Union Bank of India Stock Analysis

Union Bank of India is engaged in the Business of Banking Services, Government Business,Merchant Banking, Agency Business Insurance, Mutual Funds,Wealth Management etc. The company was founded on 11 November 1919 and is headquartered in Mumbai.

| Current Price ₹ 33.6 | Market Cap ₹ 21,175 Cr. | Dividend Yield – |

| High / Low ₹ 52.4 / 22.6 | Book Value ₹ 52.9 | ROE -10.3 % |

| Stock P/E 15.2 | ROCE 4.23 % | Face Value ₹ 10.0 |

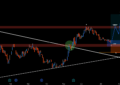

A Breakout trade in Union Bank of India, Stock is in uptrend and looking good to buy at CMP.

Buy UNIONBANK around Rs . 33 – 34 for the Targets of Rs .37 and 40.

Stoploss Rs .31.

Expected profit 20%

Trade Close | All Targets Achieved.

Hodling period should be more than 15 Days..

CMP- 33.60 | Support- 31 | Resistance- 40 | Trend UP↑

Technical Analysis

| MOVING AVERAGES | Indication |

|---|---|

| Simple Moving Average (9) | Bullish |

| Simple Moving Average (18) | Bullish |

| Simple Moving Average (25) | Bullish |

| Simple Moving Average (43) | Bullish |

| Simple Moving Average (100) | Bullish |

| Simple Moving Average (200) | Bullish |

| OSCILLATORS | Indication |

|---|---|

| Commodity Channel Index (20) | Overbought |

| Williamson%R(14) | Overbought |

| MACD(12,26,9) | Bullish |

| Relative Strength Index (14) | Bullish |

| MFI(14) | Bullish |

| Stochastic(20,3) | Overbought |

| PIVOT LEVELS | R1 | R2 | R3 | PP | S1 | S2 | S3 |

|---|---|---|---|---|---|---|---|

| Classic | 33.90 | 34.75 | 35.40 | 33.25 | 32.40 | 31.75 | 30.90 |

| Fibonacci | 33.82 | 34.18 | 34.75 | 33.25 | 32.68 | 32.32 | 31.75 |

| Camarilla | 33.19 | 33.32 | 33.46 | 33.25 | 32.91 | 32.78 | 32.64 |

| Strengths |

|---|

| Rising Net Cash Flow and Cash from Operating activity |

| Growth in Net Profit with increasing Profit Margin (QoQ) |

| Company with Zero Promoter Pledge |

| Weaknesses |

|---|

| MFs decreased their shareholding last quarter |

| Declining Revenue every quarter for the past 2 quarters |

| Companies with High Debt |

| Daily Trend – Bullish ↑ |

| Weekly Trend – Bullish ↑ |

| Monthly Trend – Bullish ↑ |

Also Read | Sacheta Metals Stock Analysis

Profile:- Union Bank of India

Sector:- Finance

Industry:- Major Banks

Employees:- 20,341 (2020)

Union Bank of India is engaged in the Business of Banking Services, Government Business ,Merchant Banking, Agency Business Insurance, Mutual Funds, Wealth Management etc. The company was founded on 11 November 1919 and is headquartered in Mumbai.

Quarterly Results Standalone

| Mar 2019 | Jun 2019 | Sep 2019 | Dec 2019 | Mar 2020 | Jun 2020 | Sep 2020 | Dec 2020 | |

|---|---|---|---|---|---|---|---|---|

| Revenue | 8,387 | 8,960 | 9,468 | 9,688 | 9,363 | 18,556 | 17,913 | 17,220 |

| Interest | 5,760 | 6,392 | 6,512 | 6,499 | 6,434 | 12,031 | 11,496 | 10,506 |

| Expenses + | 8,180 | 3,296 | 5,854 | 3,923 | 6,000 | 7,977 | 8,718 | 10,465 |

| Financing Profit | -5,553 | -727 | -2,898 | -735 | -3,071 | -1,452 | -2,300 | -3,750 |

| Financing Margin % | -66% | -8% | -31% | -8% | -33% | -8% | -13% | -22% |

| Other Income | 1,534 | 1,094 | 1,285 | 1,297 | -397 | 1,931 | 2,899 | 3,788 |

| Depreciation | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Profit before tax | -4,020 | 366 | -1,613 | 563 | -3,468 | 479 | 599 | 38 |

| Tax % | 17% | 39% | 26% | 2% | 24% | 31% | 13% | -1,756% |

| Net Profit | -3,331 | 230 | -1,192 | 554 | -2,713 | 341 | 534 | 719 |

| EPS in Rs | -18.90 | 1.31 | -6.76 | 1.62 | -7.93 | 0.53 | 0.83 | 1.12 |

| Gross NPA % | ||||||||

| Net NPA % |

Share Holding Pattern in (%)

| Mar 2019 | Jun 2019 | Sep 2019 | Dec 2019 | Mar 2020 | Jun 2020 | Sep 2020 | Dec 2020 | |

|---|---|---|---|---|---|---|---|---|

| Promoters + | 74.27 | 74.27 | 74.27 | 86.75 | 86.75 | 89.07 | 89.07 | 89.07 |

| FIIs + | 3.15 | 2.93 | 2.84 | 1.38 | 1.29 | 0.83 | 0.66 | 0.66 |

| DIIs + | 13.15 | 13.10 | 13.24 | 6.44 | 6.37 | 5.02 | 4.78 | 4.58 |

| Government + | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Public + | 9.42 | 9.70 | 9.65 | 5.43 | 5.59 | 5.08 | 5.49 | 5.69 |

Also Read | Intraday Stocks Watchlist | Stocks for Intraday Trading

Also Read | How To Make Money in the Stock Market? | 2 Easiest way to make money in stock market

Get Important Stock Market Update and regular stock investment ideas From StockFinz. Follow Us: Telegram | Twitter | Facebook | YouTube

(*Note:- The recommendation are based on technical analysis. There is a risk of loss.)