Indian Bank Update on Stocks

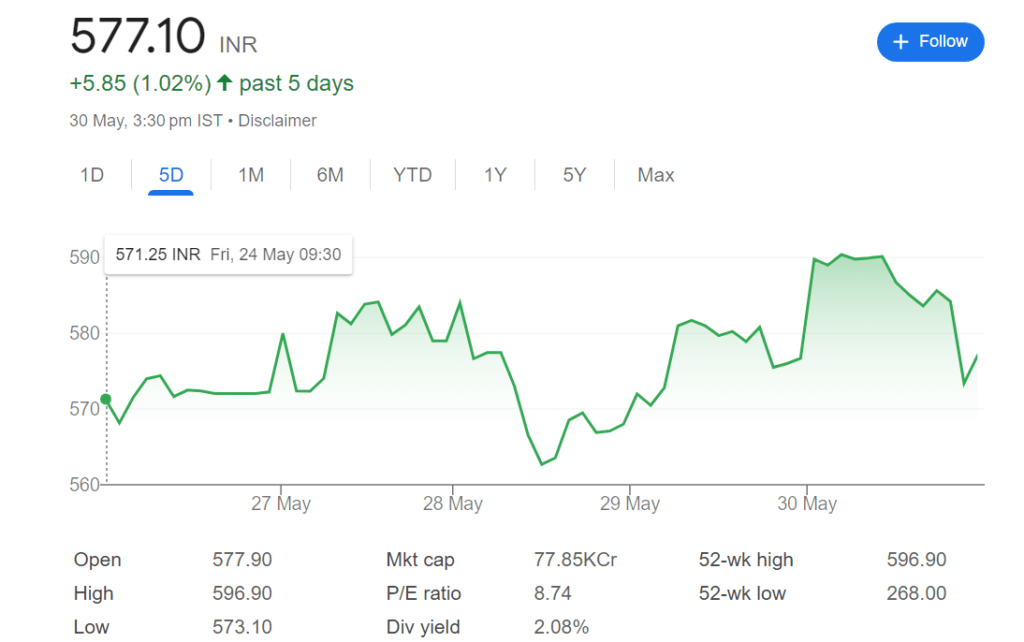

On May 30, Indian Bank shares reached an all-time high of Rs 582 per share, up 3.4 percent as a result of credit rating company S&P Global Ratings reaffirming their “BBB-” long-term and “A-3” short-term issuer credit ratings and changing their outlook from “stable” to “positive.”

The PSU bank’s shares has increased by more than 38% so far this year, outpacing the benchmark Nifty 50 index’s 3.7 percent gain.

For all of the market action, subscribe to our live blog.

Image Source

Indian Bank’s net profit increased by 55% year over year (YoY) to Rs 2,247 crore in the January-March quarter (Q4FY24), while net interest income increased by 9.2% YoY to Rs 6,015 crore.

The quarter ended in March saw an improvement in the lender’s asset quality as well. From 0.5 percent a quarter earlier, its net non-performing asset (NPA) decreased to 0.4 percent in Q4FY24. Gross non-performing assets (NPA) decreased from 4.4 percent in Q4FY23 to 3.9 percent in Q4FY24.

Foreign investors reduced their position to 5.29 percent in the March quarter from 5.89 percent in the December quarter, according on data from Indian Bank’s ownership pattern. On the other hand, mutual funds increased their position from 10.53 percent in the December quarter to 11.71 percent in the March quarter.

Additionally, institutional investors increased their holdings in Indian Bank from 21.73 percent to 22.24 percent in the March quarter.