Investing Tips:

On June 4, investors hastily reduced their long positions as benchmark indices plunged and volatility skyrocketed due to preliminary data indicating a weak NDA election victory.

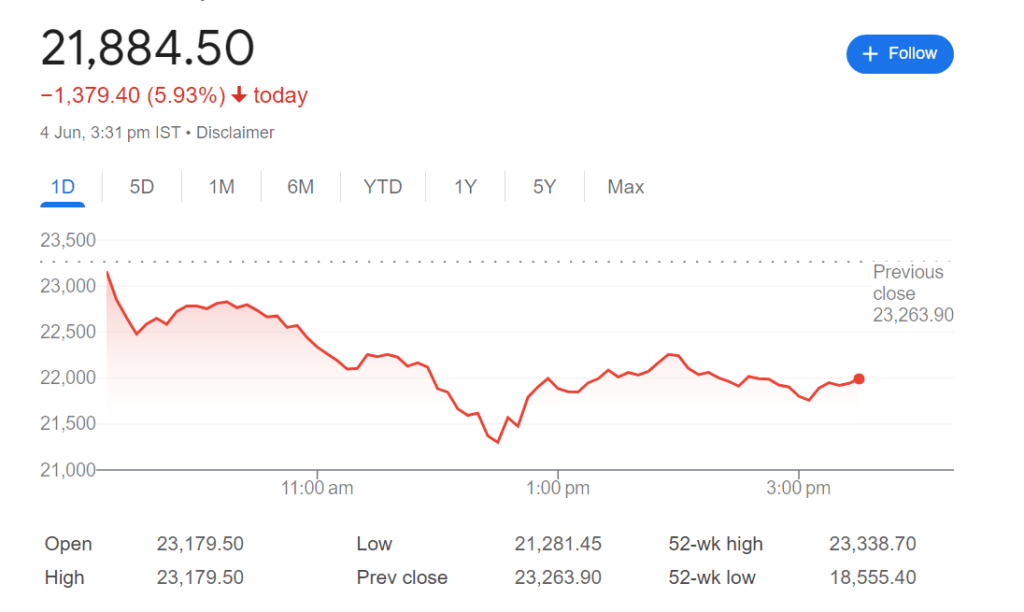

Both indices were down roughly 5–6% for the day as the Nifty dropped more than 1,300 points to below 22,000 and the Sensex plummeted over 4,200 points to 72,250. The largest one-day decline since at least February 2022 has occurred with this one.

In the meanwhile, volatility increased, as evidenced by the India VIX rising above 29 by almost 40%. In at least nine years, this is the largest increase in the volatility index.

Image Source

Nifty declines below critical levels of support

The Nifty has breached important support zones at the 22,400–22,450 level, which it had been holding since May 17, with today’s decline. Additionally, according to Sudeep Shah, DVP and Head of Technical and Derivative Research at SBI Securities, it is maintaining below short-term moving averages of 10–20 EMA.

The 100 DMA, which hasn’t been decisively broken since November 2023, is located between 22,150 and 22,170, and we feel this is the next critical support level for the Nifty. Levels of 21,900–21,750, which were the swing lows of March–April–May 2024, might be revisited below 22,150, according to Shah.

PSU shares saw shorting and longs were liquidated

On June 4, there was a significant long liquidation in Nifty futures, resulting in a loss of about 4.5 percent in open interest. The June series presently has almost 2 crore units. Arun Kumar Mantri, the founder of Mantri Finmart, notes that in today’s trade, heavy shorting was also observed in PSU stocks, followed by Adani group entities, which are down by 15-20% with high trading volumes. This comes after the BJP-led NDA’s fractured mandate became evident in the first rounds of counting.

Investing tips: Steer clear of bottom fishing; more selling pressure is anticipated.

“It is evident that there has been significant selling in the stocks that saw a strong increase during the last one to two weeks of market rallying. The street’s general attitude has become rather negative, with resistance located around 22,800–23,000 levels on the higher side and support currently located at 21,650–21,800 levels, according to Mantri.

Observe all market activity by following our live blog.

22,600 would now be the critical number to monitor from a reversal standpoint. Refrain from creating any new positions at the current levels and refrain from bottom fishing. Hold off for a few days until the selling pressure lessens and more information becomes available, Shah advised. He continued, “The VIX is expected to approach 34–36 after rising 40% today, which would further add to the pressure on the indices.”