Image Source

Paytm Stocks Update:

Paytm reported that the UPI changeover caused a temporary disruption to its March quarter earnings, while the restriction on Paytm Payments Bank Ltd (PPBL) caused a permanent disruption.

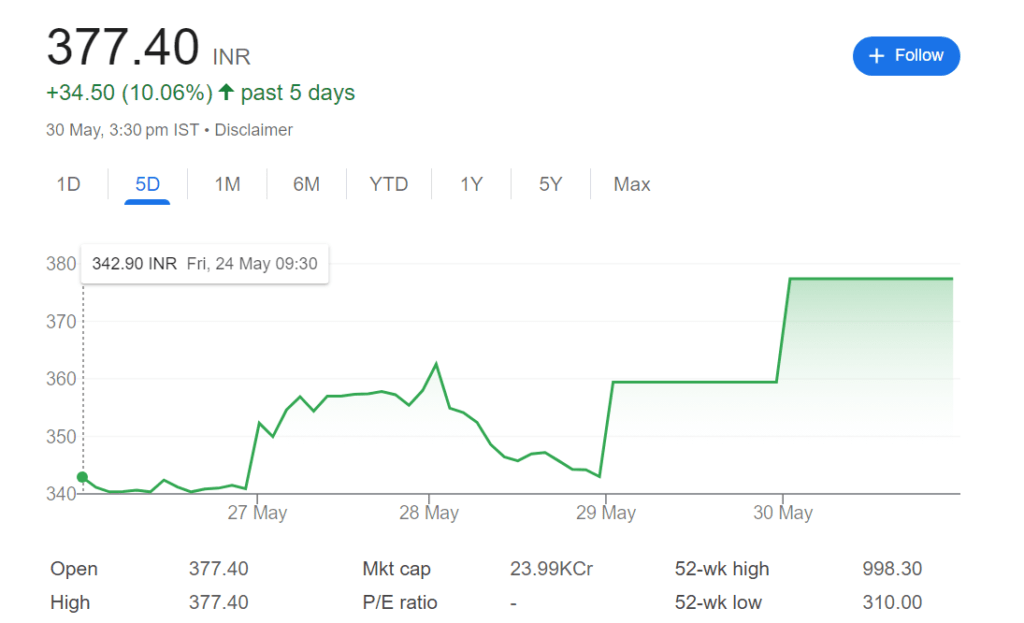

On May 30, Paytm’s shares closed above 5% for the second session in a row. Following reports that billionaire Gautam Adani is contemplating acquiring a share in One97 Communications, the parent firm of Paytm, the stock has experienced a significant surge.

Paytm, on the other hand, later clarified that the claim was merely conjecture.

“We would like to make it clear that the news item stated above is speculative, and the company has not had any discussions about it. Paytm responded in an official statement, “We have always made and will continue to make disclosures in compliance with our obligations under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.”

On the media claim, Adani Group also provided clarification, stating, “We categorically deny this baseless speculation as it is completely false and untrue.”

Paytm Stocks

The Paytm Payments Bank (PPBL) faced business restrictions from the RBI on January 31 due to continuous norm violations and non-compliance with several rules.

After February 29, the banking regulation forbade PPBL from taking on new deposits or completing credit operations. On May 9, Paytm’s stock hit a 52-week low of Rs 310.

Thus, the rumors of a collaboration with the Adani Group coincide with a favorable moment for the troubled fintech giant, which posted dismal results for the quarter that concluded in March 2024.

Paytm’s margins suffered following the RBI’s crushing restriction on PPBL, and as a result, its net loss increased to Rs 550 crore in Q4FY24, a 3.2X increase from Q4FY23. At Rs 2,267 crore, its operating revenue decreased by 2.9 percent year over year.

Currently, founder Vijay Shekhar Sharma owns over 19% of Paytm, valued at Rs 4,218 at the closing price of Rs 342 from the previous session. Sharma indirectly owns 10% of Paytm through the foreign business Resilient Asset Management, while he owns 9% of the company directly.

Paytm shares were up 5% at Rs 377.40 on the National Stock Exchange (NSE) at 2:23 PM. The fintech company’s market value increased to Rs 24,001 crore. Since Paytm is valued at 2.8 times FY26 price to sales, YES Securities has lowered its price estimate for the stock to Rs 450.

Also Read: When Paytm shares were below Rs. 400

Paytm stock is predicted by Dolat Capital to bounce back and reach Rs 650. “Paytm’s redoubled emphasis on cost-cutting & business expansion is a positive indicator for recovery.

As per expert brokerage, they maintain a “Buy” rating with a discounted cash flow (DCF)-based price target of Rs 650 since we think the current market price does not factor in a possible stronger recovery from Q2 onwards.