Two of the sources familiar with the large company’s plans say that Adani Shares for Green Energy will likely issue dollar bonds in March to raise $500 million. This will make it the first Adani group company to return to the foreign bond market in a year.

“Investors are being talked to by the company to get a feel for the price,” said a foreign banker who is involved in the talks.

“Once there’s more clarity on pricing and demand, they will finalise the details and tap the market,” he said.

Adani Green is part of Indian billionaire Gautam Adani’s ports-to-power conglomerate. Officials say that Adani Green will likely use some of the money from the planned bond issue to pay off debt that is due this year.

The officials and the banker both spoke on the condition that they not be named because they are not allowed to talk to the media. Reuters sent Adani Group an email asking for a reaction, but they didn’t answer.

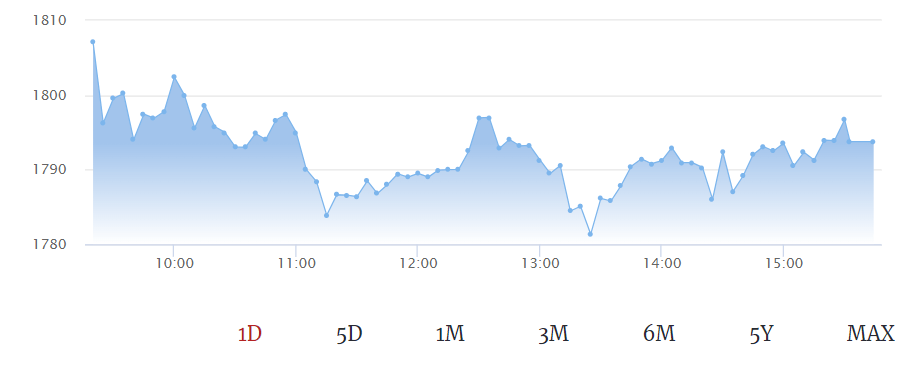

In January of last year, a report by US short seller Hindenburg Research caused a drop in the value of Adani group companies’ stocks and overseas listed bonds. This forced them to leave the foreign currency bond market and buy back $315 million in listed overseas debt securities.

The prices of most of the group’s foreign bonds have gone back up to where they were before the Hindenburg story. This makes it safe for the company to consider issuing new dollar bonds.

In January, Adani Green Energy held roadshows that did not lead to deals and called out to investors in Hong Kong and Singapore. Officials said that roadshows for the planned bond issue would begin soon, but they didn’t say when.

More statements on Adani Shares

An official from the bank said that the company is still in talks with foreign investors and banks and has not yet chosen arrangers for this deal.

“The spreads for Adani Group’s dollar bonds have definitely come down from last year, so the deal should get reasonably priced,” the banker said.

Adani Green Energy just got the money it needed to pay off its $750 million bonds that were due in September, eight months early.

Image Source

Moody’s changed Adani Green’s rating outlook from “negative” to “stable” on Tuesday. This was because the company’s finances have become more flexible and there is less risk in borrowing after the senior notes were paid off.

The rating agency also upheld Adani Green’s Ba3 rating, which means that the company has a steady flow of cash thanks to long-term power purchase deals and a lot of debt.

Traders say that Adani Transmission and other companies in the Adani group may also use the foreign bond market this year.

Read More- What ICICI securities predict for large players this week