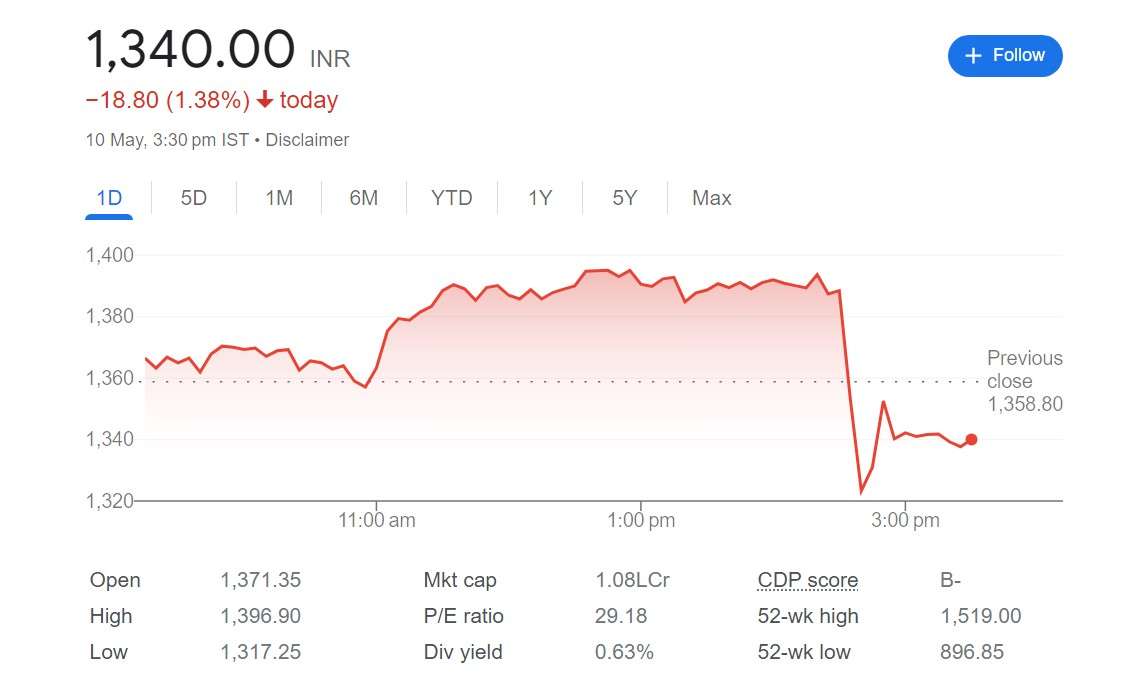

Cipla Shares Update: Following the announcement of sales and margin figures for the March quarter of fiscal year 24 that were lower than anticipated, Cipla’s stock experienced a decline of over three percent during trading on May 10.

On the National Stock Exchange (NSE), shares of Cipla were trading at Rs 1,342.25 at 2.56 p.m.

The net profit of the company, on the other hand, increased by 79 percent year-on-year to 939 crore, surpassing the forecast of 891 crore that was provided by Moneycontrol. The high increase in Cipla’s bottomline for the fourth quarter is mostly attributable to a low base, as the company’s net profit was hurt by one-time impairment charges of Rs 182.42 crore in the period prior to the current year. This is something that should be taken into consideration.

On the other hand, as compared to the previous year, revenue increased by 13 percent to Rs 6,163 crore, which was lower than the anticipated Rs 6,224 crore. The disposal of Cipla’s Uganda-based subsidiary QCIL (Quality Chemical Industries), which took place in the previous quarter, was another factor that contributed to the decline in revenue.

During this time, the topline for the January-March quarter was behind schedule as a result of the company’s India business experiencing growth that was lower than they had anticipated. The company’s sales in India were negatively impacted by the weak seasonal demand for its consumer business, and the company reported a year-on-year growth rate of only 7 percent, which was far lower than the analysts’ estimates of a low-double-digit increase.

Image Source

Cipla Shares Future Prospects

Despite this, the pharmaceutical company’s business in the United States proved to be the most successful in terms of growth. Sales from the region increased by 11 percent year-on-year to a total of $226 million. This growth was backed by ongoing growth in key unique assets as well as base portfolio.

On the operational front, the EBITDA margin increased by 54 basis points to 21.4 percent, but it fell short of the 22 percent objective that was recommended by management in the midst of increased expenditures on research and development.

The amount of money spent on research and development during the quarter increased by 11 percent compared to the previous year, reaching Rs 444 crore, which is equivalent to 7.2 percent of the entire income.

In addition, Cipla has submitted an application for five assets in the respiratory market. These assets include generic versions of Symbicort and Qvar, launches of which are planned to take place within the next three years. Furthermore, the company has set a goal to submit two additional respiratory assets within the next twelve to fifteen months.

Cipla has submitted applications for twelve assets in the peptides and complex generics category, with the intention of launching these products within the next two to four years. Additionally, during the fiscal year 25 (FY25), the company intends to introduce four peptide assets.

For more such news and content, read our blog section.