Tata Steel

Tata Steel is an eminent steel producer in the world. Currently, the organization is making waves in the stock market of India. Tata Steel announced its substantial growth in its fourth-quarter steel production of higher profits.

With a remarkable surge of more than 4% in the steel output of India, the stock of the company has increased with a notable uptick value of 2%. This is a clear example of investor confidence in the performance of the company.

The facts-Tata Steel

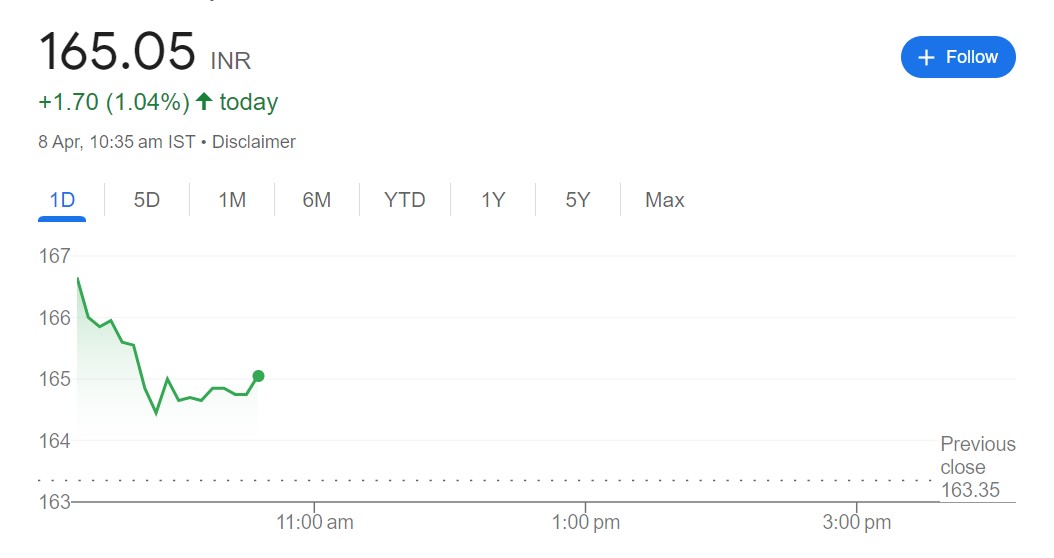

Following the announcement made by Tata Steel on April 5 that its fourth quarter crude steel output in India increased by 4.5 percent year over year to 5.38 million tonnes (MT), the company’s shares increased by 2 percent at the opening of trading on April 8. The price of the stock was 166.15 rupees at 9:20 in the morning.

Continue reading our market intra-day blog for real-time updates.

In the same year, deliveries reached 5.41 MT, which is a year-over-year rise of 5 percent. It was reported in the filing that Tata Steel India recorded its highest-ever annual crude steel output of 20.8 MT in FY24, with a growth rate of 4 percent year over year.

When compared to the net loss of Rs 2,501.95 crore that was recorded in the third quarter of fiscal year 23 (Q3FY23), the firm declared a consolidated net profit of Rs 522.14 crore in the October-December quarter of Q3FY24. In addition, the revenue from operations for the same time decreased by three percent, reaching 55,311.9 crore, as opposed to 57,083.56 crore in the fiscal year before to this latest one.

The Bottom Line

The significant expansion of the steel shows the robust operational abilities of the company. It also reflects the overall positive trajectory of the steel industry of the nation. The global demand of steel continues to rise and Tata Steel’s impressive growth hints at a promising outlook for the company and the sector at large.