PFC and REC Shares update:

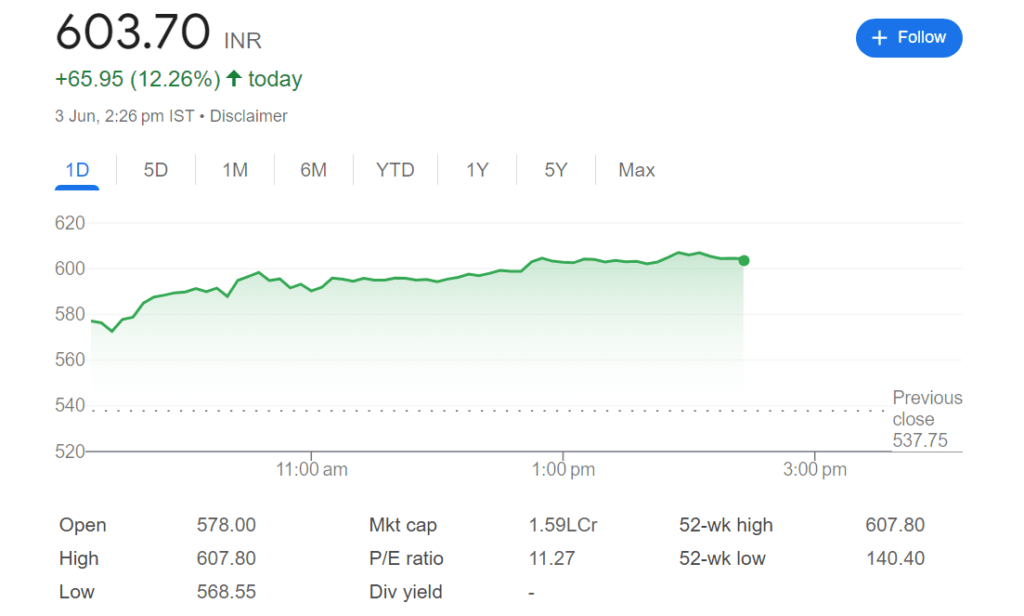

On June 3, REC Ltd.’s shares surged by up to 12 percent, reaching a new all-time high of Rs. 602.75 on the National Stock Exchange (NSE). This was following the board of the company’s approval of a fundraise through the private placement of non-convertible debentures (NCDs) up to another Rs. 1.45 lakh crore.

India’s government owns REC, a provider of infrastructure financing. They provide funding for both public and private enterprises for projects in the power (including innovative technologies) and non-power (roads, metro, IT, etc.) sectors.

PFC and REC shares post-election results

Up to Rs 1.45 lakh crore in unsecured or secured, non-convertible bonds and debentures would be issued by the Maharatna business to raise capital. In the meantime, Harsh Baweja’s nomination as the company’s director of finance and chief financial officer (CFO) has been authorized by the board.

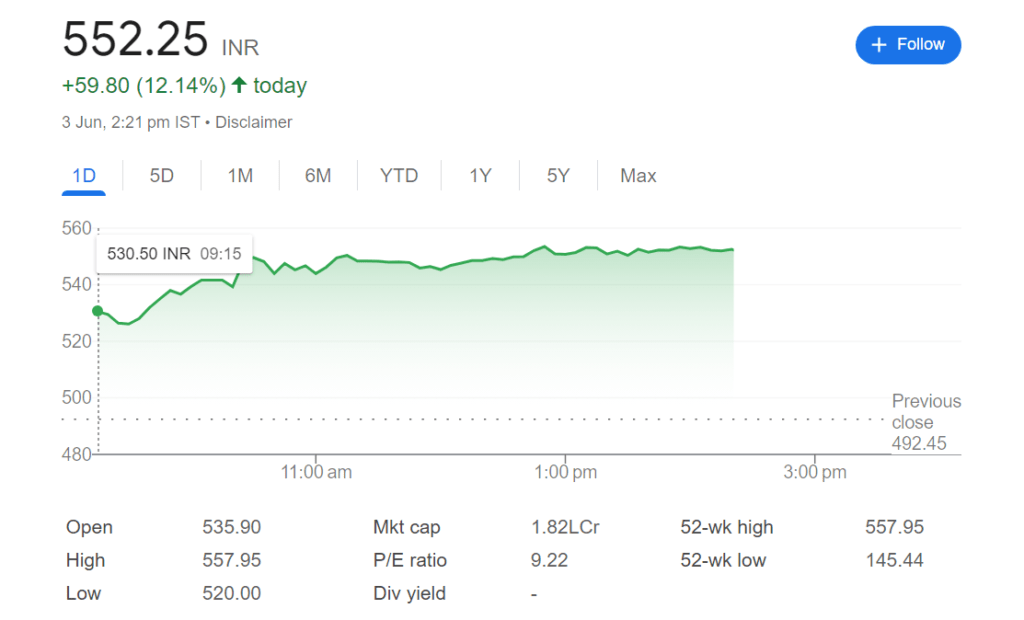

On June 3, the value of another PSU financier surged by 12 percent. Power Finance Corporation (PFC) shares jumped to a new high of Rs 557.95 per share on the NSE.

The sudden surge occurred when exit polls showed the NDA administration had secured a landslide victory, leading market analysts to forecast political and policy continuity. According to the analysts, this sentiment points to the possibility of PSU shares continuing to outperform.

The majority of exit polls indicated that the BJP-led NDA government led by Prime Minister Modi will be re-elected with over 350 Lok Sabha seats, either matching or exceeding the bull case predictions of most brokerages for the stock market.

The BJP’s continued hold on power is expected to sustain the recent strong rise in stocks that are directly linked to the government’s economic agenda, particularly those that deal with capital spending or public sector units (PSUs).

In the past year, shares of REC and PFC have increased by 315 percent and 255-255 percent, respectively. The good success of the stock prices of corporations in the power sector can be attributed to the notable rise in electricity demand.

Image Source

Distributors, financial companies, and electricity generators are included in this. Furthermore, it is anticipated that government programs like the Renewable Energy Development and Solar Scheme (RDSS) and LPS schemes will increase funding opportunities in the power industry.

Image Source

Analysts predict that strong order books across companies, coupled with ample funding potential for renewable energy projects between FY22 and FY32, and rising infrastructure credit uptake because of the availability of assets like roads, airports, data centers, and EV charging stations will also act as catalysts for stocks like PFC and REC.

The Indian Renewable Energy Development Agency (IREDA) had a 4% intraday increase in its shares during this same period.

Read further: Indian Market surges high before election results