Apollo Hospital | Apollo Hospital Stock Analysis | Apollo Hospital Share Price

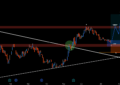

Buy APOLLO HOSPITALS Above Rs. 1755 for The Target of Rs. 1800.

Stoploss- Rs. 1730.

Hodling period should be 3 to 5 days..

| Market Cap: ₹ 23,338 Cr. | Stock P/E: 71.90 | Sales Growth (3Yrs): 15.73 % |

| Book Value: ₹ 240.03 | ROE: 9.73 % | Face Value: ₹ 5.00 |

| ROCE: 14.55 % | Dividend Yield: 0.36 % | |

About:- Apollo Hospital

Sector:- Health Services

Industry:- Hospital/Nursing Management

Apollo Hospitals Enterprise Limited is an Indian hospital chain based in Chennai, India. Apollo Hospital was founded by Dr. Prathap C.Reddy in 1983 as the first corporate health care provider in India. They are a leading private sector healthcare provider in Asia and engages in the operation and management of hospitals, diagnostic centers, and pharmacies. It operates through the subsequent segments: Healthcare, Retail Pharmacy, Clinics, and Others.

Strengths

| Promoters increasing shareholding | Increasing profits every quarter for the past 3 quarters |

| Growth in Net Profit with increasing Profit Margin (QoQ) | Near 52 Week High |

Weaknesses

Share Holding Pattern in (%)

| Standalone | June 2020 | March 2020 | December 2019 | March 2019 | |

|---|---|---|---|---|---|

| Promoters | 30.83 | 30.82 | 30.8 | 34.43 | |

| Pledged | 36.65 | 36.66 | 67.33 | 78.13 | |

| FII/FPI | 46.6 | 46.93 | 48.84 | 44.31 | |

| Total DII | 17.51 | 17.24 | 15.73 | 15.87 | |

| Fin.Insts | 4.67 | 3.95 | 3.92 | 0.02 | |

| Insurance Co | 2.09 | 1.94 | 1.36 | 5.71 | |

| MF | 8.36 | 8.9 | 8.07 | 7.11 | |

| Others DIIs | 2.39 | 2.45 | 2.38 | 3.03 | |

| Others | 5.05 | 5.01 | 4.63 | 5.39 | |

| Total | 99.99 | 100 | 100 | 100 |

Also Read | Flipkart to acquire 8% stake in Aditya Birla’s fashion unit for $204 million

Also Read | Intraday Stocks Watchlist | Stocks for Intraday Trading

Get Important Stock Market Update and regular stock investment ideas From StockFinz. Follow Us: Telegram | Twitter | Facebook | YouTube

Subscribe to our newsletter!