Bandhan Bank Stock Analysis

Bandhan Bank Ltd. engages in the banking and financial services. It operates through the following segments:- Treasury, Retail Banking, Corporate and Wholesale Banking, and Other Banking Business. Bandhan Bank was founded by Chandra Shekhar Ghosh on December 23, 2014 and is headquartered in Kolkata, India.

BSE:- 541153 | NSE:- BANDHANBNK | SERIES:- EQ | ISIN:- INE545U01014 | SECTOR:- BANKS – PRIVATE SECTOR

| Current Price ₹ 340 | Market Cap ₹ 54,769 Cr. | Dividend Yield — |

| High / Low ₹ 597 / 152 | Book Value ₹ 94.4 | ROE 22.9 % |

| Stock P/E 20.2 | ROCE 12.0 % | Face Value ₹ 10.0 |

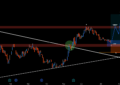

BANDHAN BANK Formed an Inverse Head and Shoulder pattern and also broken Resistance and trading above 200DMA. Sustining above 330 will boost this stock move upward.

Buy BANDHANBNK around Rs . 330 – 350 for the Targets of Rs .400 and 470.

Stoploss Rs .288.

Hodling period should be more than 1 Months..

CMP- 347 | Support- 330 | Resistance- 400 | Trend UP↑

Technical Analysis

| MOVING AVERAGES | Indication |

|---|---|

| Simple Moving Average (9) | Bullish |

| Simple Moving Average (18) | Bullish |

| Simple Moving Average (25) | Bullish |

| Simple Moving Average (43) | Bullish |

| Simple Moving Average (100) | Bullish |

| Simple Moving Average (200) | Bullish |

| OSCILLATORS | Indication |

|---|---|

| Commodity Channel Index (20) | Overbought |

| Williamson%R(14) | Overbought |

| MACD(12,26,9) | Bullish |

| Relative Strength Index (14) | Bullish |

| MFI(14) | Bullish |

| Stochastic(20,3) | Overbought |

| PIVOT LEVELS | Classic | Camarilla | Fibonacci |

|---|---|---|---|

| Resistance 1 | 346.72 | 341.31 | 345.21 |

| Resistance 2 | 353.33 | 342.51 | 348.31 |

| Resistance 3 | 359.87 | 343.72 | 353.33 |

| Pivot Point | 340.18 | 340.18 | 340.18 |

| Support 1 | 333.57 | 338.89 | 335.16 |

| Support 2 | 327.03 | 337.69 | 332.06 |

| Support 3 | 320.42 | 336.48 | 327.03 |

| Strengths |

|---|

| Increasing Revenue every Quarter for the past 4 Quarters. |

| Company with Zero Promoter Pledge. |

| FII / FPI or Institutions increasing their shareholding. |

| Weaknesses |

|---|

| Promoter holding has decreased by -20.95% over last quarter. |

| Company has low interest coverage ratio. |

| Decline in Quarterly Net Profit with falling Profit Margin (YoY). |

| Daily Trend – Bullish ↑ |

| Weekly Trend – Bullish ↑ |

| Monthly Trend – Bullish ↑ |

Also Read | Jsw Steel Stock Analysis

Profile:- Bandhan Bank Ltd.

Sector:- Finance

Industry:- Major Banks

Employees:- 45,549 (2020)

Bandhan Bank Ltd. engages in the banking and financial services. It operates through the following segments:- Treasury, Retail Banking, Corporate and Wholesale Banking, and Other Banking Business. Bandhan Bank was founded by Chandra Shekhar Ghosh on December 23, 2014 and is headquartered in Kolkata, India. More+

Quarterly Results Standalone

| Quarterly | SEP 2020 | JUN 2020 | MAR 2020 | DEC 2019 | SEP 2019 |

|---|---|---|---|---|---|

| Interest Earned | 3,197 | 3,018 | 2,846 | 2,717 | 2,690 |

| Other Income | 381 | 386 | 500 | 357 | 360 |

| Total Income | 3,579 | 3,404 | 3,346 | 3,075 | 3,050 |

| Total Expenditure | 1,951 | 1,820 | 1,825 | 1,811 | 1,743 |

| Operating Profit (incl. Excep Items) | 1,627 | 1,584 | 1,520 | 1,263 | 1,306 |

| Provisions & Contigencies | 394 | 849 | 827 | 294 | 145 |

| PBT | 1,233 | 735 | 693 | 969 | 1,161 |

| Tax | 312 | 185 | 176 | 237 | 189 |

| Net Profit | 920 | 549 | 517 | 731 | 971 |

Share Holding Pattern in (%)

| Standalone | September 2020 | August 2020 | June 2020 | March 2020 | |

|---|---|---|---|---|---|

| Promoters | 40 | 40 | 60.95 | 60.95 | |

| Pledged | 0 | 0 | 0 | 0 | |

| FII/FPI | 32.24 | 27.33 | 14.51 | 13.05 | |

| Total DII | 20.9 | 27.42 | 19.61 | 20.95 | |

| Fin.Insts | 0.06 | 0.21 | 0.3 | 0.31 | |

| Insurance Co | 0 | 0 | 0 | 0 | |

| MF | 4.92 | 4.19 | 1.7 | 2.75 | |

| Others DIIs | 15.92 | 23.02 | 17.61 | 17.89 | |

| Others | 6.85 | 5.25 | 4.92 | 5.06 | |

| Total | 99.99 | 100 | 99.99 | 100.01 |

Also Read | Intraday Stocks Watchlist | Stocks for Intraday Trading

Also Read | How To Make Money in the Stock Market? | 2 Easiest way to make money in stock market

Get Important Stock Market Update and regular stock investment ideas From StockFinz. Follow Us: Telegram | Twitter | Facebook | YouTube

(*Note:- The recommendation are based on technical analysis. There is a risk of loss.)