Let’s begin the week with some good news for navigating volatility. A long build-up is estimated in 60 stocks. The list includes major players such as Gujarat Gas, Tata Chemicals, Metropolis Healthcare, Mahanagar Gas, and ICICI Lombard General Insurance Company.

Let’s embark on a small journey, knowing the pre-market landscape and the data point going forward this week. We shall try to unravel the mysteries of the morning so that you get more chances of success in today’s dynamic market realm.

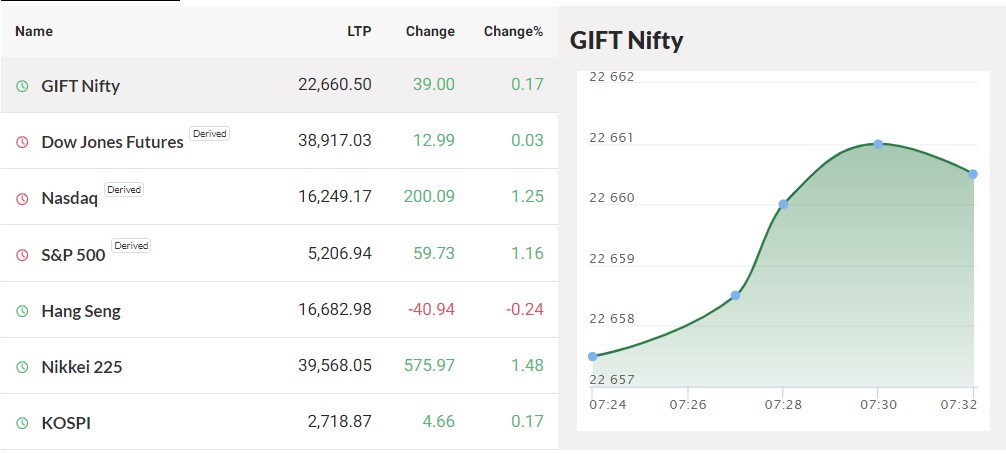

Nifty goes up to 50 points

The market is going to be volatile in the coming sessions, as expected. The focus will be on the 22,500 to 22,600 levels. The hurdle will be on the higher side, closing above the same zone. This may take the Nifty 60 or even 60 points towards the 23,000 mark. The 22,300 and 22,200 will remain the key support zone of the index, as per the experts. The reduction in volatility is becoming a major comfort for the bulls.

On Friday, the BSE Sensex increased by 21 points to 74.248. This was after the Monetary Policy Committee Maintained the repo rate of about 6.5 percent. This happened for the seventh consecutive time. The Nifty 50 fell a single point to 22, 514 and created a bullish candlestick pattern. This was accompanied by buying interest at the lower levels. The trade further indicated how the market has discounted the RBI policy meeting.

Say of the Experts-Navigating Volatility

The Index went up by 0.84 percent for the week. “For the next couple of days, the current consolidation is likely to stay in the range of 22,200 to 22,550.” “The level of 22,300 is an immediate support to keep an eye on for the Nifty. The larger support zone is between 22,150 and 22,200,” said Tejas Shah, who does technical studies for JM Financial and BlinkX.

Vice President of Technical Research at Kotak Securities, Amol Athawale, also thinks that the important support level for buyers would be 22,200, or the 20-day simple moving average. Above the same, the trend is likely to stay good.

Bank Nifty

The Bank Nifty did well after the RBI policy meeting on April 5 and went up 432 points to 48,493. It continued its upward trend for the third session in a row with above-average trading volumes. It’s only 143 points away from its all-time high of 48,636 on December 28, 2023. The index went up 2.9% over the course of the week and made a long bullish candlestick pattern on the weekly charts.

More news about stocks

Wipro

Chief Executive Officer and Managing Director of the IT services company Wipro, Thierry Delaporte, quit on April 6. Srinivas Pallia has been named CEO and MD of the company by the big software company.

Vodafone Idea

The mobile company’s board of directors has given the company permission to raise up to Rs 2,075 crore from Oriana Investments, a company in the Aditya Birla Group.

Tata Steel

India’s crude steel production rose by 4.5% year-over-year to 5.38 million tonnes (MT), according to Tata Steel, a company in the Tata Group. supplies also rose by 5% YoY to 5.41 MT, which were the biggest quarterly supplies ever.

Gland Pharma

The US Food and Drug Administration (FDA) has given the green light to Gland Pharma’s Eribulin Mesylate shot. Gland Pharma is a generic injectables-focused pharmaceutical business.

Cochin Shipyard

The US Navy and the company have signed the Master Shipyard Repair Agreement (MSRA). The MSRA is not a business deal, and it starts on April 5. This will make it easier for the Military Sealift Command to fix up US Naval ships in the Cochin Shipyard.

The FII and DII files

On April 5, preliminary data from the NSE showed that foreign institutional investors (FIIs) bought shares worth a net of Rs 1,659.27 crore and sold stocks worth a net of Rs 3,370.42 crore.

Stock that can’t be bought or sold on the NSE

The NSE added Bandhan Bank to the list of companies that can’t trade on the F&O market on April 8. Hindustan Copper, SAIL, and Zee Entertainment Enterprises are still on that list.

Check out our previous pre-market analysys reports here.