In early trade on May 2, shares of oil marketing companies Indian Oil Corp, Bharat Petroleum Corp, and Hindustan Petroleum Corp surged 2–7% in response to a decline in Brent crude prices to their lowest points in two months.

After plunging more than 7% over the previous three sessions due to a rise in US crude inventories and mounting optimism for a Middle East ceasefire, Brent oil prices fell below $84 per barrel. A rise in US crude inventories hint at softness in demand in the world’s largest economy, which weighs on the prices of Brent oil.

This comes after Brent oil prices hit the $90-mark last month, its highest since October last year and remained elevated on the back of concerns of supply disruptions due to geopolitical tensions in the Middle East.

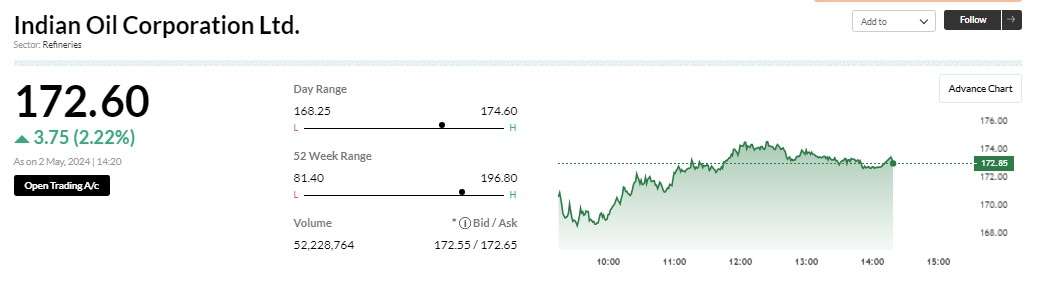

Intraday Stocks movement

Image Source

A reduction in Brent crude prices bodes good for oil marketing companies as it lowers their input costs, providing them more space to sustain competitive prices which eventually boosts their profits.

Consequently, at 11.53 am, shares of HPCL were trading nearly 7 percent higher while IOCL and BPCL were up approximately 3 percent and 4 percent, respectively, on the NSE.

Indian Oil Corp. reported its Q4FY24 results on April 30, and on May 9, Hindustan Petroleum and Bharat Petroleum are expected to reveal their quarterly results.

IOC’s consolidated net profit plummeted 49 percent year-on-year to Rs 5,487.92 crore in the January-March period, pressured by a jump in oil prices in the quarter. Crude oil prices surged 16 percent in the first three months of 2024 amid growing geopolitical uncertainty in the Middle East.

Additionally, revenue decreased, however slightly, from Rs 2.3 lakh crore in Q4FY24 to Rs 2.23 lakh crore in the same time last year.

Also read: Nifty 50 performance and stats