Image Source

Adani Group Stocks Update: Adani Group Enterprises Ltd., Adani Green Energy Ltd., and Adani Ports & SEZ are among the six Adani Group equities that have recovered from the losses caused by the damning Hindenburg report and are currently trading above the levels at which the short-seller released the report in January 2023.

The market capitalization of Adani Group’s stocks has surpassed $200 billion following the last two days’ surge. Adani Ports and Special Economic Zone Ltd. and Adani Power Ltd. have both had exceptional results thus far this year, rising by more over 40% and 35%, respectively. New Delhi Television Ltd., a broadcaster, has lagged behind, losing 5.5 percent. Adani Entertainment and Ambuja Cements, which increased by 20% and 25%, respectively, have also witnessed notable advances.

A report by Hindenburg Research, released on January 24, 2023, accused Adani group companies of accounting fraud and stock manipulation in advance of Adani Enterprises’ planned Rs 20,000 crore share sale. The corporation described the report as nefarious and unfounded.

Concurrently, the conglomerate received comfort when the Indian Supreme Court said in January that the Adani Group would not be subject to any additional inquiries beyond Sebi’s existing examination. Sebi has been investigating the Adani group for stock manipulation and use of tax havens. The ruling did not indicate that Adani faced an increased regulatory risk. Despite Hindenburg’s arguments, the court likewise ruled against changing the disclosure requirements for offshore money.

Read more: Adani group declares dividends

Adani Group Stocks Update

With brokerage IIFL anticipating Adani Enterprises’ June inclusion in the BSE Sensex index, which might draw passive funds, the Adani Group stock surged during the last two days. A Gautam Adani-owned business will make its debut in the benchmark 30-share index, drawing in about Rs 1,000 crore in passive capital.

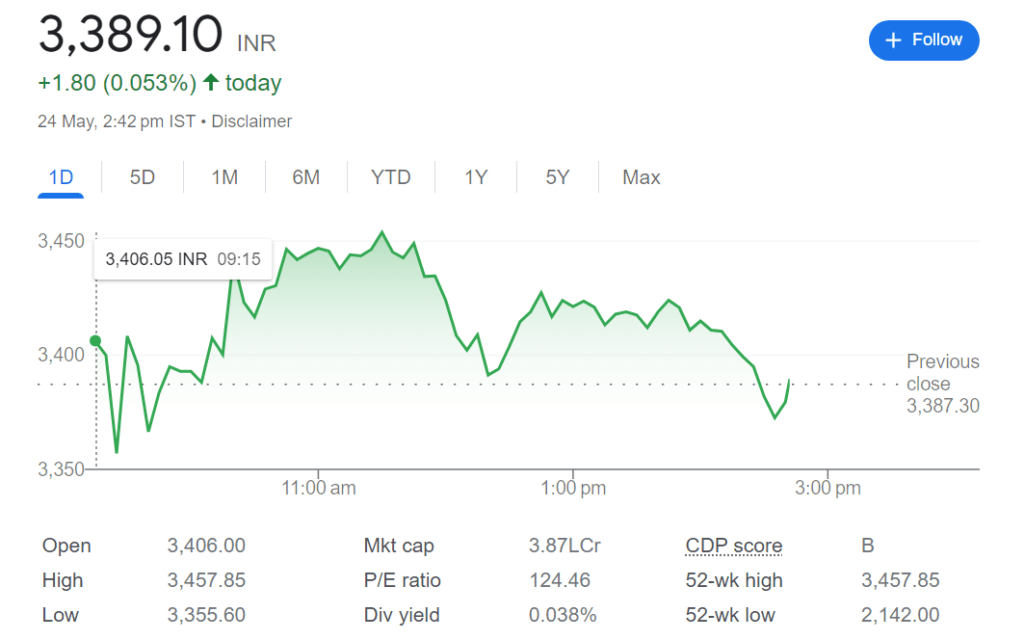

This year, the share price of Adani Enterprises has increased by 20%. With Adani included, the Sensex, which is already trading at a forward P/E multiple of 57x, could see an increase in valuation. Adani Enterprises is expected to climb 30%, according to analysts, with average price estimates of about Rs4,069 in place.

Image Source

Analysts predicted that Adani Enterprises’ investor base will grow as a result of its inclusion in the Sensex, even though Adani Ports and Special Economic Zone are already included in the Nifty50 index. It further stated that prior attempts to incorporate Adani Enterprises into the Sensex were impeded by market selloffs subsequent to the Hindenburg Research study.

Aside from the Sensex inclusion, overseas portfolio investors have shown interest in Adani Group companies due to their increased profits, cash flows, and decreased debt. One of the main reasons, according to analysts, is Adani’s excellent infrastructure, which includes cement facilities with high operational efficiencies, ports, and airports. Investor sentiment also improved as a result.