Shree Digvijay Cement Share Analysis

Shree Digvijay Cement Company Ltd. is pioneer in the business of manufacturing and selling of cements. Shree Digvijay Cement Company Ltd. has been a singular trendsetter in providing superior quality of Ordinary & Special Portland cement. the corporate employ approximately 300 Employees and the companys cement brand name “KAMAL CEMENT” is a well-known name within the cement industry.

| Current Price ₹ 61 | Market Cap ₹ 887 Cr. | Face Value ₹ 10.0 |

| Stock P/E 17.3 | Dividend Yield 2.40 % | Book Value ₹ 19.5 |

| High / Low ₹ 66.9 / 18.2 | ROCE 29.2 % | ROE 22.7 % |

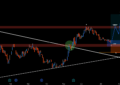

Shree Digvijay Cement is broken Resistance and at the previous resistance to retest (previous resistance becomes support). Stock is taking Support at Rs.60.

Buy Shree Digvijay Cement around Rs. 60 – 62 for the Targets of Rs. 69 and Rs. 80.

Stoploss Rs. 57.

CMP- 61 | Support- 60 | Resistance- 80 | Trend UP↑

Technical Analysis

| MOVING AVERAGES | Indication |

|---|---|

| Simple Moving Average (9) | Bullish |

| Simple Moving Average (18) | Bullish |

| Simple Moving Average (25) | Bullish |

| Simple Moving Average (43) | Bullish |

| Simple Moving Average (100) | Bullish |

| Simple Moving Average (200) | Bullish |

| OSCILLATORS | Indication |

|---|---|

| Commodity Channel Index (20) | Bullish |

| Williamson%R(14) | Bullish |

| MACD(12,26,9) | Bullish |

| Relative Strength Index (14) | Bullish |

| MFI(14) | Overbought |

| Stochastic(20,3) | Bullish |

| PIVOT LEVELS | Classic | Camarilla | Fibonacci |

|---|---|---|---|

| Resistance 1 | 64.87 | 62.86 | 64.79 |

| Resistance 2 | 67.23 | 63.22 | 65.72 |

| Resistance 3 | 68.82 | 63.59 | 67.23 |

| Pivot Point | 63.28 | 63.28 | 63.28 |

| Support 1 | 60.92 | 62.14 | 61.77 |

| Support 2 | 59.33 | 61.78 | 60.84 |

| Support 3 | 56.97 | 61.41 | 59.33 |

| Strengths |

|---|

| Company has delivered good profit growth of 69.42% CAGR over last 5 years |

| Strong Annual EPS Growth |

| Company with Debt free |

| Weaknesses |

|---|

| Promoter holding has decreased over last 3 years: -18.04% |

| Fall in Quarterly Revenue and Net Profit (YoY) |

| Stock is trading at 3.21 times its book value |

| Daily Trend – Bullish ↑ |

| Weekly Trend – Bullish ↑ |

| Monthly Trend – Bullish ↑ |

Also Read | Jsw Steel Stock Analysis

Profile:- Shree Digvijay Cement Company Ltd.

Sector:- Non-Energy Minerals

Industry:- Construction Materials

Employees:- 300

Shree Digvijay Cement Company Ltd. is pioneer in the business of manufacturing and selling of cements. Shree Digvijay Cement Company Ltd. has been a singular trendsetter in providing superior quality of Ordinary & Special Portland cement. the corporate employ approximately 300 Employees and the companys cement brand name “KAMAL CEMENT” is a well-known name within the cement industry. view more +

Quarterly Results Standalone

| Quarterly | JUN 2020 | MAR 2020 | DEC 2019 | SEP 2019 | JUN 2019 |

|---|---|---|---|---|---|

| Sales | 87 | 128 | 121 | 97 | 118 |

| Other Income | 1 | 1 | 1 | 1 | 2 |

| Total Income | 88 | 129 | 122 | 99 | 120 |

| Total Expenditure | 73 | 103 | 108 | 85 | 95 |

| EBIT | 15 | 25 | 14 | 13 | 24 |

| Interest | 0 | 0 | 0 | 0 | 1 |

| Tax | 5 | 2 | 4 | 4 | 8 |

| Net Profit | 9 | 23 | 9 | 8 | 15 |

Share Holding Pattern in (%)

| Standalone | June 2020 | March 2020 | December 2019 | September 2019 | |

|---|---|---|---|---|---|

| Promoters | 57.17 | 57.17 | 57.17 | 57.17 | |

| Pledged | 0 | 0 | 0 | 0 | |

| FII/FPI | 0 | 0 | 0 | 0 | |

| Total DII | 16.31 | 14.91 | 12.6 | 14.12 | |

| Fin.Insts | 0.17 | 0.06 | 0.02 | 0 | |

| Insurance Co | 0 | 0 | 0 | 0 | |

| MF | 0 | 0 | 0 | 0 | |

| Others DIIs | 16.14 | 14.85 | 12.58 | 14.12 | |

| Others | 26.52 | 27.92 | 30.23 | 28.7 | |

| Total | 100 | 100 | 100 | 99.99 |

Also Read | Intraday Stocks Watchlist | Stocks for Intraday Trading

Also Read | How To Make Money in the Stock Market? | 2 Easiest way to make money in stock market

Get Important Stock Market Update and regular stock investment ideas From StockFinz. Follow Us: Telegram | Twitter | Facebook | YouTube

(*Note:- The recommendation are based on technical analysis. There is a risk of loss.)