Bharat Petroleum Corporation Limited is an Indian public sector oil and gas company headquartered in Mumbai, Maharashtra, India.

| Current Price: ₹410.10 | Stock P/E: 18.75 | Book Value: ₹168.41 |

| Market Cap: ₹89,568 Cr. | ROCE: 8.34 % | Face Value: 10.00 |

| 52 weeks High: ₹549.70 | ROE: 11.53 % | Sales Growth (3Yrs): 12.24 % |

| 52 weeks Low: ₹252.00 | Dividend Yield: 4.00 % |

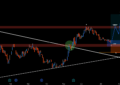

BPCL is in uptrend since 52 week low made on 24-March-2020, CMP- Rs.410.10 trading near its support.

As Long as price is above 408 we can expect the stock to move towards 435/460 Levels.

Buy BPCL Above ₹410 For the Targets of ₹435 – ₹460.

Stoploss ₹394.

CMP- 410.10 | Support- 394 , 354 | Resistance- 435 , 481 | Trend UP↑

Technical Analysis

| MOVING AVERAGES | Indication |

|---|---|

| Simple Moving Average (9) | Bullish |

| Simple Moving Average (18) | Bearish |

| Simple Moving Average (25) | Bearish |

| Simple Moving Average (43) | Bullish |

| Simple Moving Average (100) | Bullish |

| Simple Moving Average (200) | Bearish |

| OSCILLATORS | Indication |

|---|---|

| Commodity Channel Index (20) | Neutral |

| Williamson%R(14) | Bearish |

| MACD(12,26,9) | Bearish |

| Relative Strength Index (14) | Neutral |

| MFI(14) | Neutral |

| Stochastic(20,3) | Bearish |

| PIVOT LEVELS | Classic | Camarilla | Fibonacci |

|---|---|---|---|

| Resistance 1 | 418.82 | 413.92 | 417.84 |

| Resistance 2 | 424.73 | 414.94 | 420.47 |

| Resistance 3 | 429.97 | 415.97 | 424.73 |

| Pivot Point | 413.58 | 413.58 | 413.58 |

| Support 1 | 407.67 | 411.88 | 409.32 |

| Support 2 | 402.43 | 410.86 | 406.69 |

| Support 3 | 396.52 | 409.83 | 402.43 |

| Strengths |

|---|

| *Company with Zero Promoter Pledge |

| *FII / FPI or Institutions increasing their shareholding |

| *Company has been maintaining a healthy dividend payout of 66.66% |

| Weaknesses |

|---|

| *Degrowth in Revenue and Profit |

| *The company has delivered a poor growth of 3.24% over past five years. |

| *Declining Revenue every quarter for the past 2 quarters |

| Daily Trend – Bullish ↑ |

| Weekly Trend – Bearish ↓ |

| Monthly Trend – Bullish ↑ |

Profile:- Bharat Petroleum Corporation Ltd.

Sector:- Energy Minerals

Industry:- Oil Refining/Marketing

Bharat Petroleum Corporation Limited is an Indian public sector oil and gas company headquartered in Mumbai, Maharashtra, India. BPCL is engaged in the business of liquefied petroleum gas, High speed diesel and Motor sprit. The company also engaged in refining of crude oil and marketing of petroleum products. BPCL also engaged in the production of other products from crude petroleum or bituminous minerals.

Quarterly Results Standalone

| Quarterly | JUN 2020 | MAR 2020 | DEC 2019 | SEP 2019 | JUN 2019 |

|---|---|---|---|---|---|

| Sales | 38,785 | 68,991 | 74,732 | 64,340 | 76,317 |

| Other Income | 593.00 | 1,156 | 514.00 | 871.00 | 538.00 |

| Total Income | 39,378 | 70,148 | 75,247 | 65,212 | 76,856 |

| Total Expenditure | 35,865 | 71,638 | 73,002 | 62,918 | 75,052 |

| EBIT | 3,513 | -1,490 | 2,245 | 2,293 | 1,804 |

| Interest | 587.00 | 578.00 | 512.00 | 638.00 | 452.00 |

| Tax | 850.00 | -707.00 | 472.00 | -53.00 | 276.00 |

| Net Profit | 2,076 | -1,361 | 1,260 | 1,708 | 1,075 |

Share Holding Pattern in (%)

| Standalone | June 2020 | March 2020 | June 2019 | March 2019 | |

|---|---|---|---|---|---|

| Promoters | 52.98 | 52.98 | 53.29 | 53.29 | |

| Pledged | 0 | 0 | 0 | 0 | |

| FII/FPI | 11.95 | 12.28 | 15.3 | 15.64 | |

| Total DII | 32.14 | 31.63 | 28.74 | 28.3 | |

| Fin.Insts | 0.14 | 0.13 | 0.17 | 0.17 | |

| Insurance Co | 6.68 | 6.68 | 7.17 | 7.21 | |

| MF | 13.66 | 12.8 | 8.25 | 7.94 | |

| Others DIIs | 11.66 | 12.02 | 13.15 | 12.98 | |

| Others | 2.93 | 3.11 | 2.67 | 2.77 | |

| Total | 100 | 100 | 100 | 100 |

Also Read | Flipkart to acquire 8% stake in Aditya Birla’s fashion unit for $204 million

Also Read | Intraday Stocks Watchlist | Stocks for Intraday Trading

Get Important Stock Market Update and regular stock investment ideas From StockFinz. Follow Us: Telegram | Twitter | Facebook | YouTube

(*Note:- The recommendation are based on technical analysis. There is a risk of loss.)