Image Source

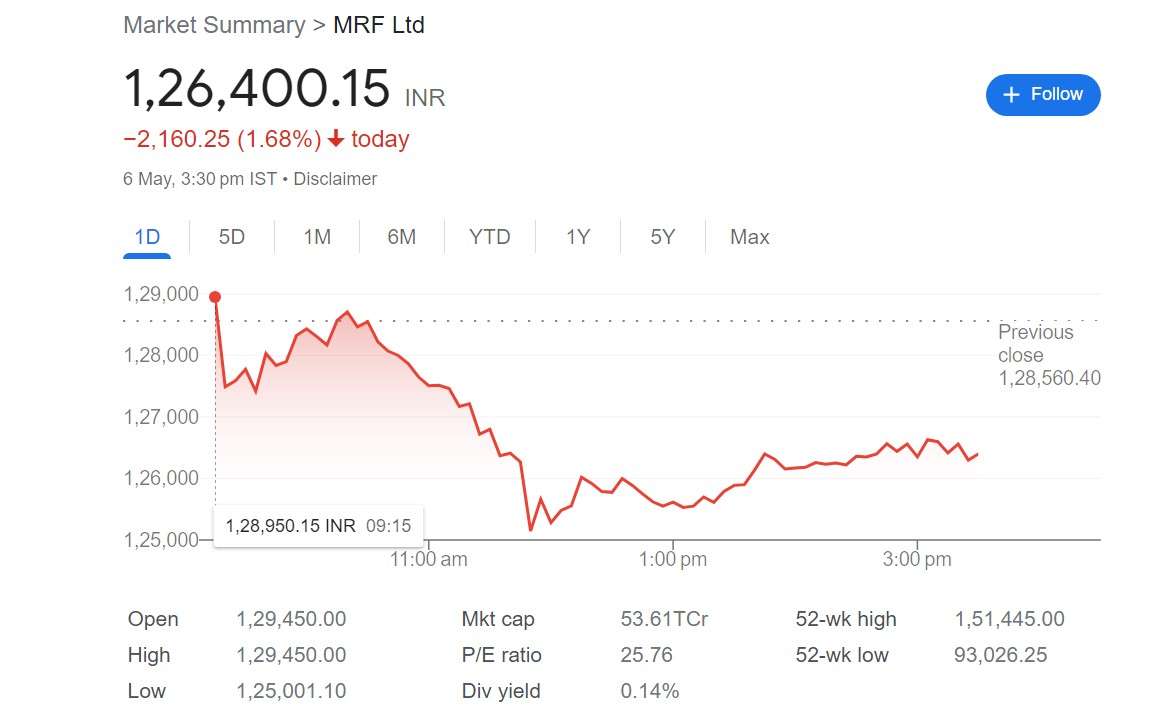

India’s most expensive stock falls down to 3%.

In the aftermath of the tyre maker’s results report for the fourth fiscal quarter of FY24, MRF, the most expensive stock in India, dropped over three percent in trading on May 6.

MRF recorded a 7.6% decrease in net profit for the quarter, from Rs 410.7 crore to Rs 379.6 crore, compared to the same period last year. Operating revenue increased by 8.7% year over year to Rs 6,349.36 crore.

MRF, India’s most expensive stock was trading at Rs 1,26,239.9 on the NSE at 2:30 pm, down 1.8 percent.

Elara Capital stated in a report that MRF has reclaimed its top spot in the domestic truck replacement market, even in the face of recent fierce competition. The highest margin for MRF and the tire industry appears to occur in FY24.

The brokerage continued, “We think there aren’t many positive catalysts for the tire business right now, but price hikes in a softening demand environment might be watched.”

Elara Capital has set a target price of Rs 1.1 lakh per share for MRF and is recommending a sell. This suggested a fourteen percent decline.

“Over the past few years, MRF’s competitive standing in the industry has diminished, which is reflected in the dilution of pricing power in the PCR and TBR categories. This should restrain the increase in return ratios, together with the effect of the anticipated capital expenditure, according to Motilal Oswal.

Additionally, the brokerage rates the participant as well, with a price target of less than Rs 1 lakh, or Rs 92,000 per share. A 28 percent decline is indicated by this.

In the last half-year, the company’s stock has increased by about 17.8%. By contrast, over the same period, the Nifty 50 index has increased by almost sixteen percent.

Read more: Titan Q4 results