Pre-market highlight- As many as 68 stocks are facing a short build-up. The popular ones include IndiaMART InterMESH, DLF, Federal Bank, Hindustan Petroleum Corporation, and Vodafone Idea.

For the first time, the market closed above the 22,500 level on Thursday. This was evident from the recovery from the earlier day’s low of 22,300 along with renewed buying interest within the last few hours of the day.

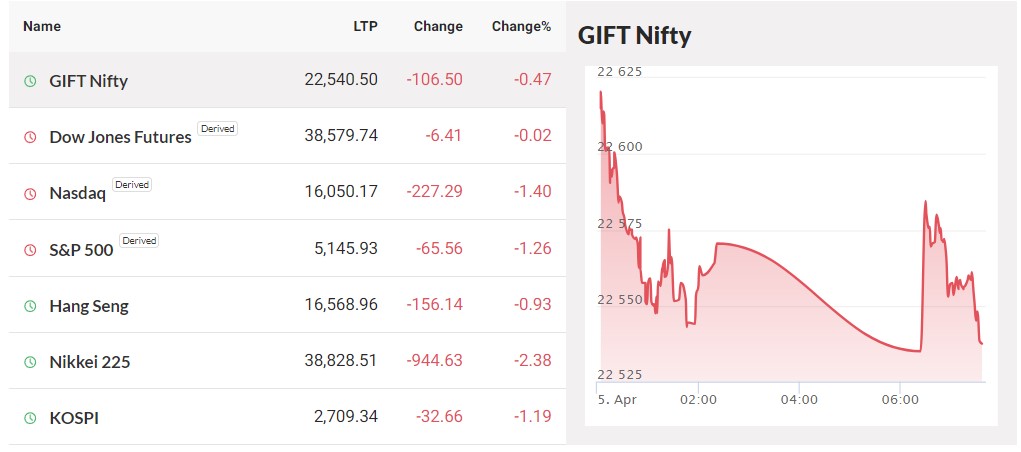

Experts predict that the market will depend on the Monetary Policy Committee meeting on April 5 for additional direction. However, if the Nifty 50 can maintain its current level, we might see prices between 22,700 and 22,800 in the next sessions, with support between 22,400 and 22,300 levels.

A bearish candlestick pattern with a long lower shadow appeared on the daily charts, suggesting strong buying interest at lower levels, as the Nifty 50 jumped 80 points to end at a record closing high of 22,515 on April 4, driving the BSE Sensex rally of 351 points to 74,228.

In addition, the index maintained a trading position above all important moving averages, including the 22,300 level of the 10-day exponential moving average (EMA).

Experts’ Pre-Market Say

Sharekhan by BNP Paribas’s technical research expert Jatin Gedia claims that the Nifty is aiming for 22,700, the upper limit of the ascending channel. “On the downside, the zone of 22,350 – 22,300 shall act as a crucial support from a short-term perspective.”

He said that buyers should take advantage of small pullbacks to support zones.

After four consecutive days of declines that gave the bulls more ammunition, the India VIX, a measure of market volatility, fell 1.34 percent to 11.22, its lowest level since November 15 of last year.

Important levels of support and resistance for the Nifty

According to the pivot point calculation, the Nifty 50 may encounter hurdles at the 22,600, 22,674, and 22,794 levels, in that order. The 22,359 level, 22,284, and 22,164 levels might provide short-term support for the index.

Major Indices at 7:40 am IST (source)

Nifty Bank

With a gap-up opening on April 4, the Bank Nifty maintained its uptrend and gained 437 points to 48,061. A Doji candlestick formation has emerged on the daily charts of the banking index, suggesting that bulls and bears are still undecided.

The index kept rising, hitting new daily highs and lows and staying above all important moving averages in the near term.

Bank Nifty exited the symmetrical triangular formation, according to the technical analysis. According to Om Mehra, a technical analyst at Samco Securities, the index has broken over its previous resistance level of 48,161.2, suggesting a robust bullish trend. “The index has immediate support at 47,600 and has resistance at 48,500 levels.”

The Bank Nifty index may encounter resistance at 48,216, 48,344 and 48,551, according per the pivot point calculator. At the bottom, we anticipate support at 47,802, then 47,674 and finally 47,467.

Call Option Data

The 22,700 strike had the highest number of open contracts for calls in the weekly options data, at 1.85 crore contracts. This level might serve as a crucial obstacle for the Nifty in the near future. Following that came the 22,500 strike, which included 1.14 crore contracts, and the 23,000 strike, which included 1.11 crore contracts.

The 22,700 strike contributed 90.81 lakh contracts, the 23,100 strike added 21.63 lakh contracts and the 23,600 strike added 16.79 lakh contracts. All of these strikes were meaningful call writing.

The 22,400 strike saw the largest unwinding of Call contracts at 28.18 lakh, followed by the 22,500 and 22,200 strikes at 10.99 lakh and 4.21 lakh, respectively.

Put Option Data

At 22,500 strike, the Put side had the highest amount of open interest, which, with 1.75 crore contracts, might serve as a crucial support level for the Nifty. The 22,400-contract strike came next, followed by the 22,000-contract strike, which included 1.14-contract worth of contracts.

