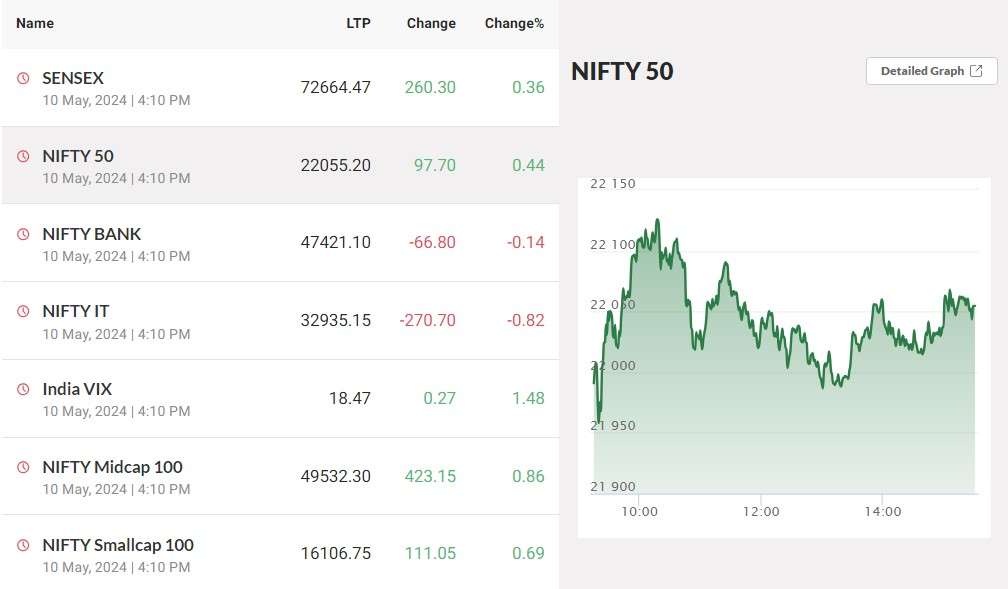

Pre-market analysis report: The market has not yet recovered, despite a surge on May 10 following a prolonged decline following its record high last week. The consolidation is anticipated to continue as long as the Nifty holds 21,900, the low of the long bearish candle of May 9 which also corresponds with the rising support trendline. The index may encounter resistance at 22,200–22,300 levels, but a break of 21,900 could push it towards 21,775, the low of April, according to experts.

On May 10, the Nifty 50 gained 98 points to 22,055 and produced a tiny bullish candlestick pattern with a small upper and lower shadow on the daily charts, while the BSE Sensex increased 260 points to 72,665.

Technically speaking, this pattern suggests a little lull in the market following a steep collapse. The Nifty is currently trading near the critical trendline support of 21,900, and senior technical analysis analyst at HDFC Securities Nagaraj Shetti stated that there is still no sign of a higher bottom reversal pattern forming at the lows.

On the weekly chart, the Nifty displayed a lengthy bearish candle with a slight lower shadow. Nifty formed a lengthy bear candle last week, indicating negative bias, following the creation of a long-legged doji at fresh highs the week before.

Experts say on Pre-market analysis report

Image Source

According to Anand Rathi’s senior manager of equity research Jigar S. Patel, the index is getting close to the lower bound of an ascending channel, and breaking it might indicate more serious market concerns. “Looking ahead, a drop below 21,900, the previous swing low of 21,777, may induce market panic,” he stated.

In the meantime, it appears that the high volatility is continuing to fuel bearish actions against bulls. The fear indicator, the India VIX, has increased by 81% over the last 12 sessions to close at 18.47, the highest level since October 13, 2022.

Stocks in the news

Tata Motors

With robust operating results and a consolidated net profit of Rs 17,407 crore for the quarter ended March FY24, the manufacturer of passenger and commercial cars saw a 222 percent increase over the same period last year due to a fiscally driven tax credit of Rs 8,159 crore. For the quarter, revenue from operations reached Rs 1,19,986 crore, an increase of 13.3% year over year.

Eicher Motors

Supported by robust operating metrics, the automaker posted a stand-alone net profit of Rs 983.3 crore for the March FY24 quarter, up 32% from the same period in the previous fiscal year. For the quarter, revenue from operations increased by 9.4% YoY to Rs 4,192 crore.

Union Bank of India

With 20 percent on-year fall provisions, the public sector lender reported a 19% year-over-year increase in net profit for the fourth quarter of the fiscal year 2024, at Rs 3,311 crore. For the quarter, net interest income was Rs 9,437 crore, an increase of 14.4% year over year.

ICICI Bank

Bijith Bhaskar has left his position as the bank’s head of consumer finance, cards, payment solutions, e-commerce ecosystem, and merchant ecosystem. He belonged to the Personnel Group for Senior Management.

Zydus Lifesciences

The US Food and Drug Administration (USFDA) has given the pharmaceutical business final permission to sell Dexamethasone tablets in the US. Arthritis, blood/hormone imbalances, allergic reactions, skin ailments, eye issues, breathing issues, intestinal disorders, cancer, and immune system disorders are among the symptoms that dexamethasone is used to treat.

Further read: Cipla shares fall under Q4 results