Pre-market update On May 23, the market hit the eagerly anticipated 23,000 mark, but profit-taking at higher levels prevented the index from closing above it.

The Nifty 50 created a small-bodied, bullish candlestick pattern with a lengthy upper shadow on the charts, reflecting this. With two weeks of consecutive 2 percent increases, the attitude is still generally in favor of the bulls. But there’s a good chance that volatility will increase, particularly before the huge event of the Lok Sabha elections on June 4.

Experts predict that moving forward, 23,000 will be critical to the index’s ascent to the top band of the Rising Channel, which is located between 23,100 and 23,200. On the other hand, 22,800 is probably going to serve as support on the bottom side.

With lower-than-average volume, the Nifty 50 closed the day at 22,957, down 10.6 points on Friday after reaching an intraday all-time high of 23,026.40. It was up 2 percent for the week and continued to build a strong bullish candlestick pattern on the weekly charts for an additional week.

The Bank Nifty, on the other hand, increased by 203 points, or 0.42 percent, to 48,972, continuing to exceed the Nifty 50. On a daily basis, the index created a bullish candlestick pattern. It was up 1.6% for the week, and the weekly charts displayed a very bullish candlestick pattern.

Also Read: Elections affects on Stock Market India

Pre-Market Update Crucial Points In The Nifty 50

Pivot point-based resistance: 23,009, 23,037, and 23,082

Pivot point support: 22,919, 22,891, and 22,845

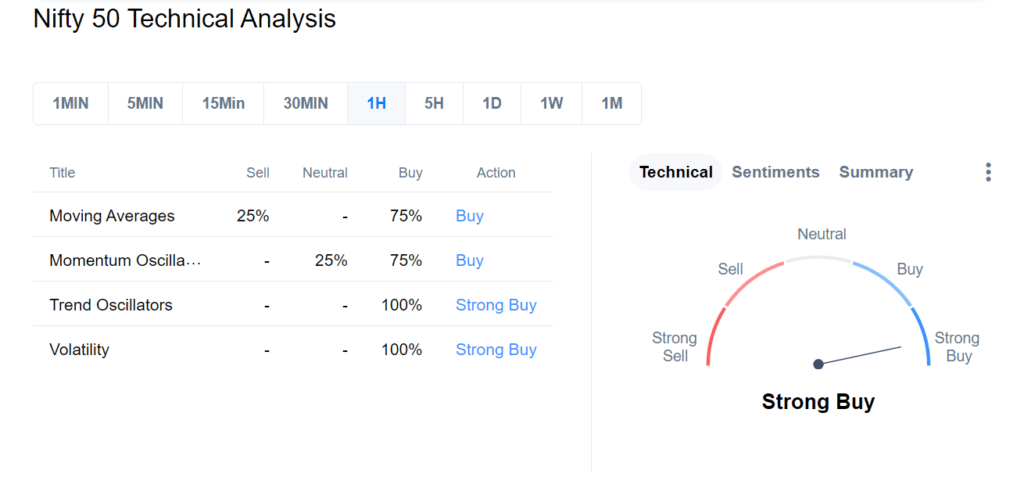

Unique formation: The index approached the upper band of the Rising Channel and saw higher highs build for ten days in a row. The Relative Strength Index (RSI), which measures momentum, crossed positive on the weekly charts and is currently at 67.26. Particularly after the Bullish Piercing Line pattern creation (a bullish reversal pattern) in the previous week, the index continued to construct a powerful bullish candlestick pattern for an additional week.

Image Source

Important Bank Nifty Levels

Pivot point-based resistance: 49,046, 49,142, and 49,298

Pivot point support: 48,734, 48,638, and 48,482

Fibonacci retracement-based resistance: 49,336, 49,975.

Fibonacci retracement-based support levels are 48,265, 48,017.

Stocks Prohibited by F&O

Securities that are prohibited under the F&O segment comprise businesses whose derivative contracts exceed 95 percent of the maximum position limit on the market.

Biocon, GNFC, and Vodafone Idea stocks have been put to the F&O ban.

Stocks held by Bandhan Bank, Hindustan Copper, India Cements, National Aluminium Company, Piramal Enterprises, and Punjab National Bank are still prohibited from trading.

Aditya Birla Capital, Balrampur Chini Mills, Indian Energy Exchange, Metropolis Healthcare, and Zee Entertainment Enterprises are among the stocks that were lifted from the F&O ban.