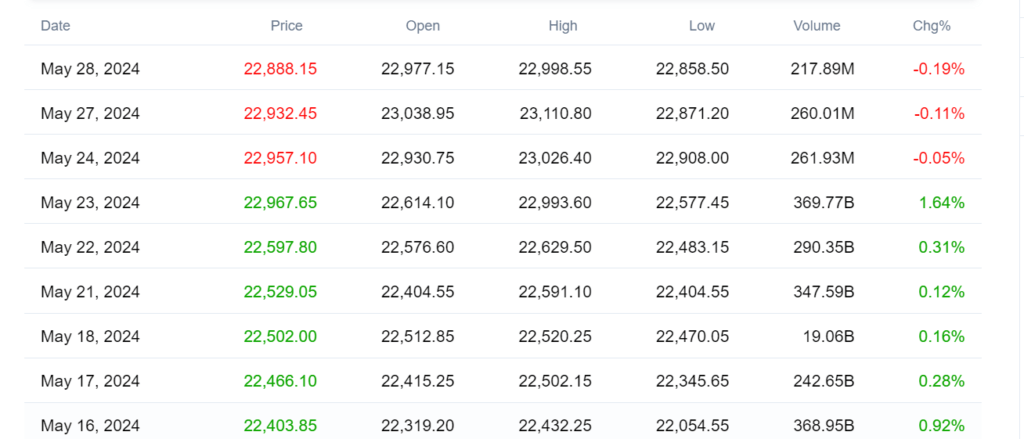

Nifty levels in earlier days- Image Source

Bank Nifty Key Levels

Pivot-point resistance: 49,411, 49,521, and 49,700

Support from pivots: 49,054, 48,943, 48,765.

Fibonacci resistance: 49,340, 49,975.

Fibonacci retracement support: 49,050, 48,658

Special Formation: The Bank Nifty held support at 49,050 for another day over 49,000. It was at the Bollinger band’s upper end and traded above all important moving averages.

Nifty on 28th May, 2024-Image Source

Nifty Call Options Data

Monthly options data showed the 24,000 strike had the most Call open interest. This level may be crucial Nifty resistance in the short future. It was followed by 23,500 and 23,000 strikes.

Maximum Call writing was at 23,000, followed by 23,500 and 23,100 strikes, while maximum Call unwinding was at 23,900, 22,500, and 22,700 strikes.

Nifty Put Options Data

The Put side had the most open interest near the 22,500 strike, a critical Nifty support level. It was followed by 23,000 and 22,000 strikes.

Put writing peaked at 22,400, followed by 22,100 and 22,000, and Put unwinding at 23,000, 23,100, and 23,300.

Bank Nifty Call Options Data

Monthly options data showed maximum Call open interest at 50,000. This may be a short-term index resistance level. It was followed by 49,500 and 49,600 strikes.

Call writing was highest at 49,200, followed by 49,600 and 49,500, and Call unwinding was highest at 48,600, 48,500, and 48,800.

Bank Nifty Put Options Data

On the Put side, the 49,000 strike has the most open interest and may support the index. This was followed by 48,500 and 49,100 strikes.

The maximum Put writing was at 49,100, followed by 48,700 and 49,200, while the maximum Put unwinding was at 49,400, followed by 49,500.

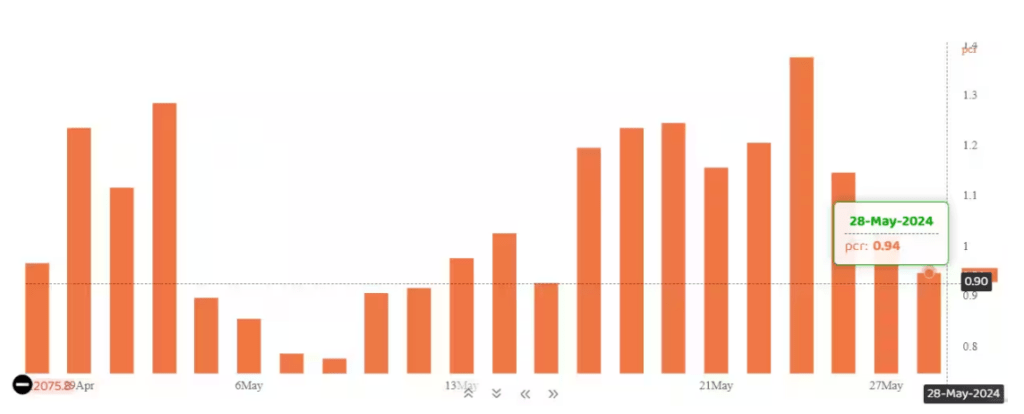

Put-Call Ratio

The Nifty Put-Call ratio (PCR), which represents market sentiment, fell to 0.94 on May 28 from 1.02 the day before.

Image Source

When the PCR rises above 0.7 or surpasses 1, traders sell more Put options than Call options, indicating market bullishness. If the ratio falls below 0.7 or approaches 0.5, Calls are selling more than Puts, indicating a bearish market.

India VIX

As exit polls and Lok Sabha election results approached, volatility reached a two-year high on Tuesday. It will likely stay high until the election. The India VIX closed at 24.20, up 4.32 percent from May 25, 2022.