Moving from a production/construction to a product-supplier model, Schneider Electric Infrastructure Ltd. offers lower risk and better cash flow with 100 percent year-to-date return.

Lately, the Schneider stocks had a brilliant run on the stock market. The shares have doubled so far this year and almost grew five times in the last 12 months. The main reason behind the exponential growth is due to the investments in the power sector.

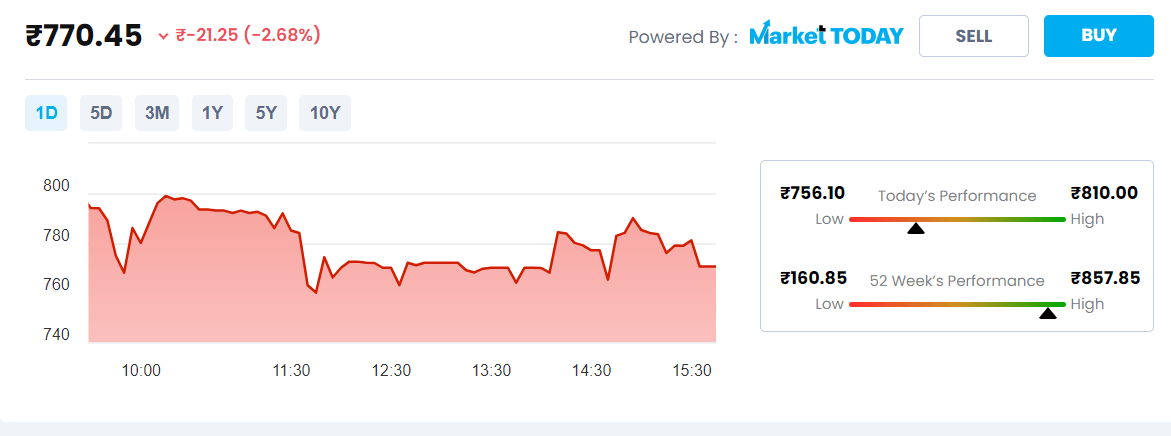

The company is one of the largest beneficiaries of the power sector operated by the Indian Government. As of April 10, the copmany’s shares closed at Rs 791, showing a growth of 91 percent this year.

Schneider – Creating the 100 percent ripple in power industry

In the fiscal third quarter, Schneider Electric Infra’s order book grew by 38.8 percent year-over-year to Rs 1,358.6 crore. When asked about the rise in the order book in February, CFO Suparna Bhattacharyya said that it was due to the power and grid segment, mobility, and other electrosensitive segments.

Voltamp CG Power and Industrial Solutions both saw their order books grow by 34%, while Transformers and Rectifiers India’s books grew by 71% during the quarter.

Schneider Electric’s income in Q3 was Rs 743.9 crore, up 29.5% year-over-year. The Power and Grid segment brought in almost half of that money. From a year ago, the net profit grew to Rs 91 crore, which is more than double. Schneider’s sales and profits have grown much faster than those of its competitors over the past year (except for Transformers and Rectifiers, whose net profit jumped from a low base in Q3 to a high one in Q4).

Should You Buy Schneider Stocks Now?

After the big rise, experts say it’s best to keep an eye on the stock and buy it when it goes down. “Schneider’s prices seem too high.” Most of the good things about the stock have already been priced in. “People shouldn’t be in a hurry to buy this stock right now,” said WealthMill Securities’ Director of Equity Strategies, Kranthi Bathini.

Shailesh Saraf, managing director of Dynamic Equities, also said that the stock was selling at a high price of 90 trailing PE, but that this was fair because the company was making a lot of money. “It makes sense when the profit rise is more than 100%. “It’s a good stock in a class whose goods are in high demand,” Saraf said.

He added that the stock might be able to keep going up because of action in the infrastructure and power sectors. “Buy it when it goes down is the best thing for investors to take action.”

For more such latest news, visit our page.