The 22,500 strike contributed 1.34 crore contracts, the 22,400 strike added 51.84 lakh contracts, and the 22,300 strike added 31.18 lakh contracts. These strikes were meaningful put writing.

At 21,700 strikes, put unwinding was observed, resulting in the loss of 8.58 lakh contracts. The next two strikes, at 21,600 and 22,100, respectively, saw a loss of 7.87 lakh and 7.05 lakh contracts.

Stocks With Potential Today

IndusInd Bank

Deposits at private sector lender IndusInd Bank reached Rs 3.85 lakh crore for the quarter ending March FY24, up 4% from the prior year and 14% from the same time last year. The net advances reached Rs 3.43 lakh crore, an increase of 5% QoQ and 18% YoY.

Bajaj Finance

In the fiscal year ending in March of 2024, Bajaj Finance’s assets under management (AUM) surged by 34% to Rs 3.3 lakh crore, and in the fourth quarter of that year, they jumped by Rs 19,400 crore. Bookings for new loans increased 4% to 7.87 million in the fourth quarter of FY24.

Bandhan Bank

Loans and advances at Bandhan Bank rose 17.8 percent year-on-year to Rs 1.28 lakh crore, while deposits soared 25.1% to Rs 1.35 lakh crore in the fiscal quarter ending in March of this year.

Hero Moto Corp

A tax demand of Rs 308.65 crore and interest of Rs 296.22 crore for six assessment years has been served on Hero MotoCorp, a manufacturer of two-wheelers.

Prestige Estate Projects

The realty firm behind Prestige Estates Projects paid Rs 450 crore for 21 acres of excellent property in Bengaluru’s Whitefield neighborhood.

Nestle India

In a case involving allegations of unfair commercial practices involving Nestle India’s Maggi Noodles, the National Consumer Dispute Redressal Commission (NCDRC) in New Delhi rejected the Central government’s appeal.

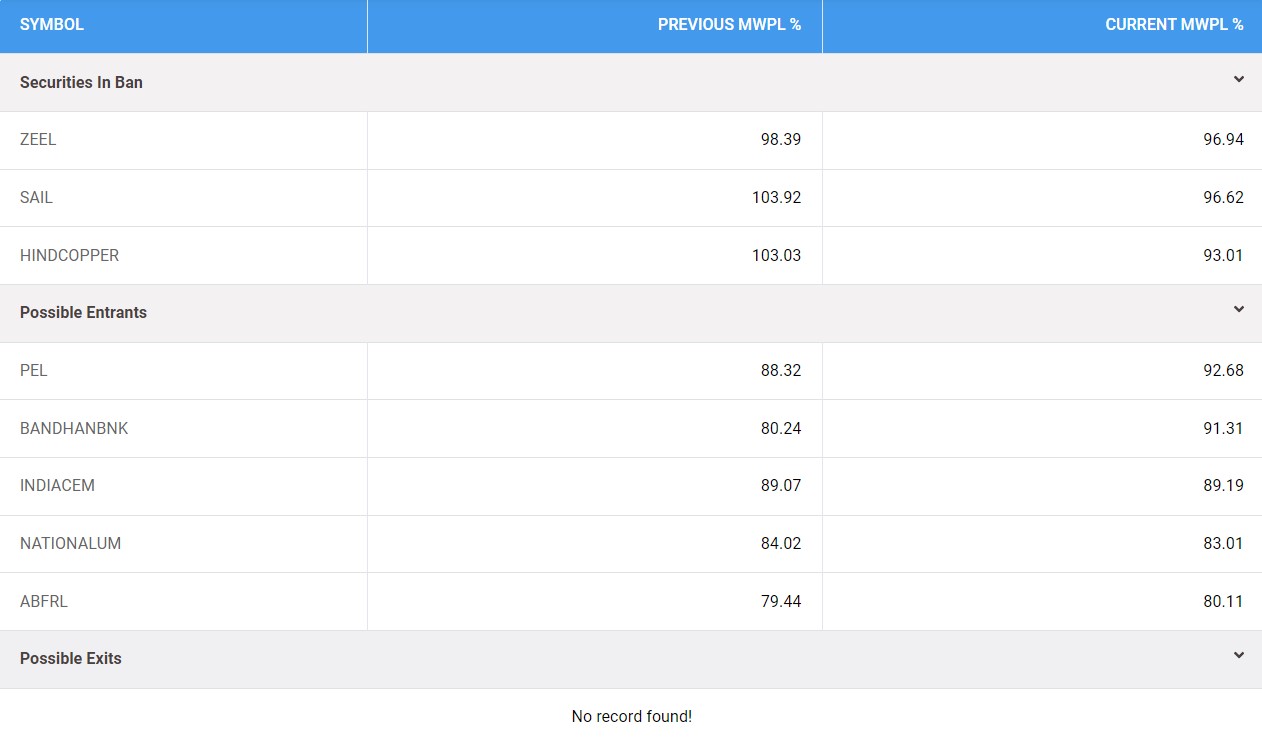

Ban List by National Stock Exchange

For the 5th of April, the NSE will continue to restrict Hindustan Copper, SAIL, and Zee Entertainment Enterprises from F&O trading.

Pre-market ban list for 5th April 2024 (Source)

Are you interested in Blockchain technology? Read our latest informative post about this popular topic here.