Image Source

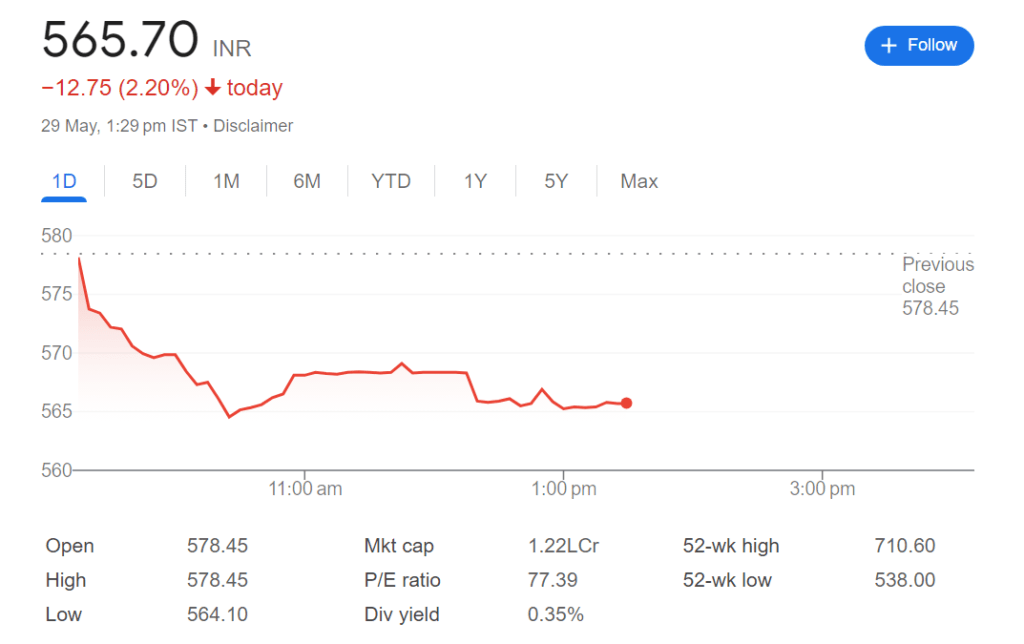

HDFC life stock update:

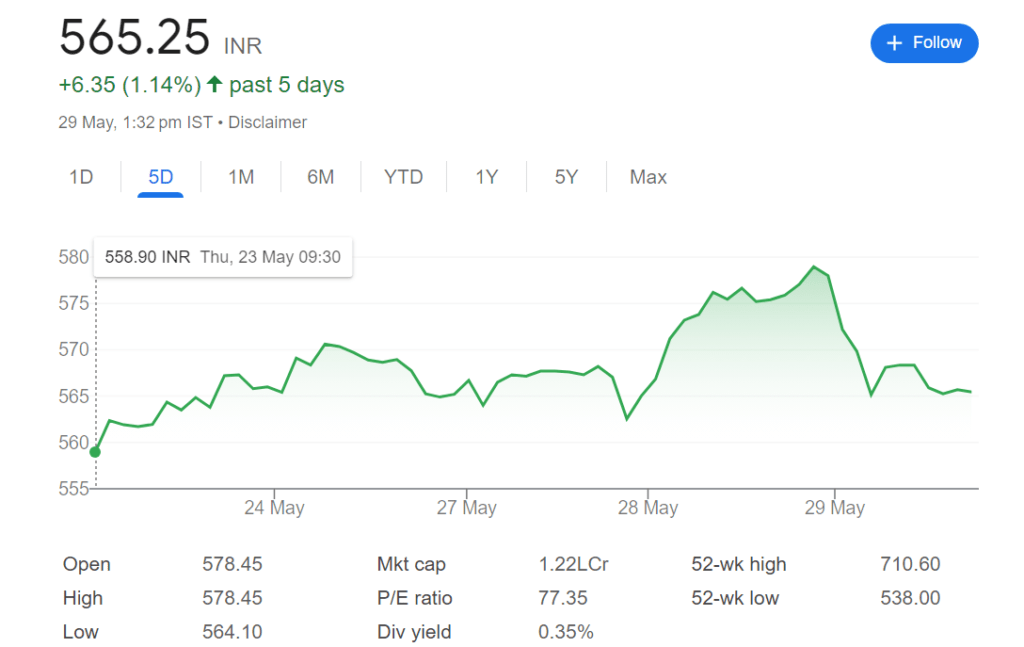

After ten days of consolidation, HDFC Life Ltd shares have broken out of the congestion zone of Rs 570-572, suggesting possible upside.

HDFC Life shares were down 0.95 percent at about Rs 572 a share in the early trade on May 29.

The daily and weekly charts show a bullish piercing candlestick pattern that points to a continuation of the uptrend, according to Avani Bhatt, Senior Vice President of Derivative Research at JM Financial. To capitalize on this trend, she suggests using a bull call spread strategy on HDFC Life stock.

HDFC Life Stock Investing Strategy Points

-Purchase 580 CE for approximately Rs 23–24.

-Sell 600 CE for between Rs. 15 and Rs. 16

-Goal: Twelve Thousand Rupees

-Rs 6,500 is the stop loss.

A trading technique for options that combines two call options is called a bull call spread. When a trader anticipates a little increase in the price of an underlying asset, they will employ this technique. In order to execute it, one must purchase call options at a particular strike price and sell an equal quantity of calls on the same asset at a higher strike price.

Image Source

Technical Specifications

After ten days of stabilization, the stock has emerged from the congestion zone between Rs 570 and Rs 572, closing above the previous three weeks’ highs. On both the daily and weekly charts, a bullish piercing candlestick pattern appeared, suggesting that the uptrend will continue. “Rs 609 and 622 are the targets for this breakout,” Bhatt stated.

Data Derivatives

On the long side, a combined futures open interest (OI) addition of 2.5 percent has been observed in terms of derivative characteristics. “There is increasing buying interest in calls for the June series at 580 and 600 strikes, suggesting positive momentum. With a 560 support base, the stock is expected to rise over the 600 zone, according to Bhatt.

Read more: Know all about insider investing and its harmful effects