Image Source

Election Results: Even if the NDA’s actual vote total is less than predicted by exit polls, market analyst A Balasubramanian does not anticipate any major negative effects on the markets. He did, however, caution that because of inflated valuations, there might not be another unexpected bounce for a few sessions.

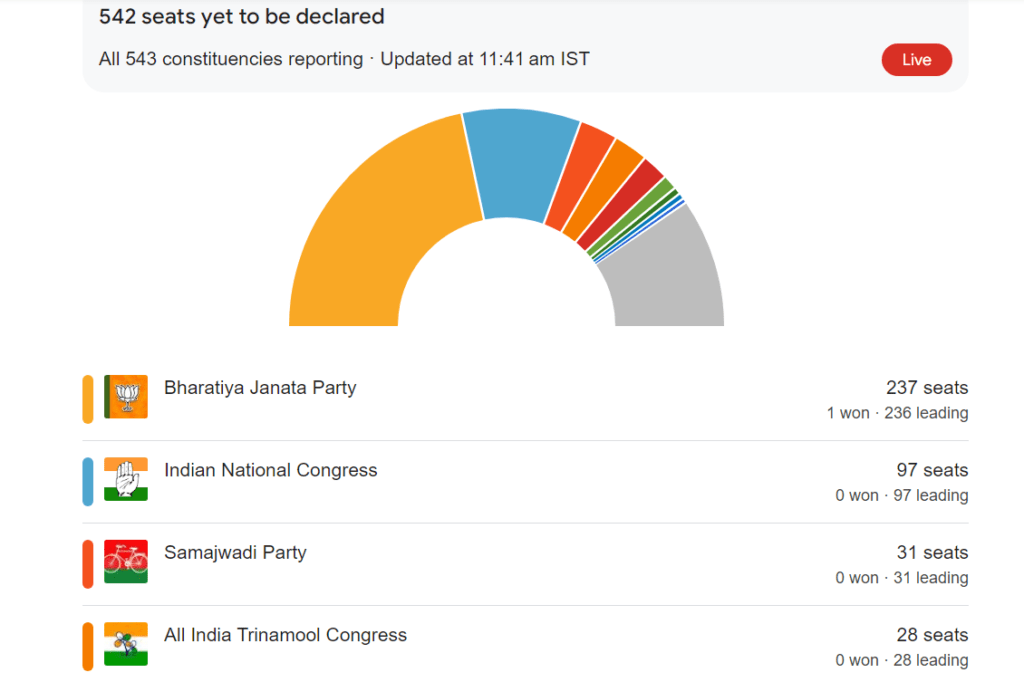

The NDA has so far won about 295 seats, which is less than the 370 seats that the average exit poll predicted. On the other hand, the opposition I.N.D.I.A coalition has picked up over 209 seats, well over the 140 seats predicted by the exit poll.

The difference has made investors less optimistic. Early on June 4, the Sensex fell more than 2,000 points, while the Nifty fell more than 600 points as market volatility increased.

INDIA shows promising comeback: Election Results

A Balasubramanian said that players would mainly concentrate on policy continuity, good fundamentals, economic momentum, stable inflation, indigenization efforts, and GDP growth even though market upswings are anticipated to persist.

Image Source

The final vote tallying results could halt the market boom because the Indian market has been trading at comparatively higher valuations than its competitors throughout the world. However, nothing can really be said while the decision is still pending,” he said.

According to Bala, the market experiences a time of consolidation as earnings and values are taken into consideration, particularly in cases where the market has previously provided excessive returns. This would not, however, imply that India’s growth momentum will slow down.

ALSO READ: Market surged high with exit polls results earlier

“In general, we anticipate that the positive bias will continue. If the market consolidates, we won’t be hesitant to rise again in a favorable environment,” he continued.

Bala responds that there won’t be any significant problems resurfacing when asked if there will be sufficient capital flows in the market. He estimates that there will be a total cash infusion of Rs 40,000 crore, of which Rs 30,000 crore will go into mutual funds.

We anticipate receiving little inflows as long as NFO receipts are robust. If there is any pressure at all on the pricing, there will be sufficient capital on hand for mutual funds to participate. The mutual fund industry as a whole may have a cash level of between 4 and 5 percent overall, according to Bala.