Image Source

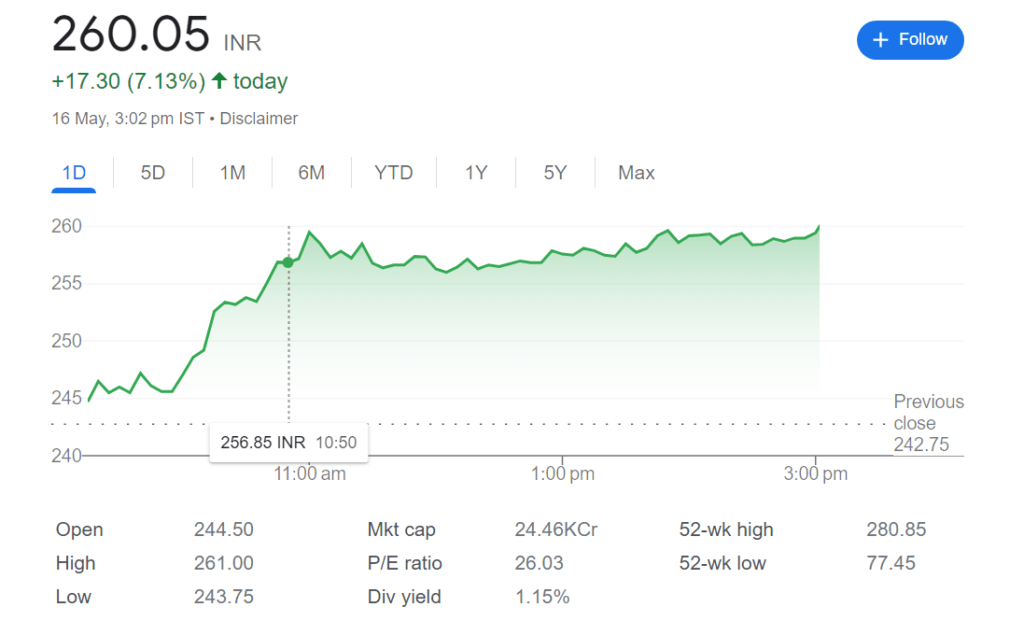

Ircon Stocks increased by about 7%, continuing their upward trend for the third straight day.

The BSE and NSE together saw around three crore shares exchange hands, which exceeded the one crore share average trading volume over a one-month period.

This led to a rise in the stock. A solid earnings quarter in January through March of 2024 is expected, which is another reason why the price is rising.

The Board of Directors will meet on May 21, 2024, to discuss and approve the audited financial statements for the quarter and year that ended in March 2024.

This information was recently provided by Ircon International. A final dividend recommendation, if any, for FY24 will also be made by the board on May 21 and will be subject to shareholder approval at the Annual General Meeting (AGM).

Ircon shares were up 6.8% at Rs 259.40 on the National Stock Exchange (NSE) at 2:08 PM. The stock has soared almost 67 percent in the last half-year, significantly underperforming the benchmark Nifty 50, which increased by 12 percent in the same time frame.

Ircon’s share price has increased by almost 230 percent in the past year, more than tripling the money of investors.

Undervalued PSU equities like Ircon, which trade at a small fraction of their intrinsic value despite having a strong core company, are great investments right now, according to Sanjiv Bhasin, Director at IIFL Securities.

“These are the blue chips, in my opinion. You are sitting on a pile of gold if you can hold them. In an interview with ET Now, he stated, “If you want to attract new investors, two equities that have the potential to double are Engineers India and Ircon.”

Ircon International is a professional construction company that offers all types of construction services and activities related to the infrastructure industry. MRTS, EHP sub-station (engineering and construction), and railway and highway building, however, are the public sector undertaking’s (PSU) primary competency areas.

The most capital expenditure in these sectors has ever been allocated, with a record Rs 2.55 lakh crore for railways and Rs 2.78 lakh crore for roads and highways included in the most recent Interim Budget.

In order to improve logistical efficiency and cut costs, the government has also announced the launch of three significant railway corridor programs as part of the PM Gati Shakti plan.

Read more: India’s core sector growth