Motilal Oswal Recommendations today

Tuesday, May 14, saw a rise in the opening of the domestic equities indices Nifty 50 and Sensex, after optimistic advances in overseas markets. At 12:08 PM, the Sensex had gained 240 points, or 0.33 percent, to 73,017.7, while the Nifty 50 had gained 0.40 percent to 22,191.75 at 12:09 PM. At roughly the same time today, Nifty Bank was only 33 points, or 0.16 per cent, higher at 47,825.6.

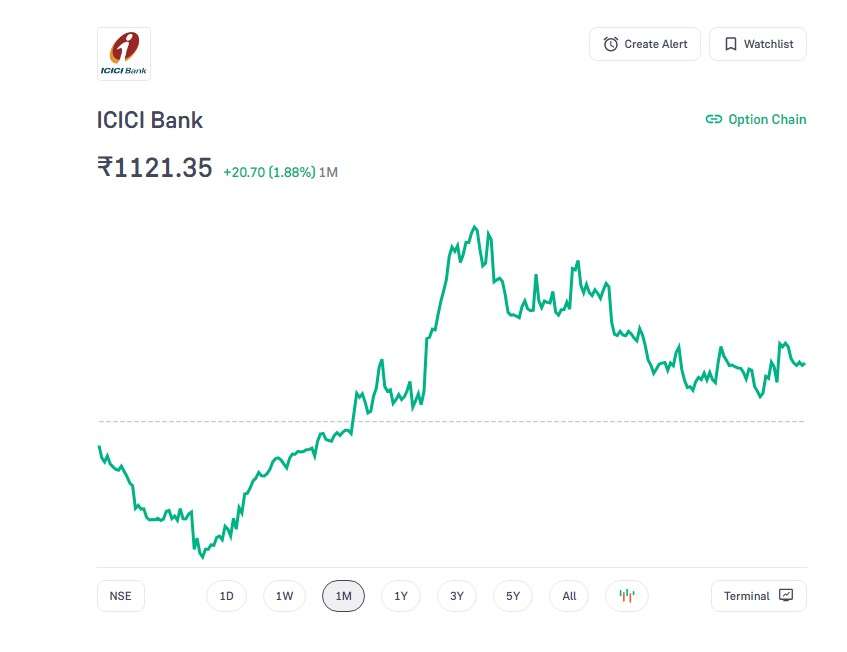

Brokerage Motilal Oswal has issued a “buy” call on ICICI Bank, the second-largest private lender in the nation, citing it as a short-term technical choice. The call is valid for two to three days.

ICICI Bank: Target Price The goal has been set by the brokerage at Rs 1,180 per share. According to the firm, the stock might rise as much as 6% from its present trading price of Rs 1,122.80. Examining ICICI Bank’s Q4 sneak peek The bank is predicted by Zee Business Research Desk to make a standalone profit of Rs 10,300 crore in the March quarter, up 12.9% from Rs 9121.9 crore during the same period previous year.

Image Source

It is also anticipated that net interest income (NII), which is calculated as the difference between interest paid and interest received, will increase from Rs 17,666.8 crore to Rs 18,880 crore, or 6.9% annually.

Additionally, the desk projects that the institution’s advances will increase by 17–19%, while deposits will probably increase by 17–18%. The lender’s retail and SME categories could see better growth, according to the research team.

Additionally, the desk expects the lender’s fee income to rise sharply over the course of the term. But while the market for unsecured loans would contract, lender provisioning would also shrink. Performance of ICICI Bank’s shares The stock increased by more than 4% during the previous month. The lender’s stock has increased by 13% year-to-date (YTD) and by over 20% in the last six months.

Read more: ICIC Securities stocks news