Elections Update: Following RBI’s generous transfer to the government, both the Sensex and the Nifty reached new highs. Historically, the market has, for the most part, exhibited a somewhat subdued reaction to the results of elections.

At the end of trading on Thursday, the major stock market indices of India, the Sensex and the Nifty, reached historic highs of 75,418 and 22,967, respectively. This was spurred by the announcement made by the Reserve Bank of India (RBI) on Wednesday regarding a generous transfer to the government that has the potential to increase the government’s spending capacity (and contain the fiscal deficit).

Since the announcement of the elections on March 16 (which was a Saturday, so it makes sense to check at the closing of the preceding Friday), the Sensex has increased from 72643.42 to 75418.04, or a gain of 3.82%.

Is this elections cycle different from those that have occurred in the past?

By their very nature, stock markets are subject to significant influence from both domestic and foreign events. Furthermore, while taking into account the far-reaching effects of Lok Sabha elections, it is also thought that these elections have a substantial influence on the markets. On the other hand, how much of an effect may the results of the election have on the stock market in India?

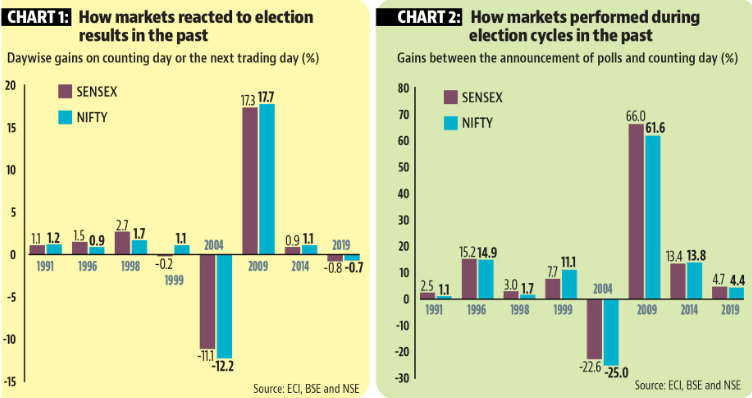

The majority of the time, in the past, the markets have exhibited a somewhat subdued reaction to the results on the day that the counting actually took place. The very following trading day was taken into consideration for this research in the event that the counting occurred on a market holiday. This is to ensure that there is no confusion. As can be seen in Chart 1, the only two instances since 1991 in which the markets exhibited a strong reaction to the results of an election on the day that the counting was being done were the elections for the Lok Sabha in 2004 and 2009. The market collapsed in 2004, but it had a meteoric rise in 2009.

To be sure, in addition to 2004, the markets experienced a decline as a result of the findings that were announced in 2019. Possibly, the markets had already taken into account the win of the National Democratic Alliance (NDA) led by the Bharatiya Janata Party (BJP), and the fact that there was a weakness in wider economic fundamentals caused investors to book profits as soon as the results were released, which resulted in a decline in market prices.

The crash that took place in 2004 was a result of the surprise win of the United Progressive Alliance (UPA), which exceeded the forecasts of the majority of observers. Over the course of the subsequent few trading days, the markets continued to decline as it became apparent that the newly formed coalition government would also have support from left-leaning parties. It took approximately six months for the markets to return to the levels that they had reached previous to the election campaign. The elections that took place in 2004 are, without a doubt, the only instance in which the markets experienced a decline simultaneously with the election cycle. Here, the term “election cycle” refers to the time period that begins with the Election Commission’s announcement of the election schedule and ends with the day when the votes are counted.

The markets, on the other hand, rallied during the election cycle and on the first trading day after the results were published in the very following elections, which took place in 2009 and were won by the United Progressive Alliance (UPA), which remained in office. The rapid recovery of India from the financial crisis that occurred in 2008, which was largely driven by a fiscal stimulus that was announced by the government, was another factor that contributed to the improvement in market sentiments during this time period.

How did market performed after the previous elections?

Image Source

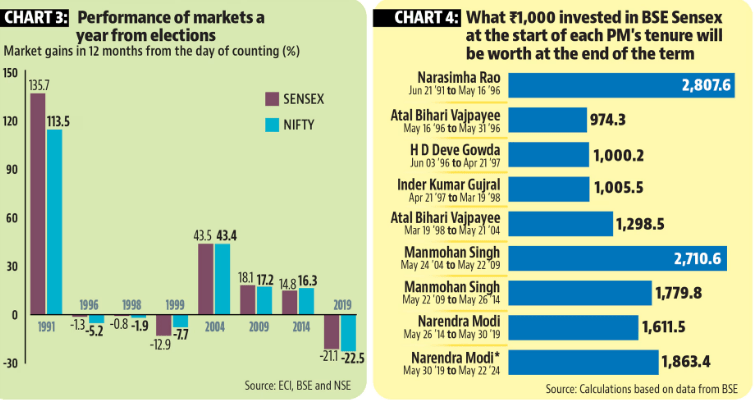

Despite the fact that the movement of markets on results day is a signal of the immediate sentiments of the markets, the performance of investors after the elections and how stocks react to policies adopted by the new administration have a much greater impact on the wealth of investors. In four of the eight elections that were analyzed, the markets experienced a decrease one year after the results were announced.

Other Past Instances

On the other hand, out of the four cases in which markets experienced a fall in the year following elections, three of those occurrences occurred during the period of 1996-1999, which was characterized by political instability in India. Meanwhile, the decrease in markets that occurred a year after the elections in 2019 was because to the Covid-19 epidemic, which caused the crash of stock markets all over the world. This is the only other time where markets had a decline that was comparable to the one that occurred in 2019.

Image Source

The most important takeaway from this analysis is that, with the exception of instances of acute political instability or exogenous causes like the Covid-19 outbreak, the Indian markets have consistently delivered investors with favorable returns. During the time period following the elections in 1991, investors experienced the greatest returns of this kind. This was because the administration led by PV Narasimha Rao commenced the liberalization of the economy of the country.

In spite of the fact that the markets saw a precipitous drop immediately following the announcement of the results of the elections in 2004, they recovered within a couple of quarters on the strength of robust GDP growth and an increase in foreign investments.

Read more: Why Market fell ahead of Lok Sabha Elections

Frequently Asked Questions

How can elections affect Indian Stock Market?

Whenever the same government is re-elected, the stock market typically experiences a significant surge, which is a reflection of the political stability that has been established. In the event that a new government is elected, however, the possibilities frequently change. According to the results of recent elections held under a variety of regimes, the stock market has behaved as follows.

Are there any stock to buy before elections?

When it comes to the large-cap market, Solanki suggests purchasing Hero MotoCorp (goal price: ₹5,650), Balkrishna Industries (target price: ₹3,500), and SBI (target price: ₹942). When it comes to the smallcap market, Solanki suggests purchasing Dalmia Bharat (goal price: ₹2,406) and United Breweries (target price: ₹2,300).

Which stocks rise during the election?

There are many stocks that surge during or before the elections. The categories include infrastructure, Banking, Financials, Technical sector, etc.