Exit Poll results are a good hint for the market today.

Sensex and Nifty began trading at all-time highs following exit polls that showed the BJP winning handily. The Sensex and Nifty 50 both increased by almost 3%, setting new highs of 76,738.89 and 23,338.70, respectively.

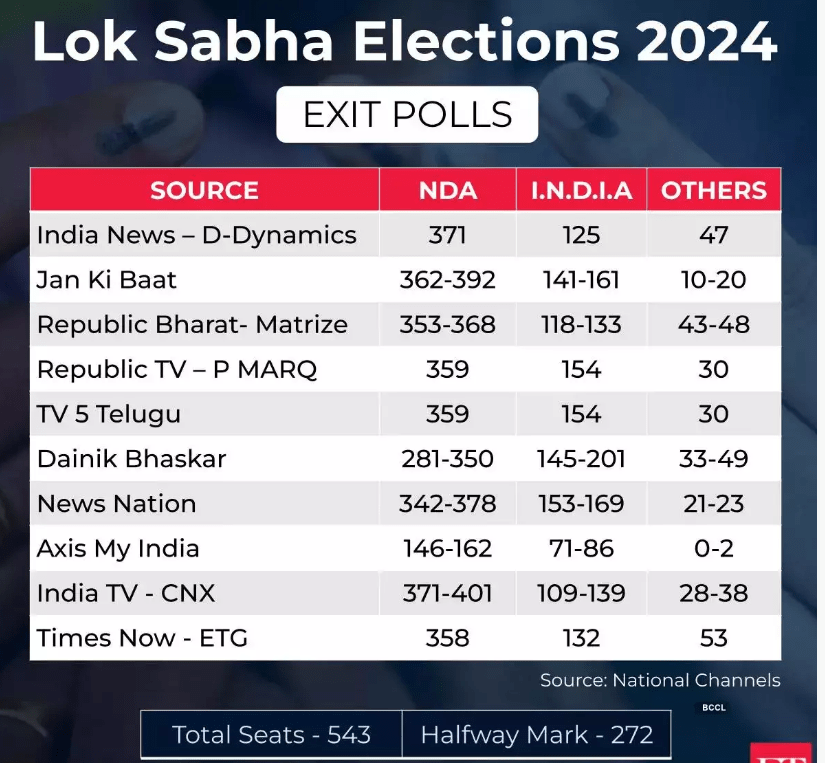

Election-related anxiety that had been affecting markets in May has subsided, according to exit poll findings showing the NDA with roughly 360 seats. This was said by V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Every one of the 13 main sectoral indicators was rising. The leading gainers were Nifty PSU Bank, Nifty Energy, and Nifty Realty, all of which increased by 4-5 percent. The two indices that had the least increase, Nifty Healthcare and Nifty Pharma, both recorded increases of 1.2 percent.

BSE Midcap increased by almost 4% and BSE Smallcap by 2% on the overall market.

Adani Ports, Shriram Finance, and Power Grid were the highest-performing individual equities in early trade, each up 7–10 percent.

Image Source

Exit Polls Affect on Adani Ports

Following the signing of a 30-year concession deal with the Tanzania Ports Authority to run and manage Container Terminal 2 at the Dar es Salaam Port in Tanzania, Adani Ports’ shares saw a 10% increase. The company’s fully owned subsidiary, Adani International Ports Holdings Pte Ltd (AIPH), is responsible for managing the port.

The Nifty 50 was up 537 points, or 2.4 percent, at 23,067 at 9.45 am, while the Sensex was up 1,731 points, or 2.3 percent, at 75,692. A total of 2,633 shares increased, 571 shares decreased, and 117 shares stayed the same.

With the exception of Eicher Motors and LTIMindtree, the other 48 firms on the Nifty 50 list saw gains.

“The market has gained confidence again, even though we won’t be entirely out of the woods until the official election results are declared. Uncertainty has greatly decreased as a result of the exit polls, according to Nirav Karkera, Head of Research at Fisdom.

For all of the market action, subscribe to our live blog.

Experts predict that the market volatility seen in May will decrease following the June 4 announcement of the election results. According to Sameet Chavan, Head of Research, Technical and Derivative at Angel One, “our markets are expected to be vulnerable until the election outcome, and volatility is likely to remain high during this time.” India VIX was down 21% at 19.3 at 9:45 a.m.

Analysts predicted that following the election, the market will concentrate on the union budget and the first 100 days of the new administration.

India’s GDP grew 7.8 percent during the January–March quarter of Q4FY24, mostly due to strong development in the manufacturing sector. The Indian economy grew by 8.2 percent in FY24, above D-Street projections. “The stronger-than-expected 8.2% GDP growth, which was revealed on Friday after market hours, will give bulls even more confidence. The market is ready for a rally both fundamentally and technically, according to Vijayakumar.

“Nifty can find support at 23,200 after a huge gap up opening, followed by 23,100 and 23,000,” stated Choice Broking Research Analyst Deven Mehata. “On the higher side, 23,650 can be an immediate resistance, followed by 23,700 and 23,800,” he stated.

Also read: How market responded to previous elections results