Recently, foreign portfolio investors took a lot of interest in Paytm, increasing their shareholding capacity above 20%. Mutual funds also increased their stakes to 6.15 percent in the last FY quarter.

Image Source

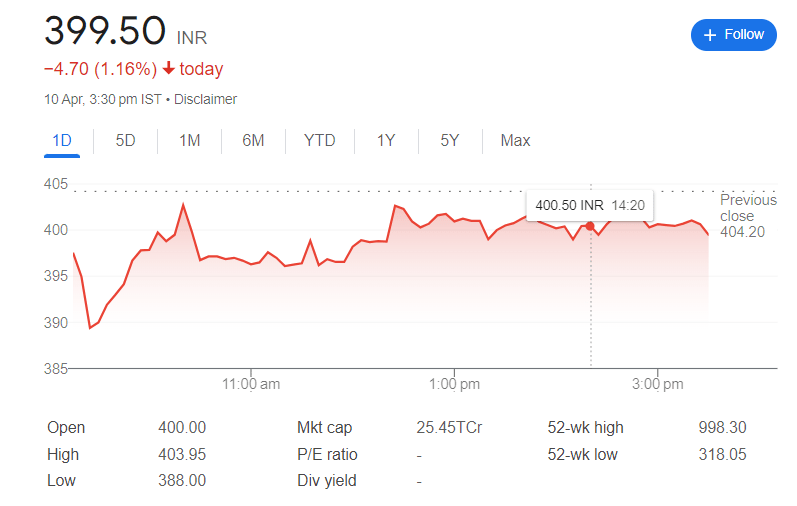

In recent news, the share of the parent company of Paytm i.e. One 97 Communications Ltd dropped to more than 4 percent and came down to Rs. 388 on 10th April 2024. The company faced another setback when the Managing Director and CEO of Paytm Payments Bank Surinder Chawla resigned today. The advancement comes as Paytm Payments Bank is already facing strict actions from RBI.

The National Payments Corporation of India (NPCI) revealed the data that hinted at how Paytm’s market share has fallen to as much as 9 to 11% in February 2024. In March, the fintech company processed 1.2 billion UPI transactions. The graph is declining, compared to 1.4 Billion in January and 1.3 Billion in February.

The data further suggests that mutual funds, FPI, and retail buying in the tech app in the March 2024 quarter were unable to lift the counter sentiment. Foreign investors have increased their shareholding in Paytm by 2 %. Mutual funds also raised the stakes to 116 basis points which equates to 6.15 percent in the last quarter of 2024.

Experts say in the matter

Experts say that Paytm is a good option for investors who are more inspired to invest. If you want to go with a lower-risk option, then you may avoid buying its shares. For a few months, the stock has been under severe pressure and scrutiny by RBI. This has harshly impacted the prospects of the enterprise.

In a recent interview, an expert said “An investor needs to look at the financial performance of the company as a whole. The most applicable results come in the March 2024 quarter and hence, the decisions can be made. Experts further recommend that financial performance and a turn-up towards nodal banking can be the key elements that will drive the direction of stock in the future.

Paytm Stats

In the last quarter of FY2024, Paytm is set to lose Rs. $69.30 crores. This can highly impact operating profitability due to bans from RBI. There will also be a decline in the payment reimbursement of the company. The gross merchandise value and total growth revenue may also decline.

The same is the story with the Paytm stocks. Technical analysts suggest that investors should avoid the stock at present levels as it may drop further. They hint that investors should wait for the stock to subpar the key resistance of Rs. 450. This can be a decisive basis to take any position in the market.

On the daily charts, there is still a push to sell Paytm. A senior manager at Anand Rathi Shares and Stock Brokers, Ganesh Dongre, said that the stock will find support between Rs 320 and Rs 330 and face resistance at Rs 450. “At this price, investors should stay away from this stock.” “For the next sessions, we will keep waiting and watching for this stock,” he said.

Shiju Koothupalakkal, Technical Research Analyst at Prabhudas Lilladher, said that Paytm has been in a consolidation phase for a while now, with the Rs. 440 level acting as a strong barrier. The company would need to break through that level in order to prove that it will continue to rise.

The chart doesn’t look good right now from a technical point of view, and a clear break below the important support level of Rs 350 would make the trend even weaker, pointing to a further drop. “The overall trend will get better only after a clear break above the important 50 EMA level of Rs 453 is proven,” he said.

Learn more about stocks news here.