GIFT Nifty finally may see a good start today, with up to 71 percent gains or 0.32 percent.

Important updates

Perhaps, a long-awaited good news today in the pre-market report. The benchmark Nifty and Sensex are likely to open up on a positive note. Today’s trends in the GIFT Nifty show a higher commencement for the broader index of India.

On April 3, the market ended flat, experiencing a highly volatile shares market session. At the end of the day, the Sensex declined to 29.09 points, or 0.04 percent, at around 73.876.82. The Nifty was down too, to 18.6 points, equaling 0.08 percent, at around 22,494.70.

Today, the Nifty 50 may face resistance, as per the pivot point calculator for pre-market. This may come at the 22,501 level. The 22,542 and 22,609 levels will follow suit. The index can support at level 22,367 with the following levels of 22,326 and 22,260.

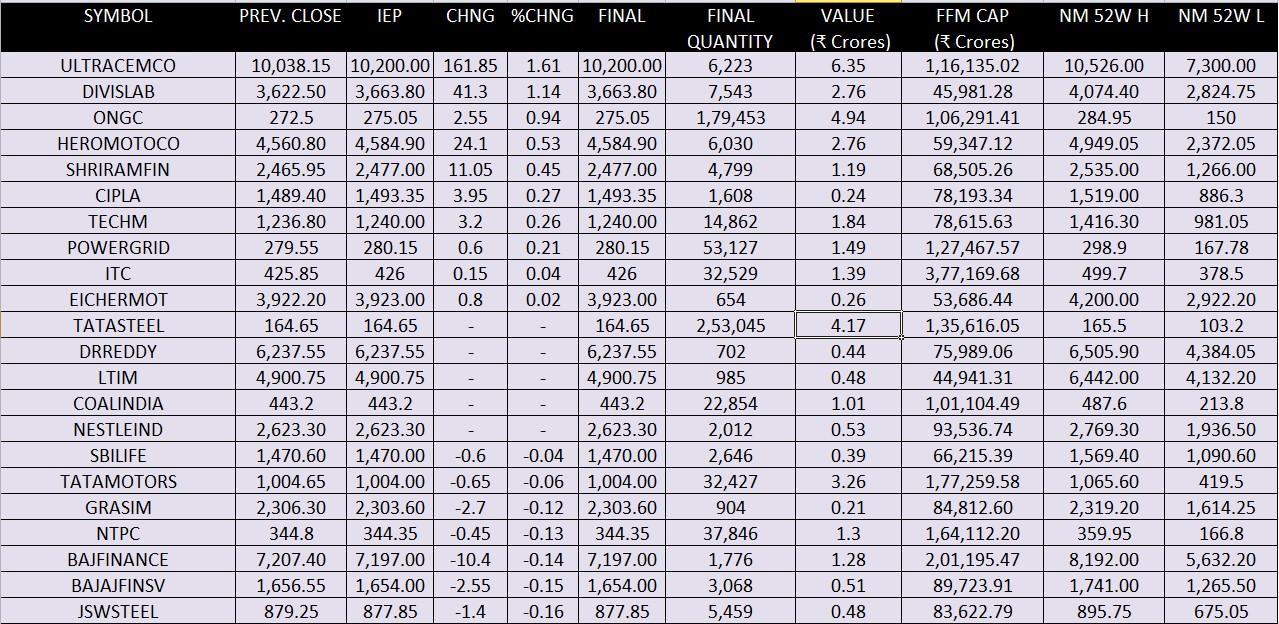

Share-wise pre-market report

NIFT GIFT

With a rise of 71 points, or 0.32 percent, the GIFT Nifty shows that the Indian stock market as a whole is off to a good start. About 22,595.50 worth of Nifty futures were being bought and sold.

The US market

The S&P 500 and Nasdaq both ended the day higher on Wednesday after data showed that growth in the US services industry slowed even more in March. However, the gain was limited after Federal Reserve chair Jerome Powell said that a rate cut was still not in the cards.

The Dow Jones Industrial Average went down 43.1 points, or 0.11%, to 39,127.14. The S&P 500 went up 5.68 points, or 0.11%, to 5,211.49, and the Nasdaq Composite went up 37.01 points, or 0.23%, to 16,277.46.

Asian Market

After a drop the previous day, Asian markets went up again as buyers thought about what US Federal Reserve Chairman Jerome Powell had to say. In early trade, both the Nikkei and Straits Times stocks went up by 1%.

Spectrum Auction Postponed Due to Lok Sabha Elections

UNI says that on April 3, the Department of Telecom put off the sale of airwaves for two weeks because of the upcoming Lok Sabha elections. It has been moved up to June 6, two days after the election results are made public. This is when the sale will now happen. The LS polls are bound to happen from April 19 to June 1.

In the auction, the government wants to give out radio frequency bands including 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz, 2500 MHz, 3300 MHz, and 26 GHz. This will be done through a sale. The government is expected to get Rs 96,300 crore if the bands are sold at the base price.

Read more about Lok Sabha elections here.

From April 8, NSE will release four new indices in the capital markets and F&O sectors

The National Stock Exchange (NSE) announced on April 3 that four new indices will be available starting April 8 in both the capital markets and Futures & Options areas.

The Nifty Tata Group 25% Cap, the Nifty 500 Multicap India Manufacturing 50:30:20, the Nifty 500 Multicap Infrastructure 50:30:20, and the Nifty MidSmall Healthcare indices are the four new ones.

So, F&O members will be able to see the broadcast of the indices in NEAT+ computers under the multiple index question screen, the NSE said in a circular.

Dollar

In pre-market trends, the dollar index stayed close to its best level in more than four months on Wednesday. This kept the yen close to its lowest level in decades, but Tokyo’s greater threat of intervening in the currency market stopped the yen from falling even more.

The Japanese yen was last worth 151.8 per dollar. It hadn’t changed much since last week, when it fell to a 34 year low of 151.975, as the Bank of Japan’s historic policy change made it even more of an oddity.

Gold Prices

On Wednesday, gold prices hit a new record high for the fourth day in a row. Rising tensions in the Middle East, predictions that the US will cut interest rates, and persistently high inflation have all made metal more appealing as per pre-market reports.

Oil Prices

Oil prices kept going up on Wednesday as investors thought about supply risks caused by attacks on Russian pipelines by Ukraine and the possibility of the war in the Middle East getting worse. At the same time, OPEC+ ministers kept their output policy the same.

The FII and DII

Foreign institutional investors (FIIs) sold a net worth of Rs 2,213.56 crore worth of shares on April 3, while domestic institutional investors (DIIs) bought a net worth of Rs 1,102.41 crore worth of stocks.

Banned Stocks under F & O

The NSE has added SAIL and Zee Entertainment Enterprises to the list of companies that can’t trade on April 4. Hindustan Copper is still on that list.

Check out our blog on the hows and whys of the Hindustan copper ban.