Mazagon Dock Shares Update: On May 29, the shares of many shipping businesses surged to 10% due to significant volume and triggers such as order wins and March quarter reports. Mazagon was ahead of the pack because investors bought after seeing its strong fourth-quarter results.

In comparison to the Rs 2,078.6 crore topline it posted during the same time previous year, the company reported sales of Rs 3,103.6 crore. From Rs 326 crore in the same quarter last year to Rs 663 crore during this period, its net profit more than doubled.

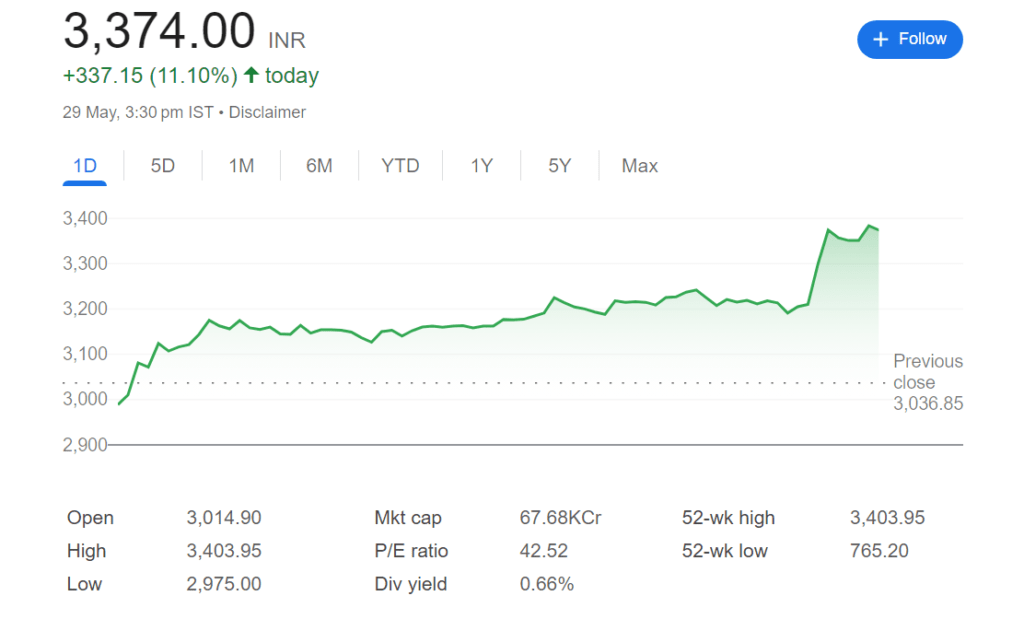

Mazagon Dock shares were up 10.5% at Rs 3,352 a share on the National Stock Exchange at 3:15 p.m. Over 41% of the stock’s value has increased in the past month.

The counter has gained more than 46% so far this year. Its enormous one-year gains of around 332% surpassed Nifty’s 25% return in the same time frame.

Image Source

Concurrently, Cochin Shipyard’s shares was up more than 5% due to the PSU’s acquisition of an international order for the construction of a hybrid service operation vessel (SOV) from North Star Shipping, an offshore renewable energy company based in the UK.

There is also a second option in the deal to build two additional of these boats. A hybrid SOV was previously contracted by North Star Shipping and the Cochin Shipyard earlier in the year.

Cochin Shipyard builds ships and repairs offshore rigs, among other things. The Navy is the company’s main source of revenue, and it is the biggest shipyard in India’s public sector. Construction of navy vessels, Coast Guard projects, commercial shipbuilding, and marine maintenance services are among its main sources of income.

The company’s shares have increased by almost 194 percent this year, almost tripling in value. The multi-bagger stock has produced phenomenal returns of more than 700 percent over the past 12 months. Within the previous month alone, the stock has experienced an incredible surge of around fifty percent.

Also Read : How stock market performed to previous Elections

On May 29, shares of Great Eastern Shipping Company saw an increase of more than 4%. In a presentation to investors, the company stated that the yard capacity has decreased dramatically over the past 15 years and that the orderbook is substantially smaller than historical levels.

The company handed over its 2004 Medium Range Product Tanker Jag Pahel to the purchasers earlier this month. The stock has increased 54% in the past year.