Image Source

A significant increase in the volume of amines and amine derivatives contributed to the fact that Balaji Amines’ revenue was 4.5% higher than our projection. The expert’s estimate was exceeded by the EBITDA principally as a result of a higher revenue than anticipated and operational expenses that were lower than anticipated.

Experts like KR Choksey are confident that the N-Butyl Amine initiative, which was just recently initiated, will make a contribution to growth. In addition, the ongoing projects involving methyl amine and dimethyl ether are making good development and are anticipated to be growth drivers over the long term.

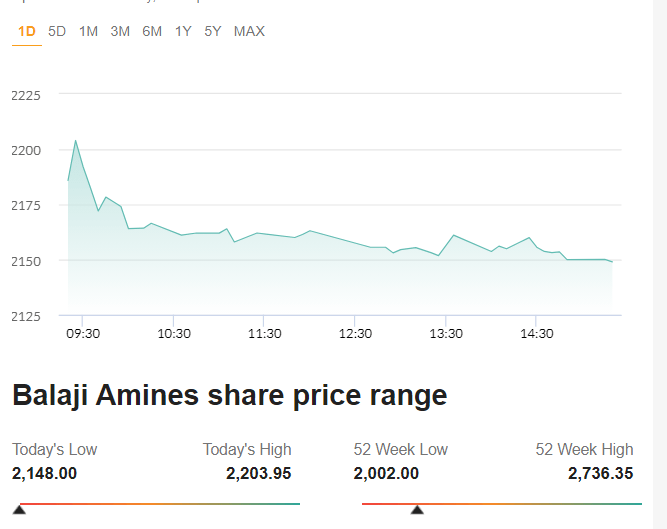

Balaji Amines Stocks Today

Image Source

At the moment, the stock is trading at PE multiples of 23.2x/18.0x, which are based on the earnings per share for FY25E and FY26E, respectively. Over the period of FY24-26E, experts anticipate that the revenue will rise at a compound annual growth rate of 21.7%, while the profit after tax will expand at a CAGR of 39.5%.

The outlook

Most of the companies maintain their BUY rating on the stock and reduce the target price to INR 2,643/share (previously: INR 2,828). This implies that the stock has a price-to-earnings multiple of 21.5x for the fiscal year 26E.

Also read: Affle India Shares Result after Q4